Instantly Simplify D&O Claims History Roofing Secrets

If you’re looking to instantly simplify your D&O claims history for roofing, you’re about to discover key insights that will streamline your process and save you time—so go ahead and browse options, search options, or see these options to make informed decisions.

Understanding D&O Claims in Roofing

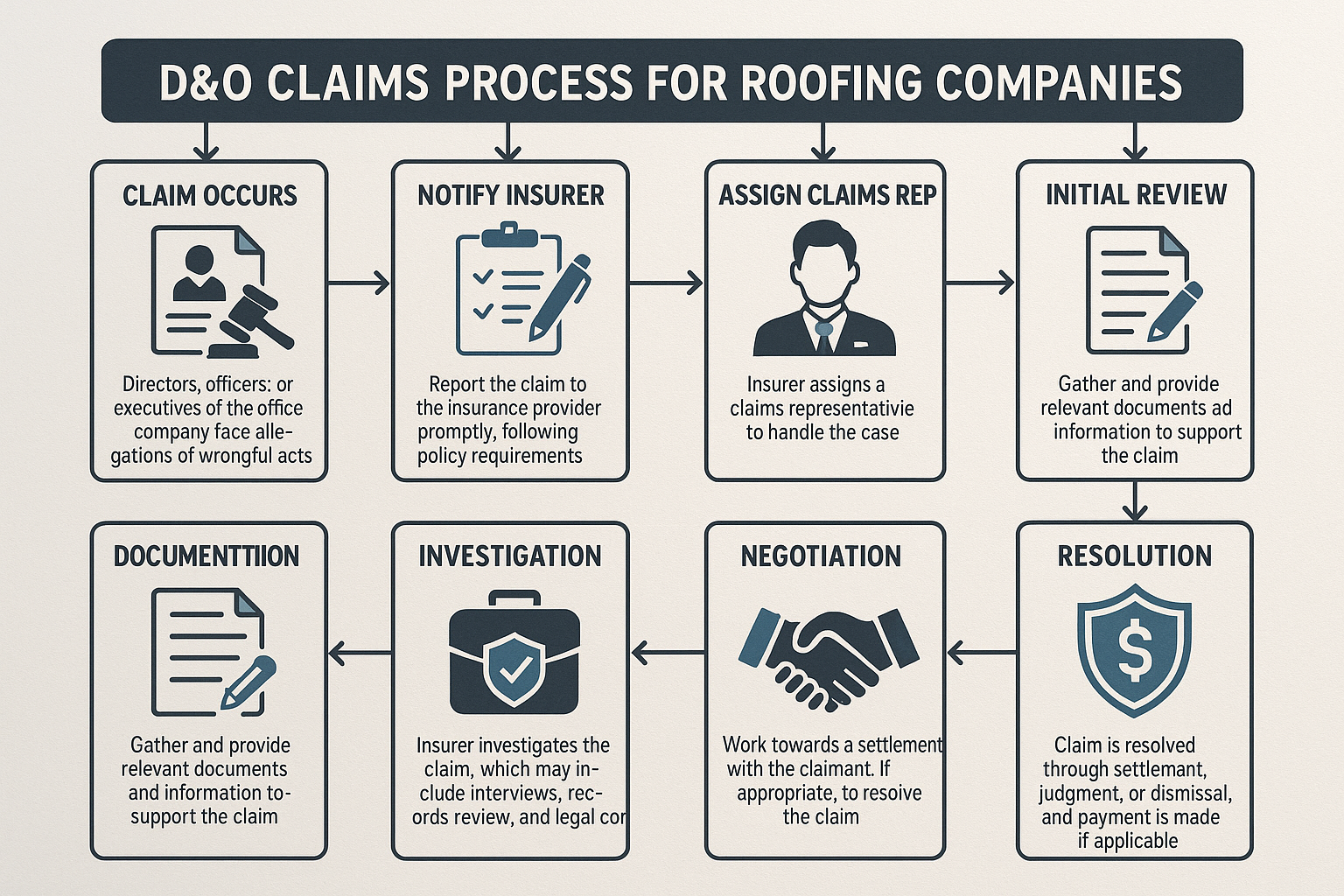

Directors and Officers (D&O) insurance claims can be complex, especially within the roofing industry, where risks and liabilities are significant. Understanding the intricacies of these claims is crucial for roofing companies to protect their leadership and financial interests. D&O insurance provides coverage for the personal liability of directors and officers as individuals, and for the company, against claims brought by third parties for alleged wrongful acts in their capacity as directors and officers1.

Challenges in Managing D&O Claims

Roofing companies face unique challenges when managing D&O claims. The industry is often subject to litigation due to construction defects, safety violations, and contractual disputes. These issues can lead to significant financial liabilities if not properly managed. Having a clear claims history is essential for negotiating better insurance terms and reducing premiums. By maintaining comprehensive records and understanding the common causes of claims, companies can mitigate risks and improve their claims management processes.

Benefits of Streamlining Your Claims History

Streamlining your D&O claims history offers numerous benefits. Firstly, it can lead to reduced insurance costs as insurers are likely to offer better rates to companies with a clean claims record. Secondly, it enhances the company's reputation, making it easier to secure contracts and partnerships. Lastly, it allows for quicker resolution of claims, minimizing disruptions to business operations. By leveraging technology and implementing robust risk management strategies, roofing companies can maintain an organized and transparent claims history2.

Practical Steps to Simplify Your D&O Claims History

To simplify your D&O claims history, consider the following strategies:

- Implement a centralized digital system for tracking all claims-related documents and communications.

- Regularly review and update your policies and procedures to ensure compliance with industry regulations.

- Conduct routine training sessions for your team to raise awareness about risk management and claims prevention.

- Engage with insurance professionals who specialize in the roofing industry to receive tailored advice and solutions.

These steps not only streamline the claims process but also empower your team with the knowledge and tools needed to handle potential claims efficiently.

Exploring Specialized Services

For those seeking additional support, various specialized services can assist in managing D&O claims. Professional claims management firms offer expertise in navigating complex insurance landscapes and can provide valuable insights into optimizing your claims history. Additionally, many insurance providers offer risk assessment and management services tailored to the roofing industry, helping businesses identify potential vulnerabilities and implement preventative measures3.

In summary, simplifying your D&O claims history in the roofing industry is not just about reducing paperwork; it's about enhancing your business's overall efficiency and financial health. By taking proactive steps and exploring specialized options, you can protect your company's leadership and ensure a more secure future.