Slash Continuing Care Retirement Community CCRC Costs Now

If you're looking to slash costs in Continuing Care Retirement Communities (CCRCs), you'll want to explore these options that can lead to significant savings while ensuring quality care and comfort.

Understanding CCRCs and Their Cost Structure

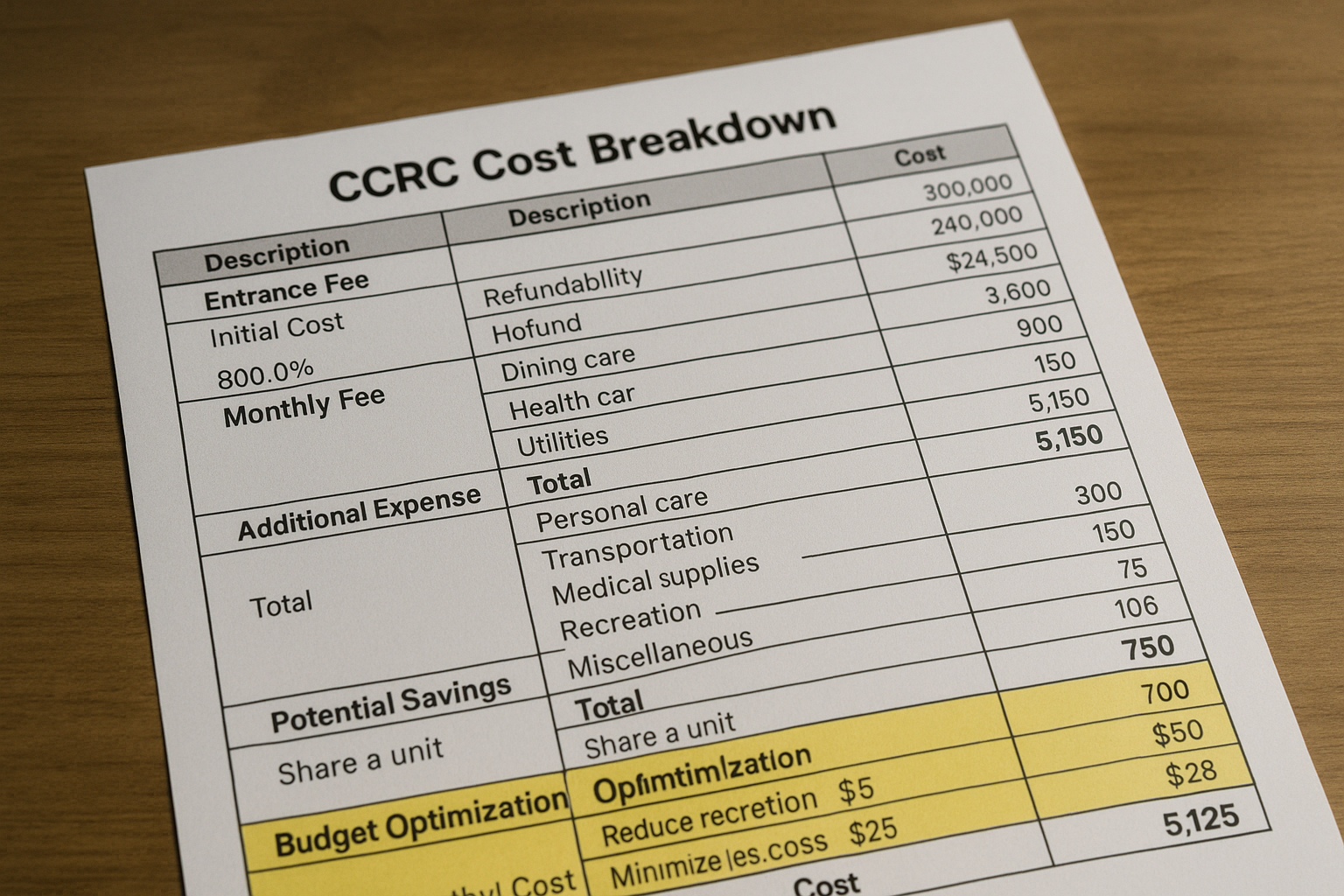

Continuing Care Retirement Communities (CCRCs) offer a unique blend of independent living, assisted living, and nursing home care within one community, providing a seamless transition for residents as their needs change. However, this convenience comes with a price. The cost structure of CCRCs typically includes an entrance fee and monthly service fees, which can vary widely based on location, amenities, and the level of care required. Entrance fees can range from $100,000 to over $1 million, while monthly fees may range from $2,000 to $5,000 or more1.

Strategies to Reduce CCRC Costs

While the costs might seem daunting, there are several strategies you can employ to make CCRCs more affordable:

1. **Evaluate Different Contract Types**: CCRCs offer various contract types, including Life Care, Modified, and Fee-for-Service contracts. Life Care contracts, though generally more expensive upfront, provide the most comprehensive coverage and can offer significant savings on long-term care costs2.

2. **Consider Location and Timing**: The cost of living in a CCRC can differ greatly by geographic area. Choosing a community in a less expensive area can reduce costs. Additionally, moving during off-peak times might result in lower entrance fees or promotional discounts3.

3. **Explore Financial Assistance Programs**: Some states offer financial assistance programs for seniors, which can help offset the costs of living in a CCRC. It's worth researching these options to see if you qualify for any subsidies or aid4.

Negotiating and Customizing Your CCRC Plan

Negotiation is a key component in managing CCRC costs. Many communities are open to discussing entrance fees and monthly costs, especially if they have open units or are looking to attract new residents. Additionally, customizing your living plan by opting out of certain services or amenities can help reduce monthly expenses. For example, if you don't require meal plans or housekeeping services, you might be able to negotiate a lower monthly fee.

Long-Term Financial Planning

It's crucial to incorporate long-term financial planning when considering a move to a CCRC. Consulting with a financial advisor who specializes in elder care can provide personalized strategies to manage your assets and ensure you can comfortably afford CCRC living. Advisors can also help you explore options such as long-term care insurance or reverse mortgages, which can provide additional financial support5.

While CCRCs offer a comprehensive and convenient living solution for seniors, understanding and implementing cost-saving strategies can make them more accessible. By evaluating contract types, considering location, exploring financial assistance, and engaging in strategic financial planning, you can significantly reduce the financial burden and enjoy the benefits of a CCRC. For those ready to take the next step, browsing options and visiting websites can provide further insights and opportunities tailored to your specific needs.