Regional Manufacturers Rejoice D&O Insurance High-Limit Secrets

If you're a regional manufacturer looking to safeguard your leadership team with high-limit D&O insurance, now is the perfect time to browse options and discover the hidden advantages that could protect your business from unforeseen liabilities.

Understanding D&O Insurance for Manufacturers

Directors and Officers (D&O) insurance is a crucial component for any manufacturing business, offering protection against potential claims that could arise from decisions made by company leaders. This type of insurance covers legal fees, settlements, and other costs associated with lawsuits against directors and officers, ensuring that personal assets remain secure in the face of legal challenges. For manufacturers, whose operations often involve complex regulatory compliance and significant financial transactions, D&O insurance provides an essential safety net.

The Importance of High-Limit D&O Insurance

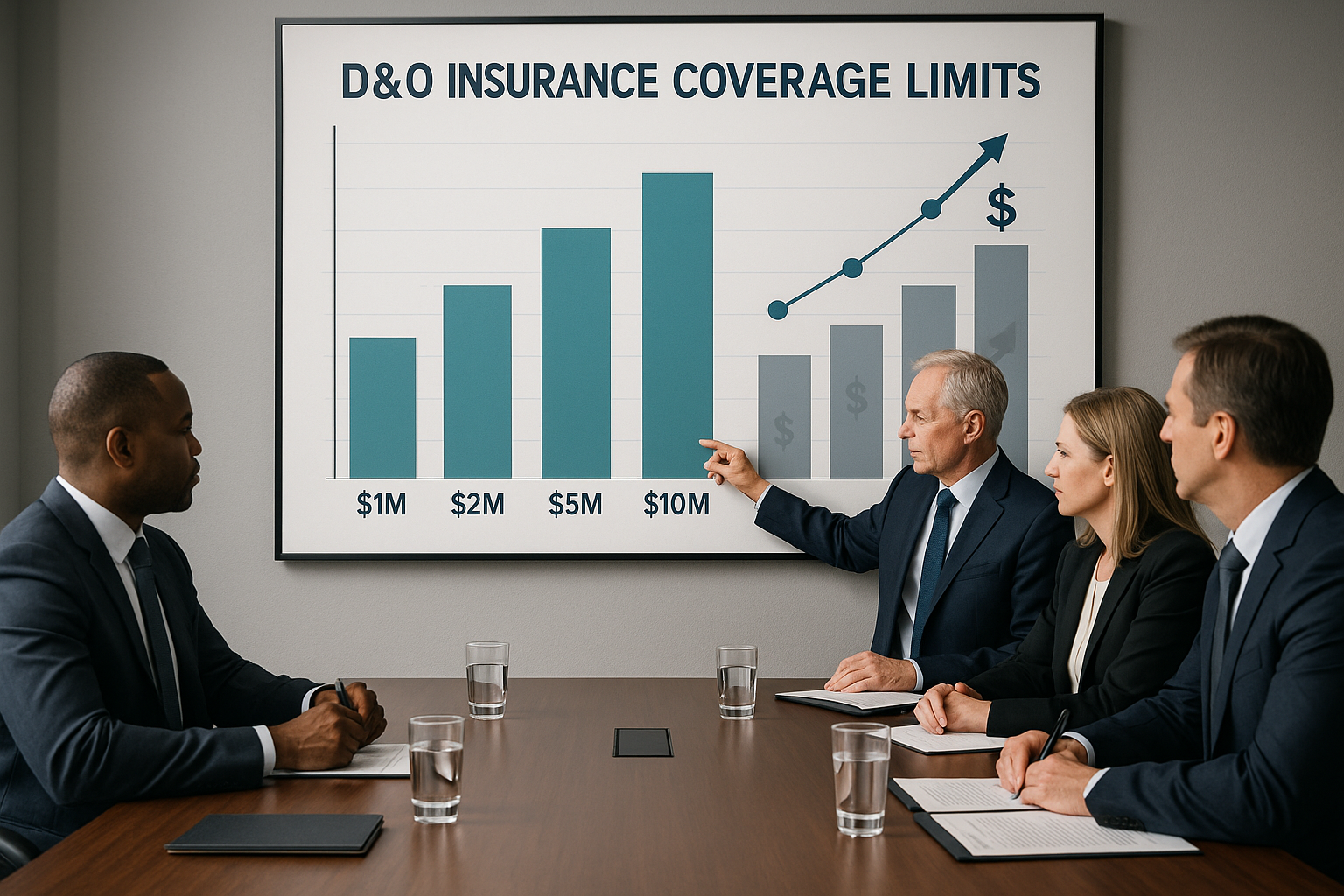

High-limit D&O insurance offers additional layers of protection, accommodating the unique risks faced by manufacturers. These policies provide increased coverage limits, which can be particularly beneficial in industries like manufacturing where the stakes are high. With increased coverage, manufacturers can confidently engage in strategic decisions, knowing they have robust protection against potential legal repercussions. This peace of mind allows companies to focus on growth and innovation without the constant worry of potential litigation.

Key Benefits of High-Limit D&O Insurance

1. **Enhanced Financial Security**: High-limit policies ensure that even in the event of substantial claims, your company’s financial stability is maintained. This is particularly important for manufacturers with significant assets and complex operations.

2. **Attracting Top Talent**: Offering comprehensive D&O insurance can be a deciding factor for top executives considering employment with your company. High-limit coverage demonstrates a commitment to protecting leadership, making your company more attractive to skilled professionals.

3. **Improved Risk Management**: With high-limit D&O insurance, manufacturers can implement more aggressive growth strategies, knowing they have comprehensive protection. This can lead to increased competitiveness and market share.

Cost Considerations for Manufacturers

The cost of D&O insurance varies based on several factors, including the size of the company, the industry, and the specific coverage limits. For manufacturers, premiums might be higher due to the inherent risks associated with the industry. However, many insurers offer customizable policies that can be tailored to fit the specific needs and budgets of manufacturing businesses. It's advisable to compare quotes from multiple providers to find the most competitive rates and coverage options.

Exploring Your Options

Manufacturers seeking high-limit D&O insurance have a variety of options available. Many insurers offer specialized policies designed to address the unique risks associated with manufacturing. By visiting websites and searching options, you can find policies that not only provide the necessary coverage but also align with your company's strategic goals. Engaging with insurance brokers who specialize in D&O insurance for manufacturers can also provide valuable insights and help tailor a policy that meets your specific needs.

Real-World Examples and Statistics

According to a recent survey, nearly 25% of manufacturing companies have faced a D&O claim in the past five years1. This highlights the necessity of having adequate coverage. Additionally, the average cost of a D&O claim in the manufacturing sector is approximately $1.5 million2, underscoring the importance of high-limit policies to cover substantial potential liabilities.

Securing high-limit D&O insurance is a strategic move for manufacturers looking to protect their leadership and ensure business continuity. By exploring the available options and customizing a policy to fit your needs, you can safeguard your company against the uncertainties of the business landscape. As you navigate this process, remember that the right coverage not only protects your assets but also empowers your company to pursue innovation and growth with confidence.