Maximize Benefits with Medicaid Spend Down Planning Advisor

Unlock the full potential of your Medicaid benefits by exploring Medicaid Spend Down Planning Advisors, where you can browse options and see these opportunities to optimize your financial strategy.

Understanding Medicaid Spend Down

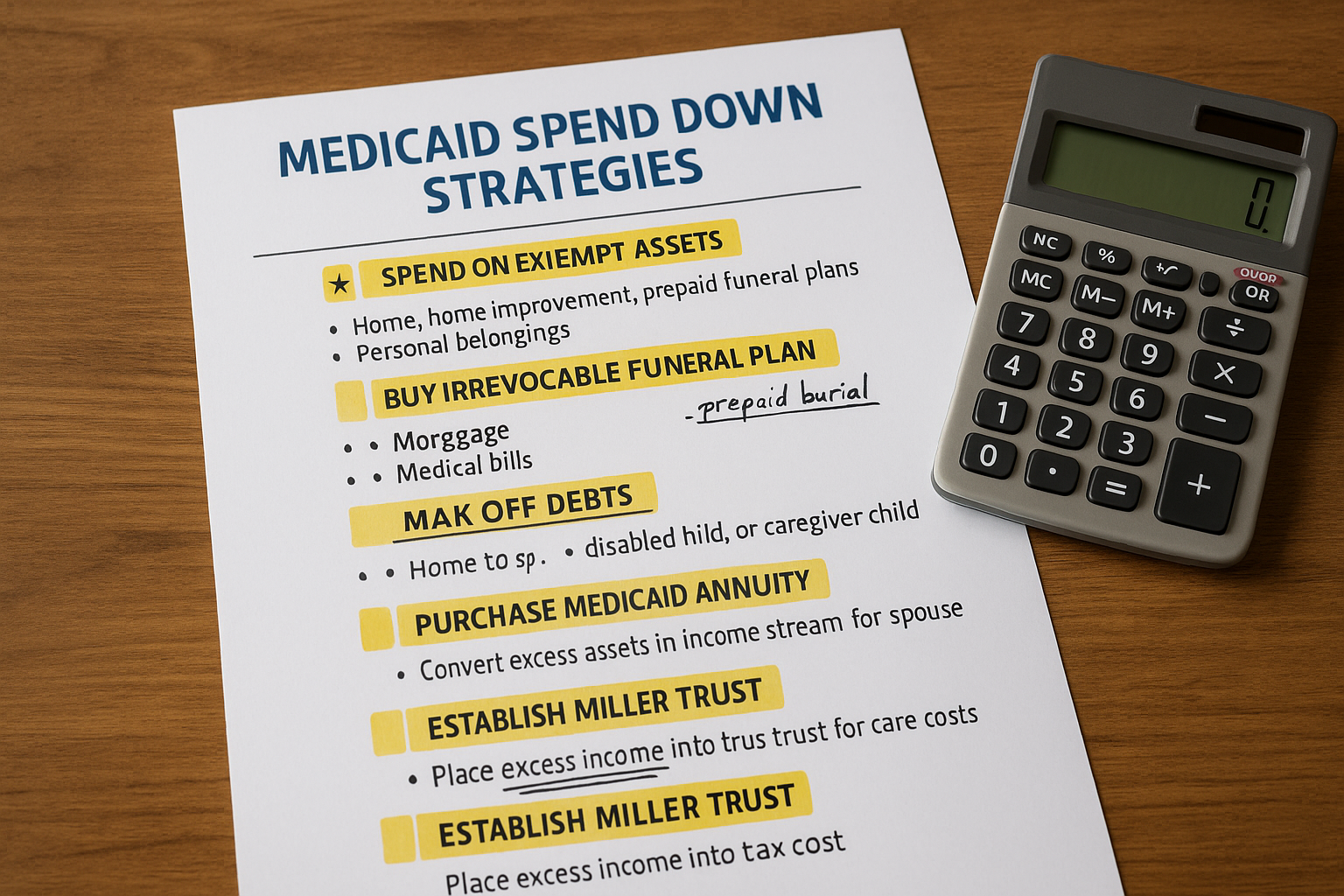

Medicaid Spend Down is a crucial financial strategy that allows individuals with income or assets above Medicaid's eligibility limits to qualify for benefits by reducing their countable assets. This process can be complex, but it is essential for those who require Medicaid to cover long-term care costs. By working with a Medicaid Spend Down Planning Advisor, you can navigate the intricacies of eligibility requirements and maximize your benefits effectively.

The Role of a Medicaid Spend Down Planning Advisor

A Medicaid Spend Down Planning Advisor specializes in helping individuals and families understand and implement strategies to meet Medicaid eligibility criteria. These professionals provide guidance on legal and financial matters, including asset restructuring, income allocation, and estate planning. By leveraging their expertise, you can ensure that your assets are protected while still qualifying for the necessary healthcare benefits.

Key Benefits of Working with an Advisor

1. **Tailored Financial Strategies**: Advisors offer personalized plans that consider your unique financial situation, ensuring compliance with Medicaid rules while preserving your assets.

2. **Expert Navigation**: The Medicaid application process is notoriously complex. An advisor can help you navigate the paperwork and procedures, reducing the risk of errors that could delay or deny your benefits.

3. **Asset Protection**: By restructuring your finances, advisors can help protect your assets from being depleted by healthcare costs, ensuring a more secure financial future.

4. **Peace of Mind**: Knowing that an expert is handling your Medicaid planning can alleviate stress and allow you to focus on other important aspects of life.

Real-World Examples and Success Stories

Many families have successfully utilized Medicaid Spend Down Planning to secure their financial future. For instance, a family with a modest income but significant savings might restructure their assets by investing in exempt resources, such as a primary residence or irrevocable trust, to meet Medicaid eligibility requirements1. Another example is reallocating income through Qualified Income Trusts (QITs), which can help individuals qualify for Medicaid while maintaining a portion of their income for personal use2.

Financial Implications and Considerations

Understanding the financial implications of Medicaid Spend Down is vital. While the cost of hiring an advisor can vary, it is often outweighed by the potential savings and asset protection achieved through strategic planning. Advisors typically charge an hourly rate or a flat fee, but the investment can lead to significant long-term savings by ensuring continued eligibility for Medicaid and avoiding unnecessary asset depletion3.

Exploring Your Options

To fully capitalize on the benefits of Medicaid Spend Down Planning, consider consulting with a specialized advisor. Many firms offer free initial consultations, allowing you to explore your options without any financial commitment. By visiting websites and searching for local advisors, you can find a professional who suits your needs and start planning for a more secure financial future.

In summary, a Medicaid Spend Down Planning Advisor can be an invaluable resource in navigating the complexities of Medicaid eligibility. By protecting your assets and ensuring compliance, these professionals help you maximize your benefits and achieve peace of mind. Explore the options available to you and take the first step towards securing your financial future with expert guidance.