Secrets to Perfect Credit Score Start Here Now

Unlocking the secrets to a perfect credit score can transform your financial future, and by following the options available, you can start your journey to financial freedom today.

Understanding the Importance of a Perfect Credit Score

A perfect credit score is more than just a number; it is a gateway to financial opportunities that can enhance your quality of life. With a high credit score, you can enjoy lower interest rates on loans and credit cards, which translates to significant savings over time. Additionally, a stellar credit score can make you a more attractive candidate for rental properties, insurance policies, and even job opportunities, as some employers consider credit history in their hiring process1.

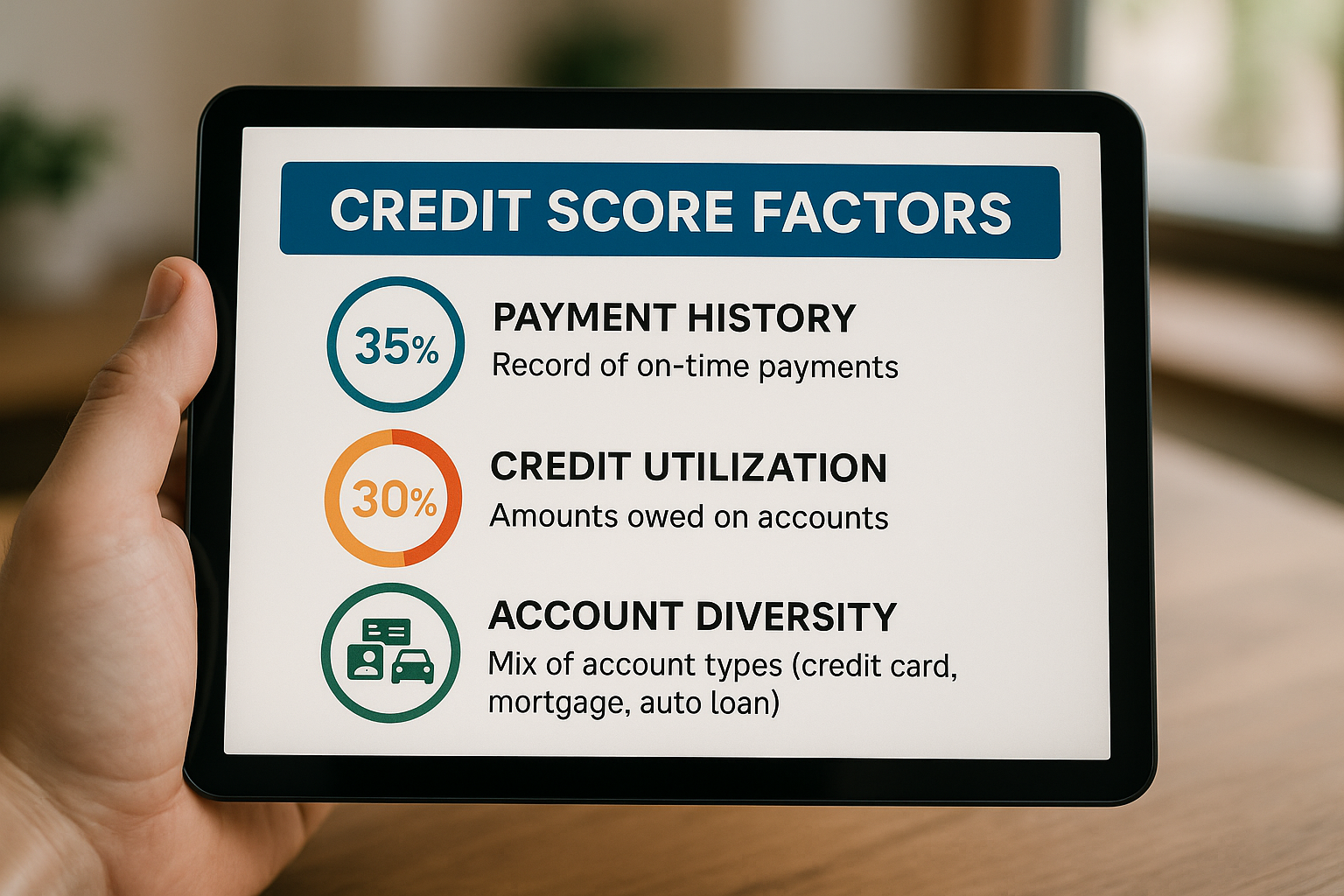

Factors That Influence Your Credit Score

Your credit score is determined by several key factors, each playing a critical role in the overall calculation. Understanding these factors can help you take actionable steps to improve your score:

1. **Payment History**: Your track record of paying bills on time is the most significant factor, accounting for 35% of your score2. Late payments can severely impact your score, so prioritize punctuality.

2. **Credit Utilization**: This refers to the ratio of your credit card balances to your credit limits. Ideally, you should aim to keep this ratio below 30% to positively influence your score3.

3. **Length of Credit History**: The longer your credit history, the better. This factor accounts for 15% of your score, rewarding those with well-established credit accounts4.

4. **New Credit Inquiries**: Opening new credit accounts can temporarily lower your score, as it accounts for 10% of the total. Be strategic about applying for new credit.

5. **Credit Mix**: A diverse mix of credit types, such as revolving credit (credit cards) and installment loans (mortgages, auto loans), can positively impact your score, making up 10% of it5.

Strategies to Achieve a Perfect Credit Score

To embark on your journey toward a perfect credit score, consider implementing these strategies:

- **Automate Payments**: Set up automatic payments to ensure you never miss a due date. This simple step can significantly boost your payment history score.

- **Reduce Debt**: Focus on paying down existing debt, especially high-interest credit card balances. This will improve your credit utilization ratio.

- **Monitor Your Credit Report**: Regularly check your credit report for errors or discrepancies. You are entitled to a free annual credit report from each of the three major credit bureaus6.

- **Limit Hard Inquiries**: Only apply for new credit when necessary. Each hard inquiry can temporarily lower your score.

- **Maintain Old Accounts**: Keep older credit accounts open to benefit from a longer credit history.

Opportunities and Resources for Further Exploration

Achieving a perfect credit score is a journey that requires diligence and strategic planning. By understanding the factors that influence your score and implementing effective strategies, you can unlock a world of financial possibilities. For those seeking personalized guidance, numerous financial services offer credit counseling and management tools. Browse options and visit websites of credit monitoring services to find the right fit for your needs.

By taking these steps, you can not only improve your credit score but also enhance your financial well-being, paving the way for a secure and prosperous future.