Uncover Nonprofit Insurance D&O EPLI Cyber Quote Secrets

Unlocking the secrets of nonprofit insurance, particularly D&O, EPLI, and Cyber coverage, can empower you to make informed decisions that protect your organization, and as you explore these options, you'll discover valuable insights that could save you time and resources.

Understanding Nonprofit Insurance: D&O, EPLI, and Cyber Coverage

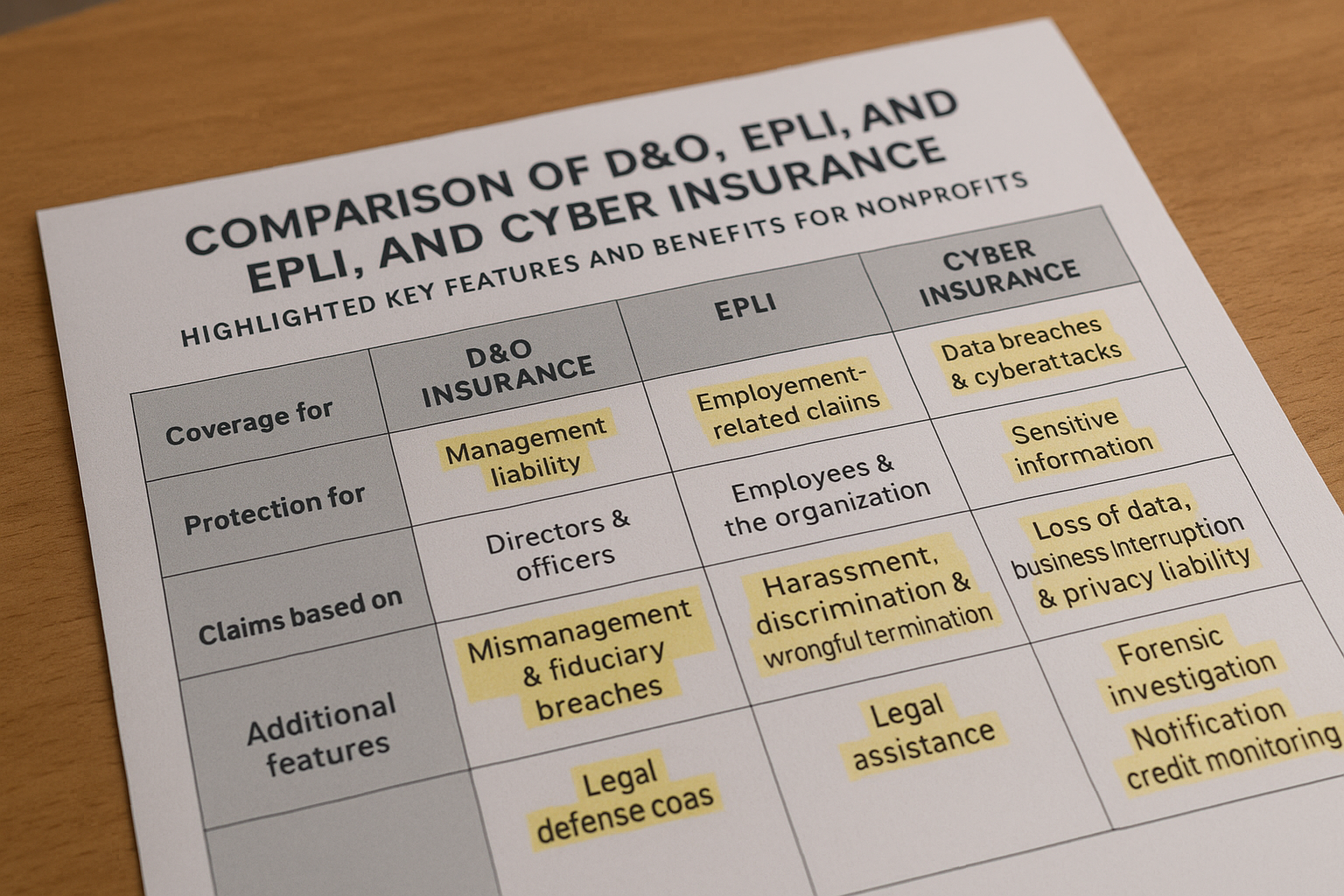

Nonprofit organizations, much like their for-profit counterparts, face a myriad of risks that require comprehensive insurance solutions. Directors and Officers (D&O) insurance, Employment Practices Liability Insurance (EPLI), and Cyber Liability insurance are critical components in safeguarding a nonprofit's leadership, operations, and digital presence.

Directors and Officers (D&O) Insurance

D&O insurance is designed to protect the personal assets of nonprofit directors and officers in the event they are sued for alleged wrongful acts while managing the organization. This type of insurance covers legal fees, settlements, and other costs associated with litigation. Given the increasing scrutiny on nonprofit governance, having D&O coverage is not just a recommendation but a necessity. Nonprofits can browse options to find policies that cater to their specific needs, often with premiums starting at a few hundred dollars annually, depending on the organization's size and risk profile1.

Employment Practices Liability Insurance (EPLI)

EPLI protects nonprofits against claims related to employment practices, such as wrongful termination, discrimination, harassment, and other workplace issues. As nonprofits often operate with limited HR resources, EPLI provides a safety net against the costly legal battles that can arise from employment disputes. Nonprofits should search options that include coverage for legal defense costs and settlements, with policies typically ranging from $800 to $3,000 annually based on the organization's size and claims history2.

Cyber Liability Insurance

In an era where data breaches are increasingly common, Cyber Liability insurance is crucial for nonprofits that handle sensitive donor, client, or financial information. This coverage helps mitigate the financial impact of cyberattacks, including data breaches, ransomware, and phishing scams. Cyber insurance policies often cover the costs of notifying affected parties, legal fees, and even public relations efforts to manage reputational damage. Nonprofits can follow the options to find policies tailored to their specific digital risks, with premiums generally starting at about $1,000 annually3.

Key Considerations for Nonprofit Insurance

When evaluating insurance options, nonprofits should consider several factors to ensure they select the most comprehensive and cost-effective coverage:

1. **Risk Assessment**: Conduct a thorough risk assessment to identify potential vulnerabilities in governance, employment practices, and cyber security.

2. **Policy Limits and Exclusions**: Carefully review policy limits and exclusions to ensure adequate coverage for all potential risks.

3. **Insurance Provider Reputation**: Choose reputable insurers with a history of working with nonprofits, as they often offer specialized resources and expertise.

4. **Cost vs. Coverage**: Balance the cost of premiums with the breadth of coverage to ensure financial protection without overextending the budget.

Exploring Further Resources

For nonprofits seeking to enhance their insurance strategies, numerous resources and specialized services are available. By visiting websites of insurance providers and industry experts, nonprofits can gain deeper insights into tailored solutions that address their unique challenges. Engaging with professional insurance brokers can also provide valuable guidance and access to exclusive deals that might not be readily available through standard channels.

As you delve into these options, remember that the right insurance coverage not only protects your nonprofit's assets but also fortifies its mission, enabling it to continue making a positive impact without the looming threat of financial setbacks.