Revolutionize 3PL Shielding with Unbeatable High Limit Coverage

If you're looking to elevate your 3PL operations with high-limit coverage that shields you from unforeseen risks, now is the time to explore these options and see how they can transform your business.

Understanding the Importance of High-Limit Coverage in 3PL

Third-party logistics (3PL) providers play a crucial role in the supply chain, offering services that range from warehousing to transportation. However, the nature of these operations exposes them to various risks, including cargo damage, theft, and compliance issues. High-limit coverage acts as a financial safety net, protecting your business from substantial losses that could otherwise cripple your operations. By investing in comprehensive shielding, you ensure that your company can withstand unexpected challenges and maintain seamless service delivery.

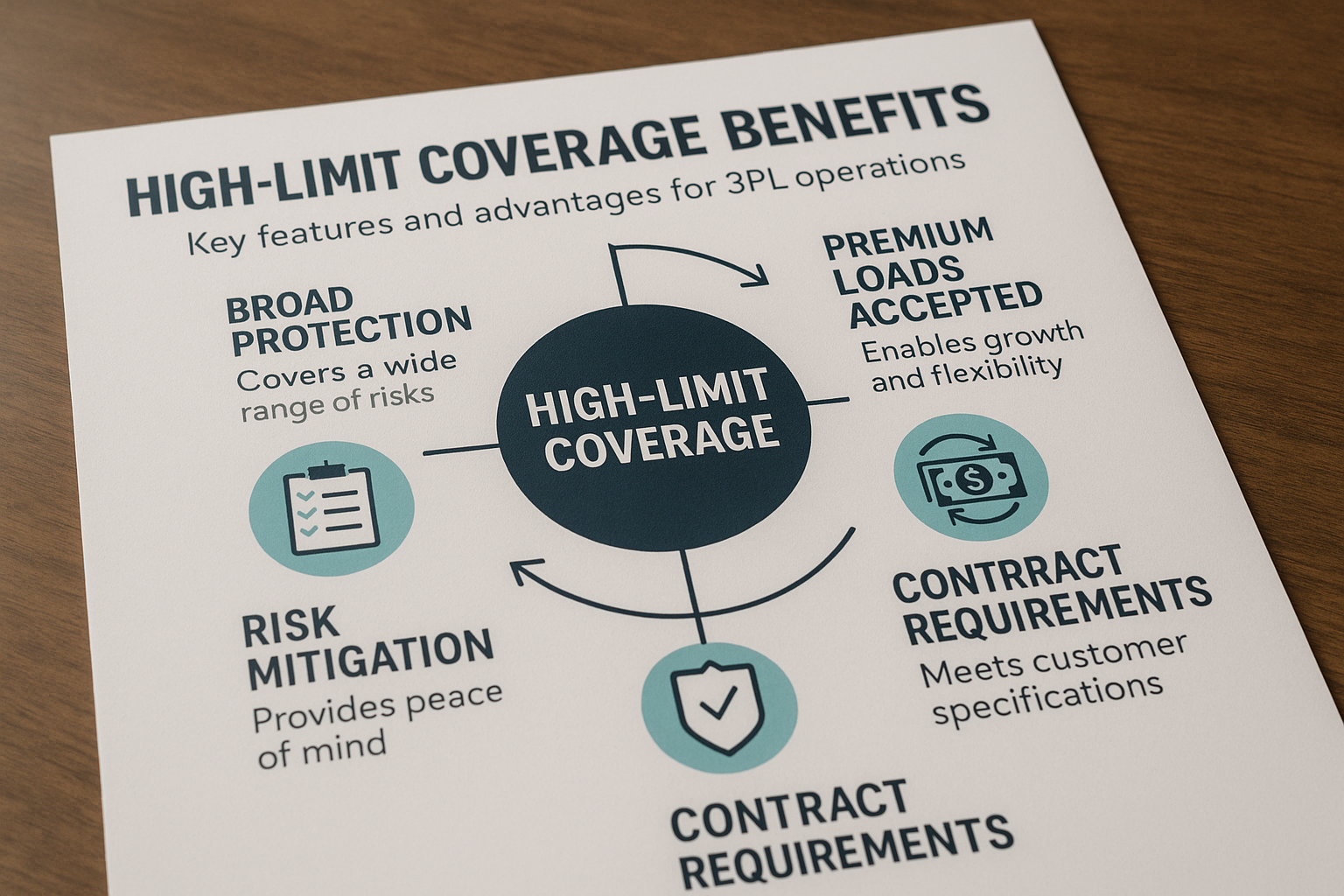

Key Benefits of High-Limit Coverage

The primary advantage of high-limit coverage is the extensive protection it offers. Unlike basic insurance policies, high-limit coverage is tailored to meet the specific needs of 3PL providers, offering higher payout limits and broader terms. This ensures that even in the event of a major incident, your financial exposure is minimized. Additionally, having robust coverage can enhance your reputation with clients, who will appreciate your proactive approach to risk management.

Types of Coverage Available

When considering high-limit coverage, it's essential to understand the different types available:

1. **Cargo Insurance**: Covers loss or damage to goods during transit, ensuring you can recover costs in the event of theft or accidents.

2. **Liability Insurance**: Protects against claims arising from bodily injury or property damage caused by your operations.

3. **Property Insurance**: Covers damages to your facilities, such as warehouses and offices, from natural disasters or vandalism.

4. **Cyber Liability Insurance**: As 3PL providers increasingly rely on digital systems, this coverage protects against data breaches and cyberattacks.

Each type of coverage addresses specific risks, and a comprehensive policy will often include a combination of these elements tailored to your business needs.

Real-World Examples and Statistics

The logistics industry is no stranger to risk. For instance, in 2022, global cargo theft incidents resulted in losses exceeding $200 million1. Such statistics underscore the importance of robust insurance solutions. Companies that have invested in high-limit coverage often report not only financial protection but also improved client trust and competitive advantage2.

Financial Considerations

The cost of high-limit coverage varies based on factors such as the size of your operations, the types of services offered, and the specific risks associated with your industry. While premiums may be higher than standard insurance policies, the potential savings from avoiding catastrophic losses make it a worthwhile investment. Many insurers offer flexible payment plans and discounts for bundling multiple types of coverage3.

Exploring Specialized Solutions

For businesses seeking tailored solutions, numerous specialized providers offer bespoke insurance packages designed specifically for the logistics sector. These packages often include risk assessment services and personalized advice on how to mitigate potential threats. By visiting websites of industry leaders and browsing options, you can find the coverage that best aligns with your operational needs and budget.

High-limit coverage is more than just an insurance policy; it's a strategic investment in the resilience and longevity of your 3PL operations. By safeguarding against significant financial risks, you not only protect your bottom line but also enhance your service offerings and client relationships. As you explore these options, consider the long-term benefits and peace of mind that come from knowing your business is well-shielded.