Instant Fidelity Bond Quotes Every Notary Signing Agent Needs

If you're a notary signing agent looking to safeguard your business with minimal hassle, browse options for instant fidelity bond quotes and discover the peace of mind they offer.

Understanding Fidelity Bonds for Notary Signing Agents

Fidelity bonds are a critical component for notary signing agents, providing protection against losses due to fraudulent acts committed by the notary or their employees. These bonds are a safety net, ensuring that clients feel secure in their transactions. As a notary signing agent, obtaining a fidelity bond can enhance your credibility and trustworthiness, which are paramount in this field.

The Importance of Instant Quotes

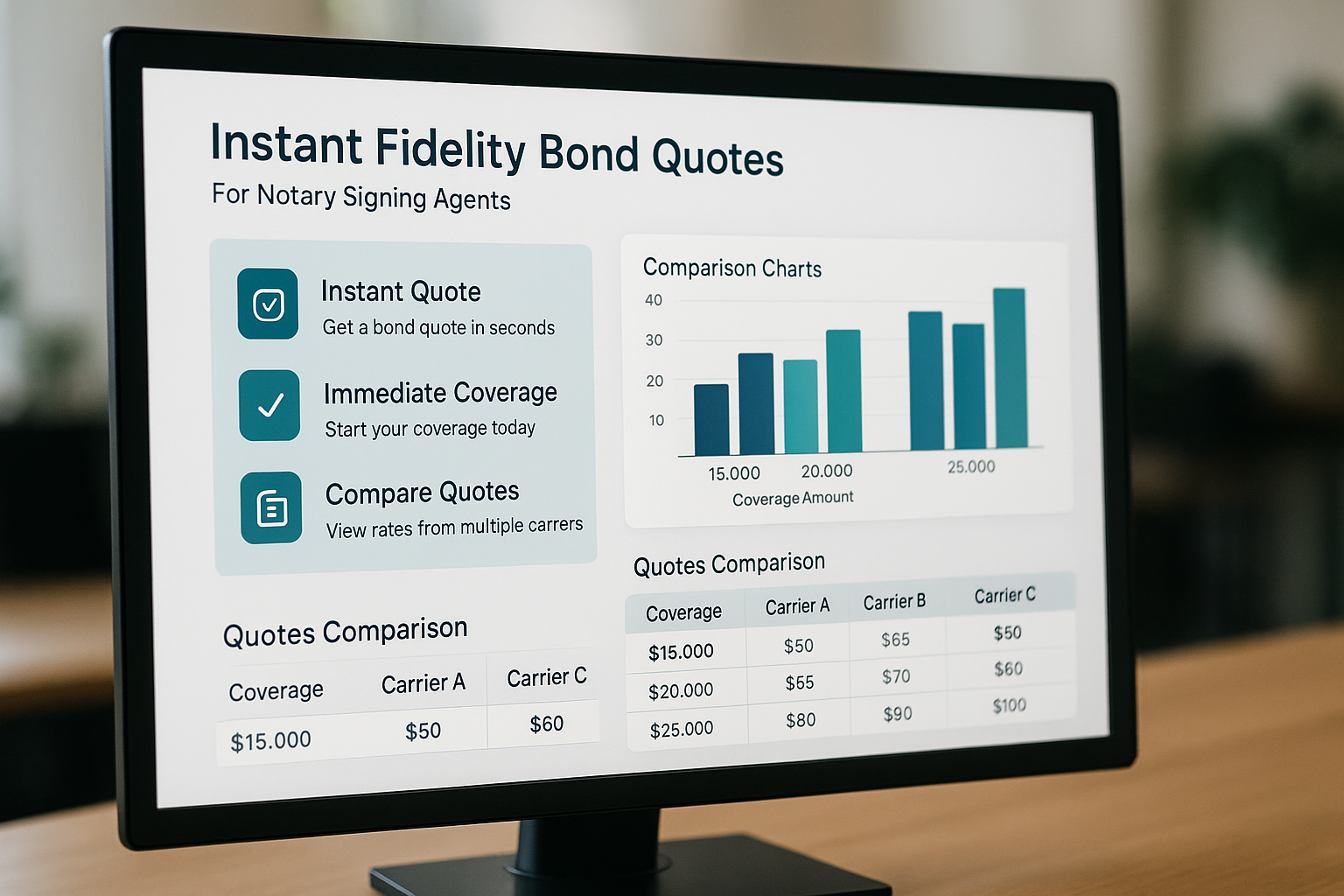

In today's fast-paced world, time is of the essence. Instant fidelity bond quotes allow notary signing agents to quickly assess their options and make informed decisions without unnecessary delays. This efficiency not only saves time but also ensures that agents can remain focused on their core responsibilities. By visiting websites that offer instant quotes, you can compare different providers, evaluate coverage options, and choose the one that best suits your needs.

How Fidelity Bonds Work

A fidelity bond is essentially an insurance policy that covers dishonest acts by the bonded party. For notary signing agents, this means protection against potential financial losses due to fraudulent activities. The bond amount typically ranges from $5,000 to $100,000, depending on the level of coverage required by the state or client. The cost of a fidelity bond varies based on factors such as the bond amount and the applicant’s credit score. Generally, premiums range from 1% to 3% of the bond amount annually1.

Benefits of Fidelity Bonds

For notary signing agents, fidelity bonds offer several benefits:

1. **Client Assurance:** Clients are more likely to trust a notary who is bonded, as it provides a financial guarantee against fraudulent acts.

2. **Competitive Edge:** Being bonded can set you apart from competitors who are not, potentially leading to more business opportunities.

3. **Legal Compliance:** Some states require notary signing agents to have a fidelity bond as part of their licensing requirements2.

Finding the Right Fidelity Bond

When searching for a fidelity bond, it’s crucial to consider several factors:

- **Coverage Limits:** Ensure the bond amount meets or exceeds the requirements of your state or clients.

- **Reputation of the Provider:** Choose a reputable insurance provider with a history of reliable service and client satisfaction.

- **Cost:** Compare quotes to find a bond that offers the best value without compromising on coverage.

By following the options available online, you can efficiently navigate the fidelity bond market and secure the necessary protection for your business.

Exploring Additional Resources

For notary signing agents seeking comprehensive solutions, there are numerous resources available. From specialized insurance providers to industry associations offering guidance and support, these resources can help you make informed decisions about your fidelity bond needs. Consider exploring platforms that offer detailed comparisons and expert advice to ensure you select the best option for your situation.

Instant fidelity bond quotes are an invaluable tool for notary signing agents, offering a streamlined way to secure essential coverage. By leveraging online resources and expert insights, you can protect your business, enhance your professional reputation, and gain a competitive edge in the industry. Take the time to explore these options, and ensure your notary signing agent business is well-protected and poised for success.