Slash Your Debt Hassle-Free IRS Payment Plan Setup

If you're struggling with tax debts and looking for a hassle-free way to manage them, exploring IRS payment plan options can provide you with the relief you need—browse options, search options, and see these options to find the best fit for your financial situation.

Understanding IRS Payment Plans

Navigating the complexities of IRS tax debt can be daunting, but setting up a payment plan offers a structured way to tackle what you owe without the stress of immediate full payment. An IRS payment plan, or installment agreement, allows you to pay off your tax debt over time, usually in monthly installments. This option is particularly beneficial for those who cannot afford to pay their taxes in full by the due date.

The IRS offers several types of payment plans, including short-term and long-term agreements, each designed to accommodate different financial situations. A short-term payment plan is typically for debts that can be paid off in 180 days or less, while a long-term plan extends beyond 180 days and can last up to 72 months. Understanding which plan suits your needs can help you manage your finances more effectively.

Benefits of an IRS Payment Plan

Opting for an IRS payment plan comes with several advantages. First and foremost, it prevents the IRS from taking more aggressive collection actions, such as wage garnishments or bank levies. Additionally, it allows you to budget your payments over time, making it easier to manage your monthly expenses without sacrificing your financial stability.

Moreover, setting up a payment plan with the IRS can help you avoid accruing additional penalties and interest on your tax debt. While interest will still accrue, the penalties for failing to pay on time can be significantly reduced once you're on a formal plan. This can lead to substantial savings over the life of your repayment period.

Steps to Set Up an IRS Payment Plan

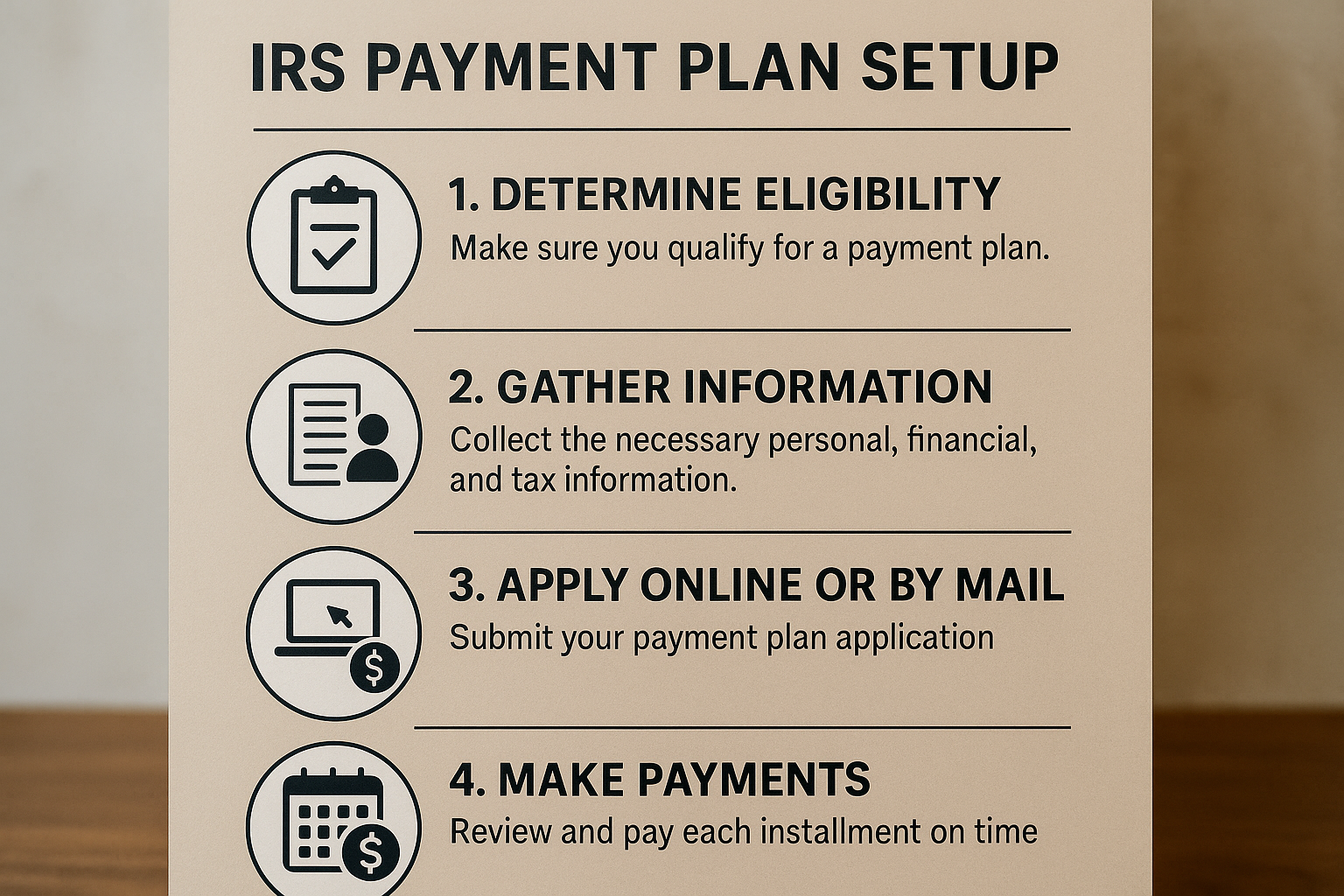

Establishing an IRS payment plan is a straightforward process. Here’s how you can get started:

- Determine Your Eligibility: Generally, you qualify for a short-term payment plan if you owe less than $100,000 in combined tax, penalties, and interest. For a long-term plan, the threshold is $50,000.

- Apply Online: The IRS offers an online application process through their website, which is the fastest way to set up a plan. You can also apply by phone, mail, or in person at an IRS office.

- Choose Your Payment Method: Decide whether you’ll pay via direct debit, check, money order, or credit card. Direct debit is often preferred as it ensures timely payments and may reduce the setup fee.

- Agree to the Terms: Once your application is approved, you'll need to adhere to the terms of the agreement, which includes making all scheduled payments on time.

Costs Associated with IRS Payment Plans

While setting up a payment plan can alleviate immediate financial pressure, it’s important to be aware of the costs involved. There is typically a setup fee for long-term payment plans, which can range from $31 to $225 depending on your payment method and income level. Low-income taxpayers might qualify for reduced fees or even fee waivers1.

Additionally, interest and penalties on your unpaid balance will continue to accrue until the debt is fully paid. However, these are often less burdensome than the penalties for not making any payments at all.

Exploring Additional Resources

For those seeking further assistance, there are numerous resources available that can provide guidance on managing tax debt. Many websites offer detailed comparisons of payment plan options, and financial advisors can help tailor a plan to your specific needs. Visiting these resources can provide you with a better understanding of your options and help you make informed decisions about your financial future.

Securing an IRS payment plan can be a pivotal step in regaining control over your financial health. By understanding your options and the benefits they offer, you can take decisive action to manage your tax debt effectively. Explore the options available today and pave the way to financial stability.