Reveal Hidden Secrets in Claims vs Occurrence Policies

Unlocking the hidden secrets of claims versus occurrence policies can empower you to make informed insurance choices that protect your assets and peace of mind, while you browse options and explore the best solutions tailored to your needs.

Understanding Claims-Made and Occurrence Policies

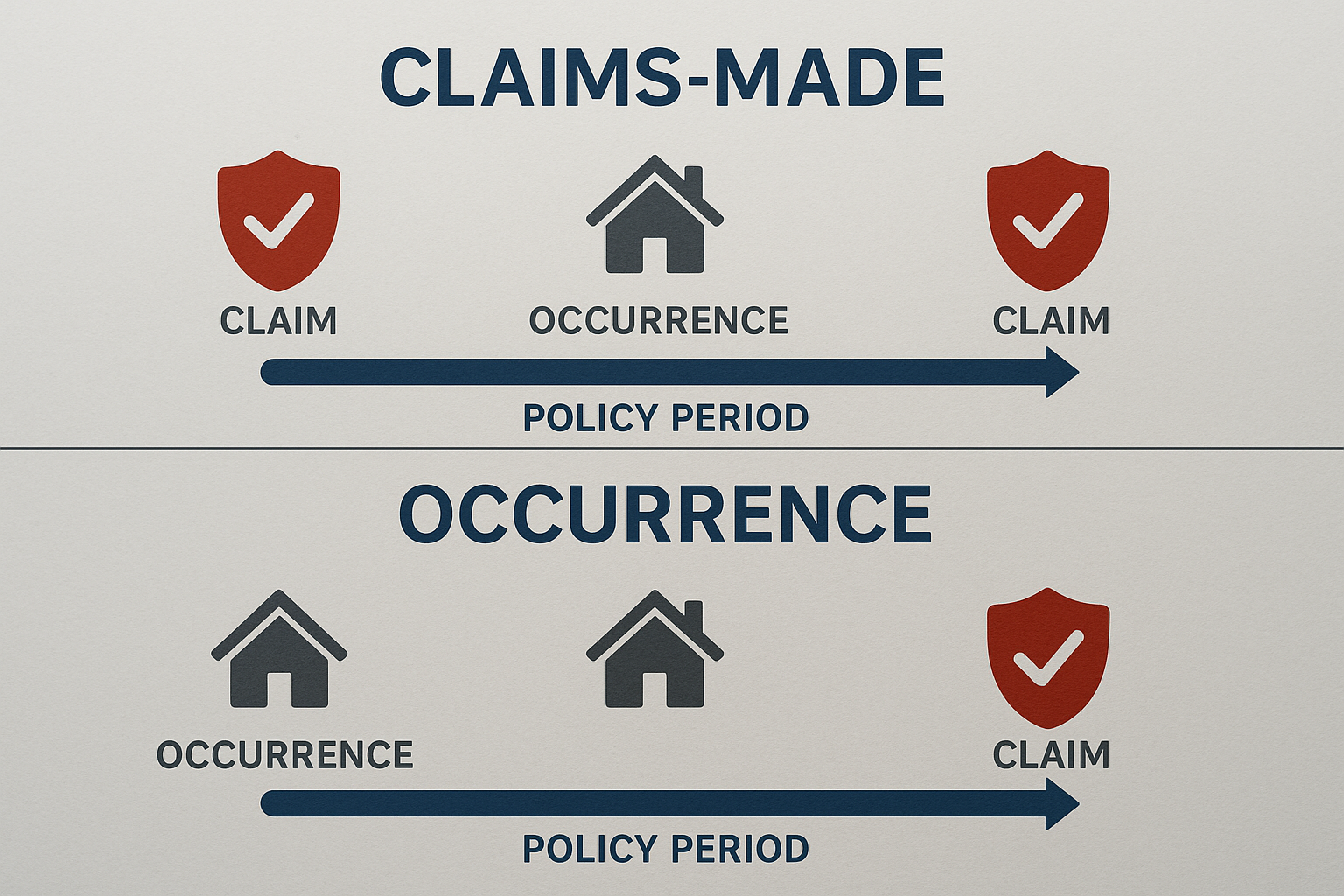

Insurance policies are a crucial part of risk management for individuals and businesses alike, and knowing the differences between claims-made and occurrence policies can significantly impact your coverage. A claims-made policy provides coverage for claims made during the policy period, regardless of when the incident occurred, as long as the incident happened after the policy's retroactive date. In contrast, an occurrence policy covers incidents that happen during the policy period, regardless of when the claim is made. This fundamental difference can influence your decision based on your specific risk exposure and financial planning.

The Financial Implications

When considering these policies, cost is a significant factor. Claims-made policies often have lower initial premiums, making them attractive for those seeking immediate cost savings. However, they may require the purchase of "tail coverage" if you switch insurers or retire, to cover claims reported after the policy ends. Occurrence policies typically have higher premiums but offer peace of mind with long-term protection without the need for additional coverage. Understanding these financial implications helps you weigh the short-term savings against long-term security.

Choosing the Right Policy for You

Selecting between claims-made and occurrence policies depends on various factors, including your industry, risk profile, and financial strategy. Professionals in fields with long-tail liabilities, such as healthcare or legal services, might prefer occurrence policies for their comprehensive protection. Conversely, businesses with stable, predictable risks might opt for claims-made policies to manage costs effectively. By evaluating your specific needs, you can make a choice that aligns with your risk management goals.

Exploring the Market

The insurance market offers a variety of options for both claims-made and occurrence policies. As you search options and visit websites, you'll find insurers providing tailored solutions to meet diverse needs. Some insurers may offer discounts or bundled deals if you purchase multiple policies, so it's worth exploring these opportunities. Engaging with a knowledgeable insurance broker can also provide insights into the best deals and the most suitable coverage for your situation.

Real-World Examples

Consider a healthcare professional who opts for an occurrence policy to ensure coverage for any potential malpractice claims arising from past treatments, even years after they retire. Alternatively, a tech startup might choose a claims-made policy with lower premiums to allocate more resources to business growth, purchasing tail coverage later if needed. These examples illustrate how different policies serve varying needs and highlight the importance of aligning your insurance strategy with your long-term goals.

Understanding the distinctions between claims-made and occurrence policies equips you with the knowledge to make strategic insurance decisions. By evaluating your specific risks, financial considerations, and exploring available options, you can secure the protection that best suits your needs. As you continue to navigate the insurance landscape, remember that there are numerous resources and specialized services available to guide you in finding the optimal coverage.