Maximize Your Medicaid Savings With Expert Trust Guidance

Maximize your Medicaid savings by exploring expert trust guidance options that can help you navigate complex eligibility requirements and uncover significant financial benefits.

Understanding Medicaid Trusts

Medicaid trusts are specialized legal tools designed to help individuals qualify for Medicaid benefits while protecting their assets. These trusts can be particularly beneficial for those who require long-term care but want to preserve their estate for their heirs. By transferring assets into a Medicaid trust, you can potentially lower your countable assets, making you eligible for Medicaid assistance without depleting your life savings.

Types of Medicaid Trusts

There are primarily two types of Medicaid trusts: revocable and irrevocable trusts.

Revocable trusts offer flexibility, allowing you to alter the trust terms or even dissolve it entirely. However, because the assets in a revocable trust are still considered part of your estate, they do not protect your assets from Medicaid's asset limits.

Irrevocable trusts, on the other hand, are more rigid, as you relinquish control over the assets placed in the trust. The advantage here is that assets in an irrevocable trust are generally not counted toward Medicaid eligibility, offering a strategic way to safeguard your wealth1.

Benefits of Expert Guidance

Navigating the intricacies of Medicaid trusts can be daunting, which is why expert guidance is invaluable. Professionals specializing in Medicaid planning can help you:

Determine the best type of trust for your financial situation.

Structure the trust to comply with state-specific Medicaid rules.

Optimize asset protection to maximize savings.

Moreover, these experts can assist in timing the creation of the trust, as Medicaid has a "look-back period" of up to five years, during which asset transfers can affect eligibility2.

Financial Implications and Savings

The cost of long-term care can be exorbitant, with nursing home expenses averaging over $100,000 annually in the United States3. By establishing a Medicaid trust, you can potentially save a significant portion of these costs by qualifying for Medicaid coverage. This not only preserves your assets but also provides peace of mind knowing that your healthcare needs are covered without financially burdening your family.

Real-World Examples

Consider the case of a retiree who transferred his home, valued at $250,000, into an irrevocable Medicaid trust. This strategic move allowed him to qualify for Medicaid, covering his long-term care costs, while ensuring that the home remained in the family4. Such examples highlight the tangible benefits of Medicaid trusts when combined with expert guidance.

Explore Your Options

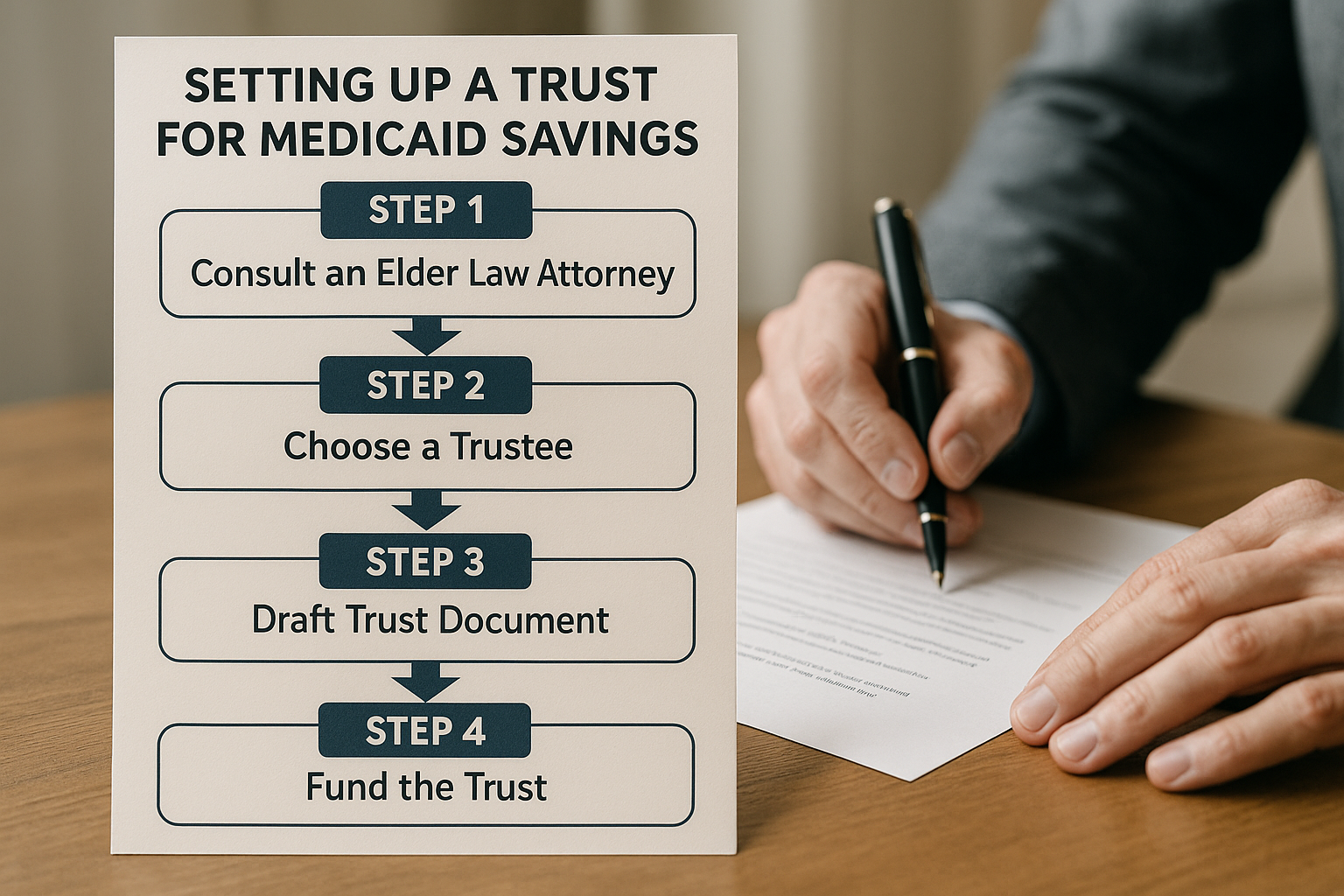

If you're considering Medicaid planning, now is the time to explore your options. Browse options for legal experts who specialize in Medicaid trusts, and see these options to ensure you make informed decisions that align with your financial goals. With the right guidance, you can protect your assets and secure your future.

References

- ElderLawAnswers: Medicaid and Trusts

- Nolo: Medicaid Look-Back Rules

- Genworth: Cost of Care Survey

- The New York Times: Medicaid and Long-Term Care

By understanding the nuances of Medicaid trusts and seeking expert guidance, you can effectively manage your financial future, ensuring that your healthcare needs are met without sacrificing your legacy. Visit websites and consult with professionals to explore the best strategies tailored to your unique situation.