Secure Big Savings on Multifamily D&O Insurance Now

Unlock significant savings on Multifamily Directors and Officers (D&O) Insurance by exploring tailored options that protect your investments while reducing costs—browse options to discover the best deals available today.

Understanding Multifamily D&O Insurance

Multifamily D&O Insurance is a specialized form of coverage designed to protect the personal assets of directors and officers of multifamily housing organizations. This insurance is crucial because it shields against claims of mismanagement, breach of fiduciary duty, and other allegations that could arise from their managerial decisions. Given the complex regulatory environment and the potential for litigation, having a robust D&O policy is essential for safeguarding both personal and organizational assets.

Why You Need Multifamily D&O Insurance

As a stakeholder in the multifamily housing industry, you face unique challenges that can lead to costly legal battles. D&O insurance provides financial protection by covering legal fees, settlements, and other related costs. This type of policy ensures that your personal finances are not at risk, allowing you to focus on managing your properties effectively. Furthermore, securing D&O insurance can enhance your organization's reputation, making it more attractive to potential investors and partners.

How to Secure Savings on Your Policy

To secure substantial savings on your multifamily D&O insurance, consider the following strategies:

- Compare Quotes: By comparing quotes from multiple insurers, you can identify the most competitive rates. Many insurance providers offer online platforms where you can easily browse options and obtain quotes tailored to your specific needs.

- Bundle Policies: Some insurers offer discounts when you bundle your D&O insurance with other types of coverage, such as property or liability insurance. This approach not only reduces costs but also simplifies policy management.

- Risk Management Practices: Implementing strong risk management practices can lower your premiums. Insurers often provide discounts to organizations that demonstrate proactive measures to minimize potential risks.

- Policy Review: Regularly reviewing your policy can help you identify unnecessary coverage or outdated terms, allowing you to adjust your policy for better rates.

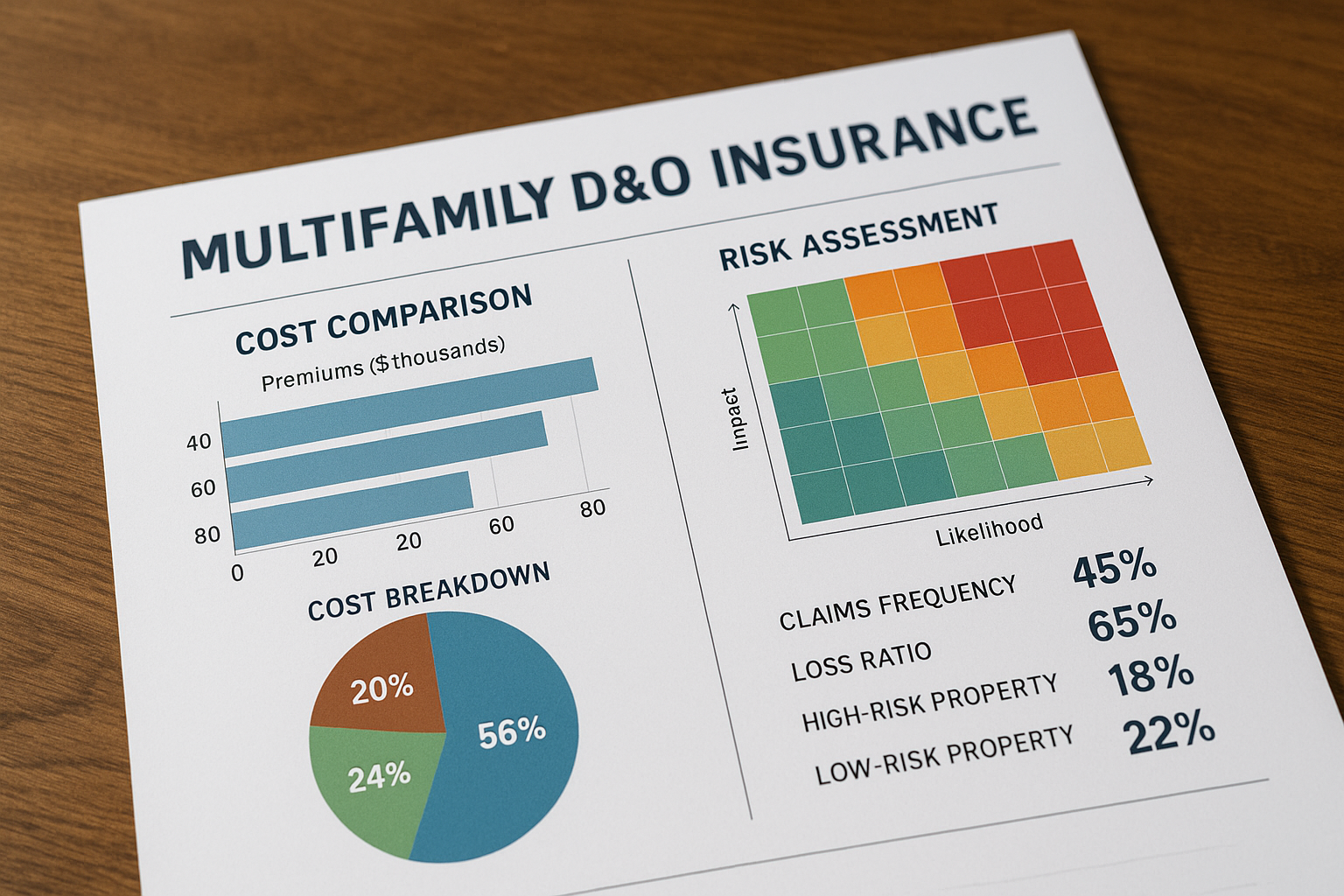

Real-World Examples and Statistics

According to industry reports, the average cost of D&O insurance for multifamily organizations ranges from $5,000 to $10,000 annually, depending on the size and risk profile of the organization1. However, organizations that actively engage in risk management and policy optimization can see savings of up to 20% on their premiums2. Additionally, a recent survey found that 75% of multifamily housing organizations with D&O insurance reported a significant reduction in legal expenses3.

Exploring Specialized Solutions

For those seeking tailored solutions, there are insurance brokers specializing in multifamily D&O policies. These brokers have in-depth knowledge of the industry and can offer personalized advice to ensure comprehensive coverage at competitive rates. By partnering with a specialized broker, you can gain access to exclusive deals and insights that are not available through standard channels.

Securing big savings on multifamily D&O insurance requires a proactive approach, including comparing quotes, bundling policies, and implementing effective risk management practices. By following these strategies and exploring specialized options, you can protect your investments while optimizing your insurance costs. For more information and to explore specific options, visit websites dedicated to multifamily insurance solutions.