Slash Costs Instantly With Outsourced Bookkeeping Monthly Pricing

Slash your business expenses today by exploring outsourced bookkeeping monthly pricing options that can streamline your financial operations while delivering significant cost savings—browse options and discover how this strategic move can benefit your bottom line.

Understanding Outsourced Bookkeeping

Outsourced bookkeeping is a service where businesses hire external professionals to handle their financial records, transactions, and reporting. This approach allows companies to access expert financial management without the overhead costs associated with in-house staff. By outsourcing, businesses can focus on their core operations while ensuring their books are accurate and compliant.

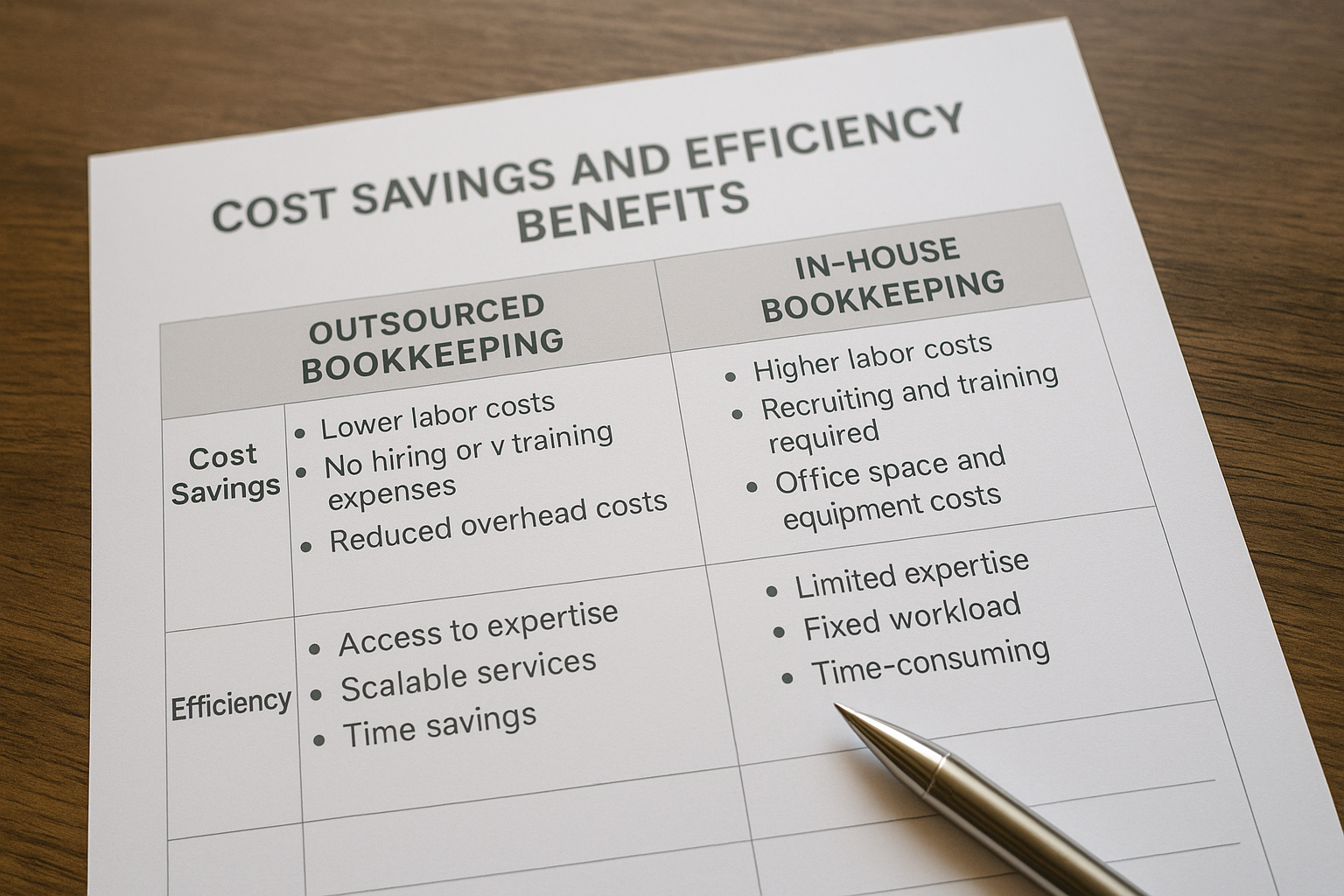

The Financial Benefits of Outsourcing

One of the most compelling reasons to outsource bookkeeping is the potential for cost savings. Maintaining an in-house accounting team involves salaries, benefits, training, and infrastructure costs. In contrast, outsourced bookkeeping services offer flexible pricing models, often based on the volume and complexity of transactions, allowing businesses to pay only for what they need.

For example, small businesses might find monthly packages starting at around $200-$500, which can be significantly less than hiring a full-time bookkeeper1. This model ensures that financial management remains scalable and cost-effective as the business grows.

Improved Accuracy and Compliance

Outsourced bookkeeping services often employ certified professionals who stay updated on the latest accounting standards and tax regulations. This expertise reduces the risk of errors and ensures compliance with legal requirements. For businesses, this translates to fewer penalties and more accurate financial statements, which are crucial for strategic decision-making and investor relations.

Access to Advanced Tools and Technology

Outsourcing firms typically use the latest accounting software and technologies, providing businesses with access to advanced tools without the need for significant investment. These platforms offer features such as automated data entry, real-time financial reporting, and enhanced security measures, which can improve the efficiency and reliability of financial operations.

Flexibility and Scalability

As businesses evolve, their accounting needs change. Outsourced bookkeeping provides the flexibility to adjust services as required, whether scaling up during peak periods or down during slower times. This adaptability ensures that businesses only pay for the services they need, optimizing their financial management strategies.

Finding the Right Outsourced Bookkeeping Service

When considering outsourced bookkeeping, it's essential to evaluate the options available. Look for providers with a proven track record, industry-specific expertise, and transparent pricing models. Many firms offer free consultations, allowing businesses to assess their services before committing. As you search options, consider exploring reviews and testimonials to gauge the experiences of other businesses.

Real-World Examples and Case Studies

Numerous businesses have successfully reduced their accounting costs by outsourcing. For instance, a mid-sized retail company reported a 30% reduction in bookkeeping expenses after switching to an outsourced provider, allowing them to reinvest the savings into marketing efforts2. Such examples highlight the tangible benefits of this strategic decision.

Outsourced bookkeeping offers a practical solution for businesses looking to reduce costs while maintaining high standards of financial management. By leveraging external expertise, companies can enjoy improved accuracy, compliance, and access to cutting-edge technologies. As you explore these options, consider how outsourcing can align with your business goals and deliver measurable value.