Slash Medical Bills with Accident Insurance Supplement Coverage

You can significantly reduce your out-of-pocket medical expenses by exploring accident insurance supplement coverage options, offering you peace of mind and financial security in the face of unexpected injuries.

Understanding Accident Insurance Supplement Coverage

Accident insurance supplement coverage is a type of insurance designed to help cover the costs associated with accidents that are not fully covered by your primary health insurance. This coverage can be a financial lifesaver, especially when dealing with high medical bills from unexpected accidents. It provides cash benefits that can be used for various expenses, such as hospital stays, medical treatments, and even household bills while you recover.

Why Consider Accident Insurance Supplement Coverage?

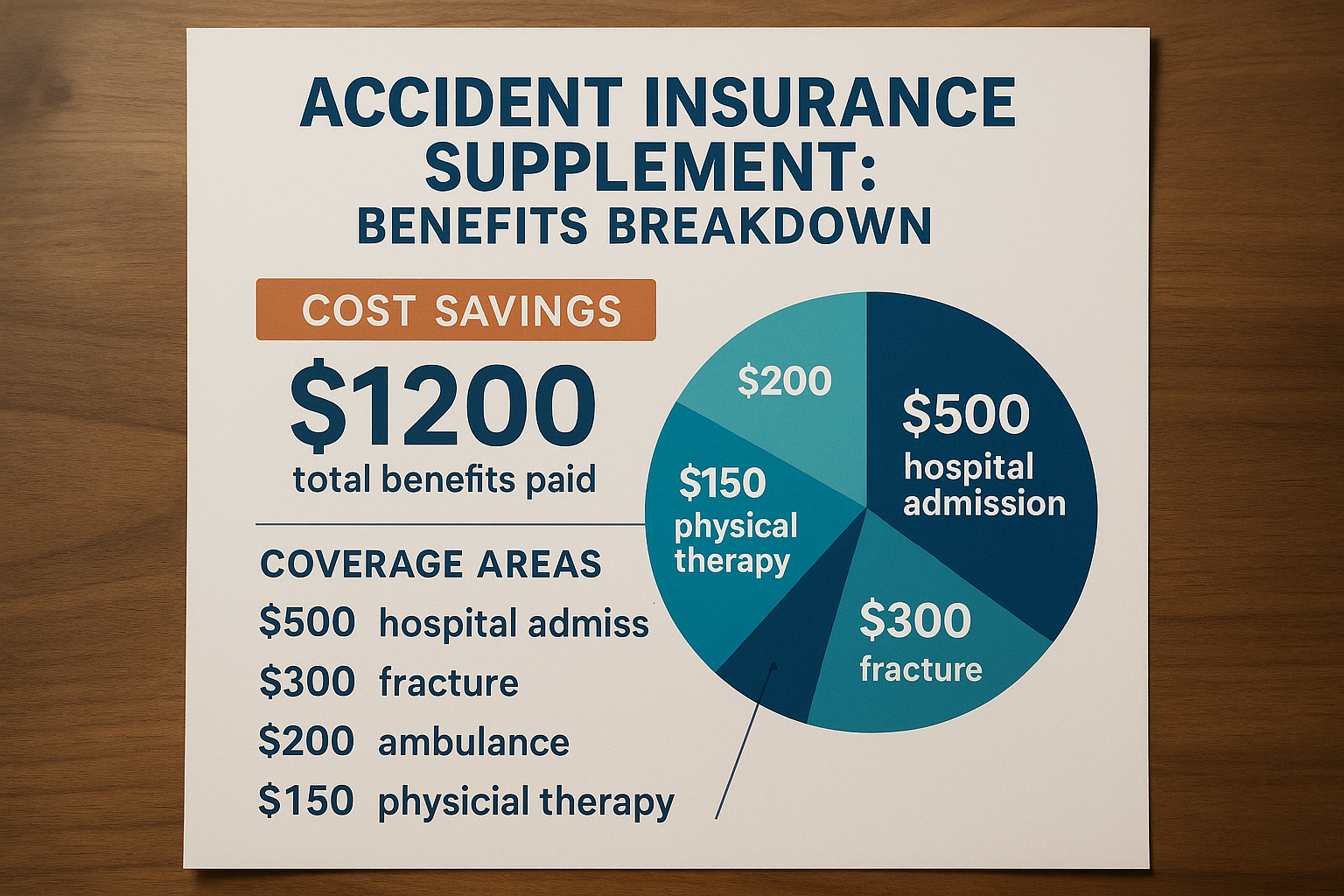

The primary advantage of accident insurance supplement coverage is the financial protection it offers. Medical bills can quickly escalate, especially if an accident requires surgery or an extended hospital stay. With this coverage, you receive a lump sum payment or ongoing benefits that can be used to cover deductibles, co-pays, or other out-of-pocket expenses. This can prevent financial strain and allow you to focus on recovery rather than worrying about mounting bills.

How It Works

When you have an accident insurance supplement policy, it typically pays out directly to you, rather than to the healthcare provider. This direct payment gives you the flexibility to use the funds as needed. For example, if you experience a broken leg, your policy might pay a predetermined amount for the injury, which you can use to cover medical costs or even everyday expenses if you're unable to work during recovery.

Types of Coverage Available

Accident insurance supplement plans vary widely, so it's essential to understand the different types available:

- Individual Plans: These are tailored to cover one person and are ideal if you're looking for personal coverage.

- Family Plans: These plans cover multiple family members, offering a comprehensive safety net for your loved ones.

- Group Plans: Often provided by employers, these plans can offer lower premiums due to the larger pool of insured individuals.

Cost Considerations

The cost of accident insurance supplement coverage can vary based on factors such as age, health status, and the level of coverage selected. On average, premiums can range from $10 to $50 per month, making it an affordable option for many1. Some providers offer discounts for bundling policies or for maintaining a healthy lifestyle, so it's worthwhile to browse options and compare plans.

Real-World Benefits

Consider the case of a 35-year-old office worker who slipped and fractured an ankle. Her primary insurance covered only part of the hospital expenses, leaving her with a substantial bill. However, her accident insurance supplement policy paid a lump sum that covered not only her medical costs but also provided extra funds for her monthly rent while she was unable to work2.

Exploring Your Options

If you're considering adding accident insurance supplement coverage to your financial plan, it's crucial to research thoroughly. Start by visiting websites of reputable insurance providers to compare coverage details and pricing. Look for plans that align with your specific needs and budget, and don't hesitate to reach out to insurance agents for personalized advice.

Accident insurance supplement coverage can be a vital component of your financial safety net. By understanding how it works and exploring the available options, you can make informed decisions that protect you and your family from the financial impact of unexpected accidents.