Secure Exclusive Manufactured Home Insurance Quote Today

Are you ready to secure peace of mind and protect your investment by exploring exclusive manufactured home insurance options today?

Understanding Manufactured Home Insurance

Manufactured home insurance is a specialized type of coverage designed to protect your manufactured or mobile home from a variety of risks. These policies typically cover damage from natural disasters, theft, vandalism, and liability issues. Unlike traditional homeowners insurance, manufactured home insurance takes into account the unique construction and placement aspects of these homes. This means you can tailor your policy to fit the specific needs of your home, ensuring comprehensive protection.

Why You Need Manufactured Home Insurance

Owning a manufactured home comes with its own set of challenges and risks. The construction materials and mobility of these homes can make them more susceptible to certain types of damage. For instance, they may be more vulnerable to wind and water damage compared to site-built homes. Having the right insurance policy in place can help mitigate these risks and provide financial security in the event of unexpected damages.

Benefits of Securing an Exclusive Quote

By securing an exclusive manufactured home insurance quote, you gain access to tailored coverage options that are specifically designed for your home's needs. This means you can enjoy the peace of mind that comes with knowing you have the right protection in place. Additionally, exclusive quotes often come with competitive pricing and potential discounts, which can lead to significant savings over time. For example, some insurers offer discounts for installing safety features like smoke detectors or security systems.

Factors Affecting Insurance Costs

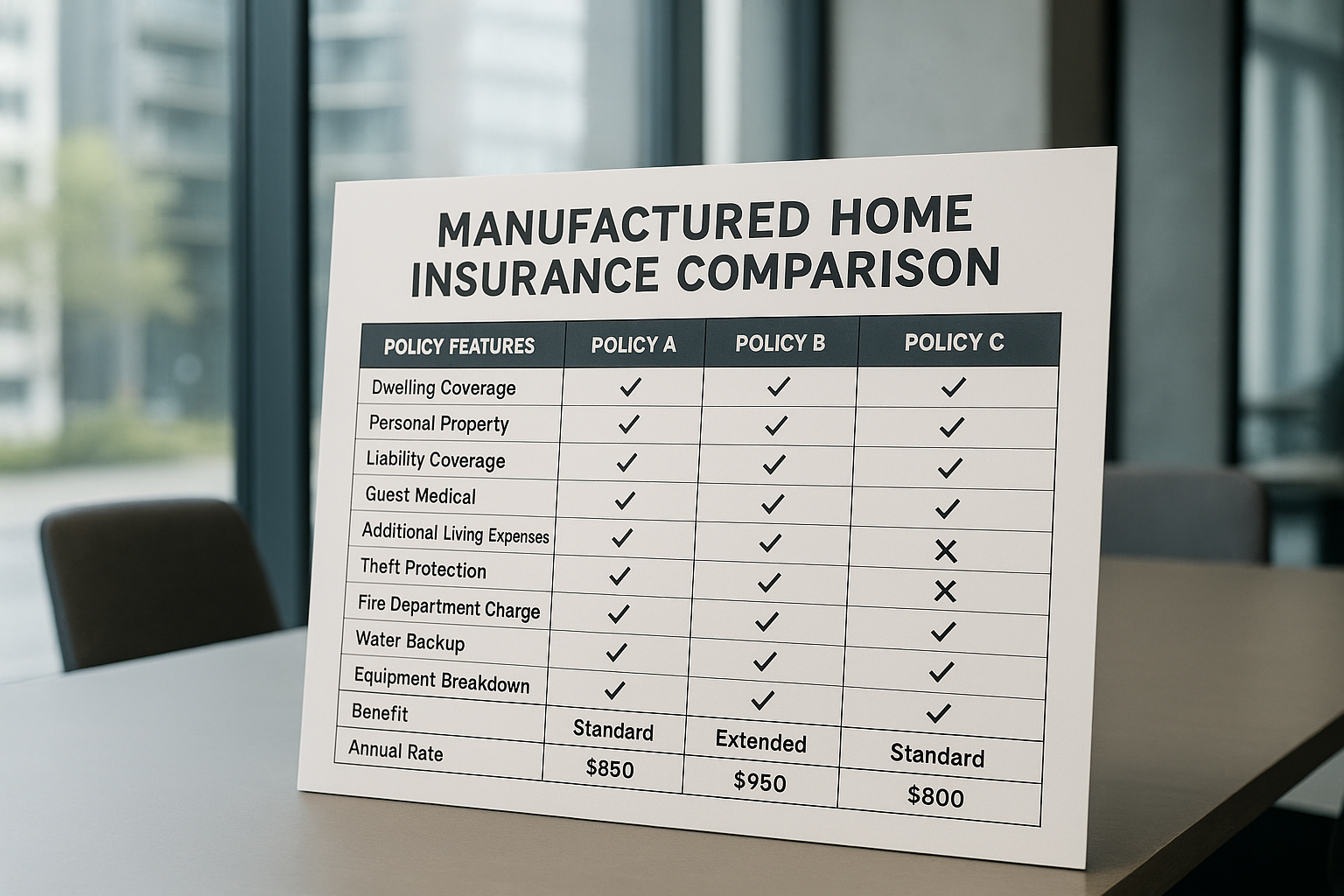

The cost of manufactured home insurance can vary based on several factors. These include the age and condition of your home, its location, and the coverage limits you choose. Homes located in areas prone to natural disasters like hurricanes or floods may have higher premiums due to increased risk. However, by comparing quotes from different providers, you can find the best deal that suits your budget and coverage needs.

How to Get Started

To start the process of securing an exclusive manufactured home insurance quote, begin by gathering information about your home, such as its age, size, and location. You can then browse options from various insurance providers to compare coverage details and pricing. Many insurers offer online tools that allow you to quickly obtain quotes by entering basic information about your home.

It's essential to read the policy details carefully and understand what is included and excluded in the coverage. Consider reaching out to an insurance agent who specializes in manufactured homes to get personalized advice and recommendations. This can be particularly helpful if you have unique coverage needs or if your home has specific features that require special consideration.

Exploring Additional Resources

For those interested in learning more about manufactured home insurance, there are numerous online resources and communities dedicated to providing information and support. Websites like the Insurance Information Institute offer comprehensive guides and articles on the topic, helping you make informed decisions about your coverage options.

By taking the time to research and compare different policies, you can ensure that your manufactured home is adequately protected, providing you with the security and peace of mind you deserve.