Maximize Medicaid Power Nursing Home Eligibility Secrets Revealed

If you're navigating the complexities of Medicaid eligibility for nursing home care, you can unlock significant benefits and opportunities by understanding the secrets behind maximizing Medicaid power—browse options and see these options to make informed decisions.

Understanding Medicaid and Its Importance for Nursing Home Eligibility

Medicaid is a crucial program for many seniors and families, providing financial assistance for long-term care in nursing homes. Unlike Medicare, which offers limited coverage for nursing home care, Medicaid covers a more comprehensive range of services, making it an essential resource for those who qualify. Understanding how to maximize Medicaid benefits can significantly impact your financial planning and ensure that you or your loved ones receive the necessary care without exhausting personal savings.

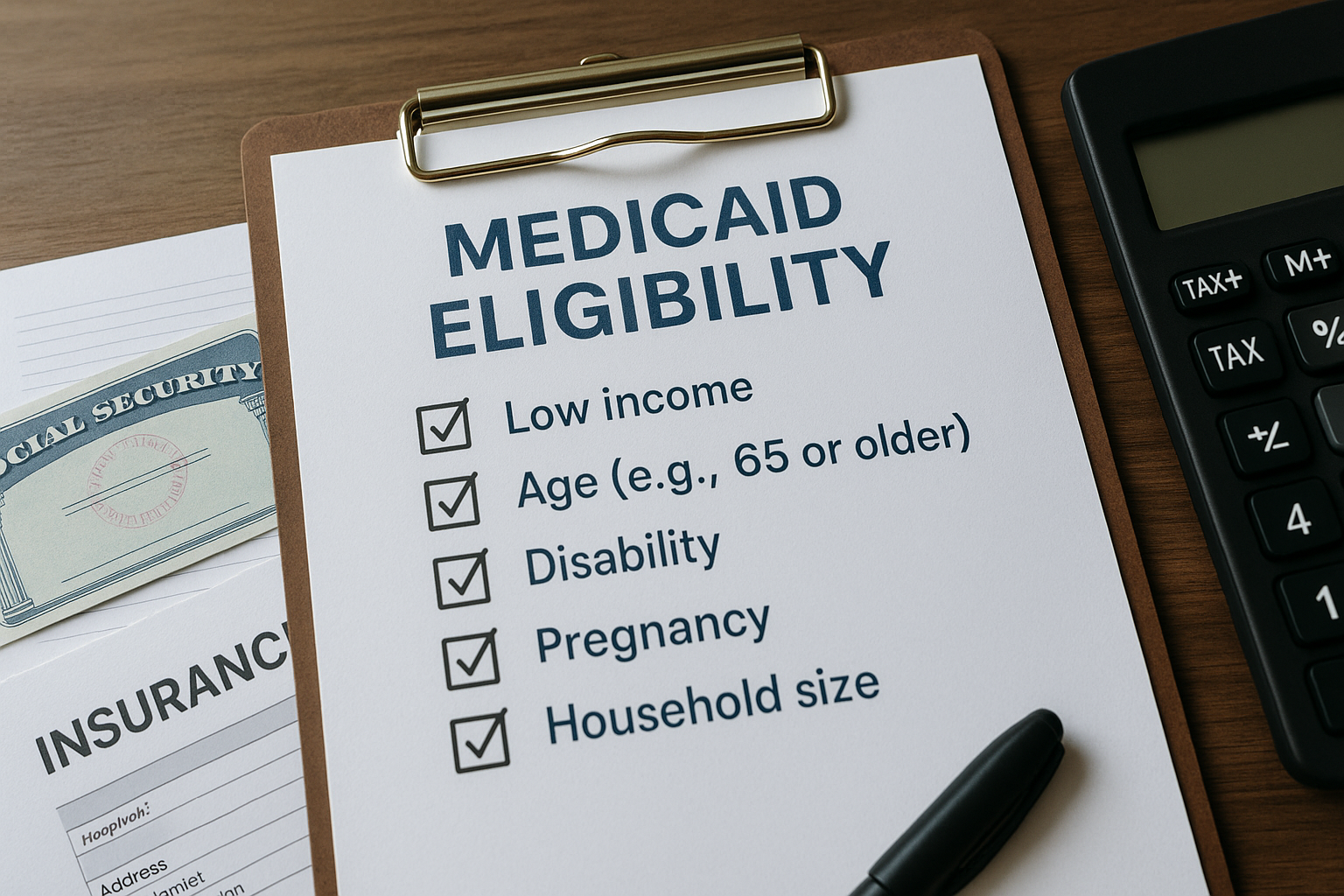

Eligibility Criteria: Navigating the Complex Requirements

Medicaid eligibility for nursing home care is determined by both financial and medical criteria. Financially, applicants must meet specific income and asset limits, which vary by state. For instance, in 2023, the federal poverty level for a single individual is approximately $14,580 annually, but states have discretion in setting their thresholds1. Medically, individuals must demonstrate the need for a nursing home level of care, which typically involves an assessment of daily living activities and cognitive impairments.

Strategies to Maximize Medicaid Benefits

To effectively maximize Medicaid benefits, it's essential to explore strategic planning options:

1. **Spend-Down Strategies**: This involves reducing countable assets to meet Medicaid's asset limits. This can be achieved by paying off debts, making home improvements, or prepaying funeral expenses.

2. **Asset Protection Trusts**: Establishing a Medicaid Asset Protection Trust can protect assets while still allowing eligibility for Medicaid. These trusts must be set up well in advance, as they are subject to a five-year look-back period2.

3. **Annuities and Life Estates**: Converting assets into income streams through annuities or creating a life estate for a home can also help in meeting eligibility criteria while preserving wealth for heirs.

Common Pitfalls and How to Avoid Them

One of the most significant challenges in maximizing Medicaid benefits is the five-year look-back period, which examines all financial transactions to prevent asset divestment solely for Medicaid eligibility. Violating this can result in penalties and delayed benefits. Working with a qualified elder law attorney can help navigate these regulations and avoid costly mistakes3.

Exploring Specialized Services and Resources

For those seeking more personalized guidance, numerous elder care consultants and financial planners specialize in Medicaid planning. These professionals can offer tailored strategies to optimize eligibility and benefits. Additionally, visiting websites of local elder law firms and Medicaid planning services can provide valuable resources and options for those looking to delve deeper into this complex process.

Key Takeaways

Maximizing Medicaid power for nursing home eligibility requires a strategic approach to financial planning and a thorough understanding of state-specific regulations. By exploring options like spend-down strategies, asset protection trusts, and professional guidance, you can ensure that you or your loved ones receive the necessary care without depleting personal assets. As you navigate this intricate process, remember to browse options and explore specialized services that can offer further insights and solutions.