Reveal Secret Savings Compare EPLI Insurance for Seniors

Unlock hidden savings by comparing EPLI insurance options for seniors, and explore how you can protect your business while potentially reducing costs—browse these options to find the best fit for your needs.

Understanding EPLI Insurance for Seniors

Employment Practices Liability Insurance (EPLI) is crucial for businesses to protect against claims made by employees, such as discrimination, wrongful termination, or harassment. As businesses grow and the workforce ages, it's increasingly important to consider how EPLI insurance can cater specifically to senior employees. This demographic can present unique challenges and opportunities, making it essential for companies to explore tailored insurance solutions.

Why Seniors Need Special Consideration

Seniors in the workforce bring a wealth of experience and knowledge, but they may also face different legal challenges compared to younger employees. Age discrimination claims, for instance, are more prevalent among older workers. According to the Equal Employment Opportunity Commission (EEOC), age-related complaints have consistently been a significant portion of all employment-related claims1. Therefore, having an EPLI policy that addresses these specific risks can be beneficial.

Financial Benefits of EPLI Insurance

Securing the right EPLI insurance can offer financial peace of mind by covering the costs of legal defense and settlements. These expenses can be substantial, with the average cost of defending an employment claim reaching around $125,0002. By comparing different EPLI policies, businesses can find options that not only provide adequate coverage but also fit within their budget. Some insurers offer discounts for businesses that implement comprehensive risk management programs, which can further reduce premiums.

How to Compare EPLI Insurance Options

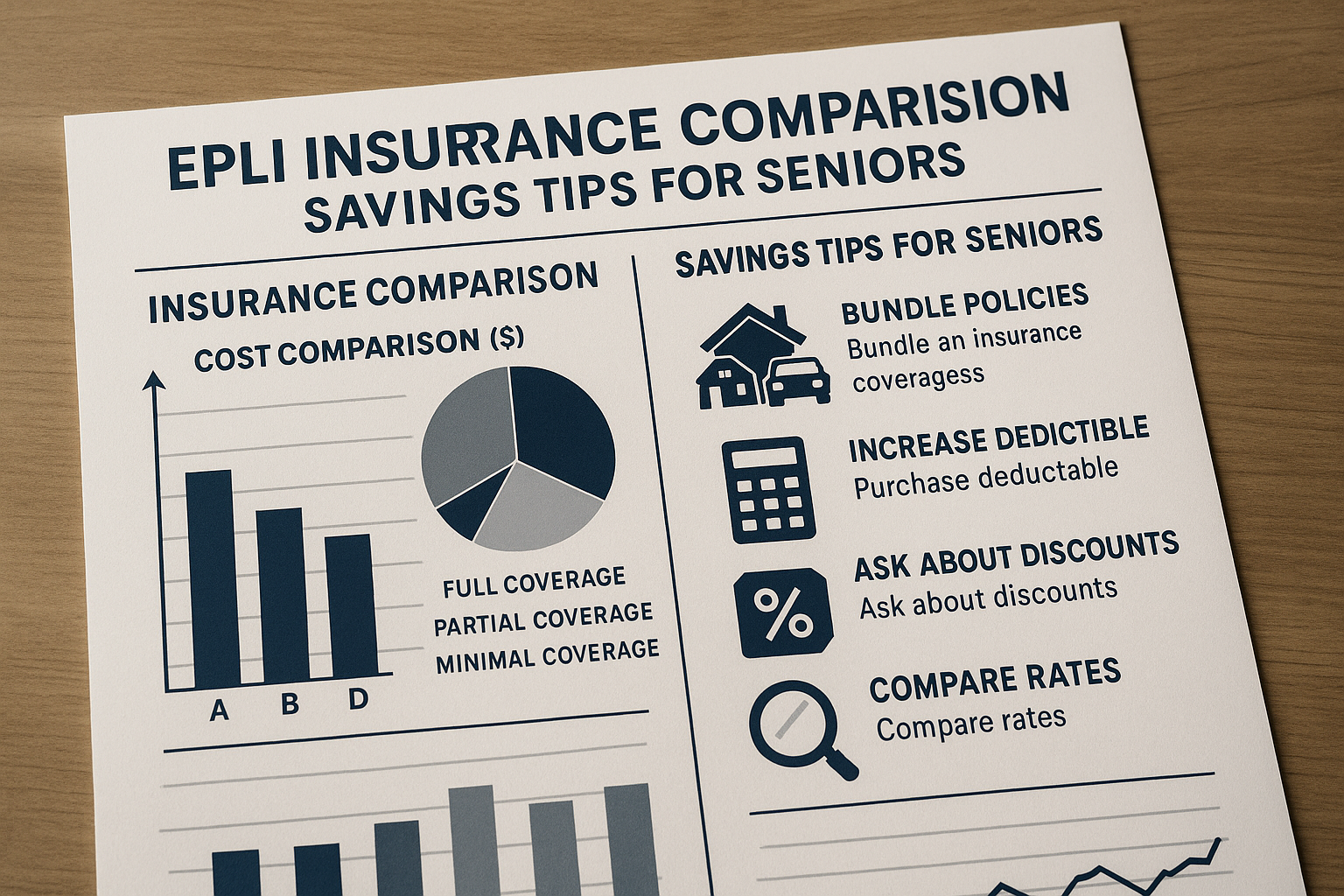

When comparing EPLI insurance options for seniors, consider the following factors:

- Coverage Limits: Ensure the policy provides sufficient coverage for potential claims, including legal fees and settlements.

- Exclusions: Review any exclusions in the policy to understand what is not covered, such as specific types of discrimination claims.

- Risk Management Support: Some insurers offer resources to help manage risks, such as training programs and legal consultations.

- Reputation and Financial Stability: Choose an insurer with a strong reputation and financial stability to ensure they can handle claims efficiently.

Real-World Examples and Statistics

Many businesses have successfully reduced their EPLI premiums by implementing robust HR practices and regular training sessions. For instance, companies that conduct annual anti-discrimination training and maintain detailed records of employee evaluations often see a decrease in claims3. Additionally, some insurers offer premium credits for businesses that demonstrate a commitment to maintaining a fair and inclusive workplace.

Exploring Specialized Services

For those seeking specific solutions, there are specialized services that cater to the needs of senior employees. These services often include personalized risk assessments and tailored policy recommendations. By visiting websites of leading insurance providers, businesses can explore these customized options and find the best fit for their unique needs.

In summary, EPLI insurance is a vital component of a comprehensive risk management strategy, especially for businesses with senior employees. By comparing options and leveraging available resources, you can protect your business from potential claims while optimizing your insurance investment. Remember to browse options and explore specialized services to ensure you're getting the best coverage for your needs.