Grab Your Hidden Life Settlement Valuation Quote Today

Unlocking the true value of your life insurance policy can offer you financial flexibility and peace of mind, so why not browse options today to see these opportunities?

Understanding Life Settlements

Life settlements are a financial transaction where a policyholder sells their life insurance policy to a third party for a cash payout. This payout is typically more than the policy's cash surrender value but less than the net death benefit1. For many, this option provides a valuable alternative to lapsing or surrendering a policy, especially when financial needs change or when the policy is no longer affordable.

Why Consider a Life Settlement?

There are several reasons why you might consider a life settlement. Perhaps your premiums have become a financial burden, or maybe your beneficiaries no longer need the policy's protection. In such cases, a life settlement can provide a lump sum of cash that can be used for other financial needs, such as medical expenses, retirement funding, or debt repayment2.

The Valuation Process

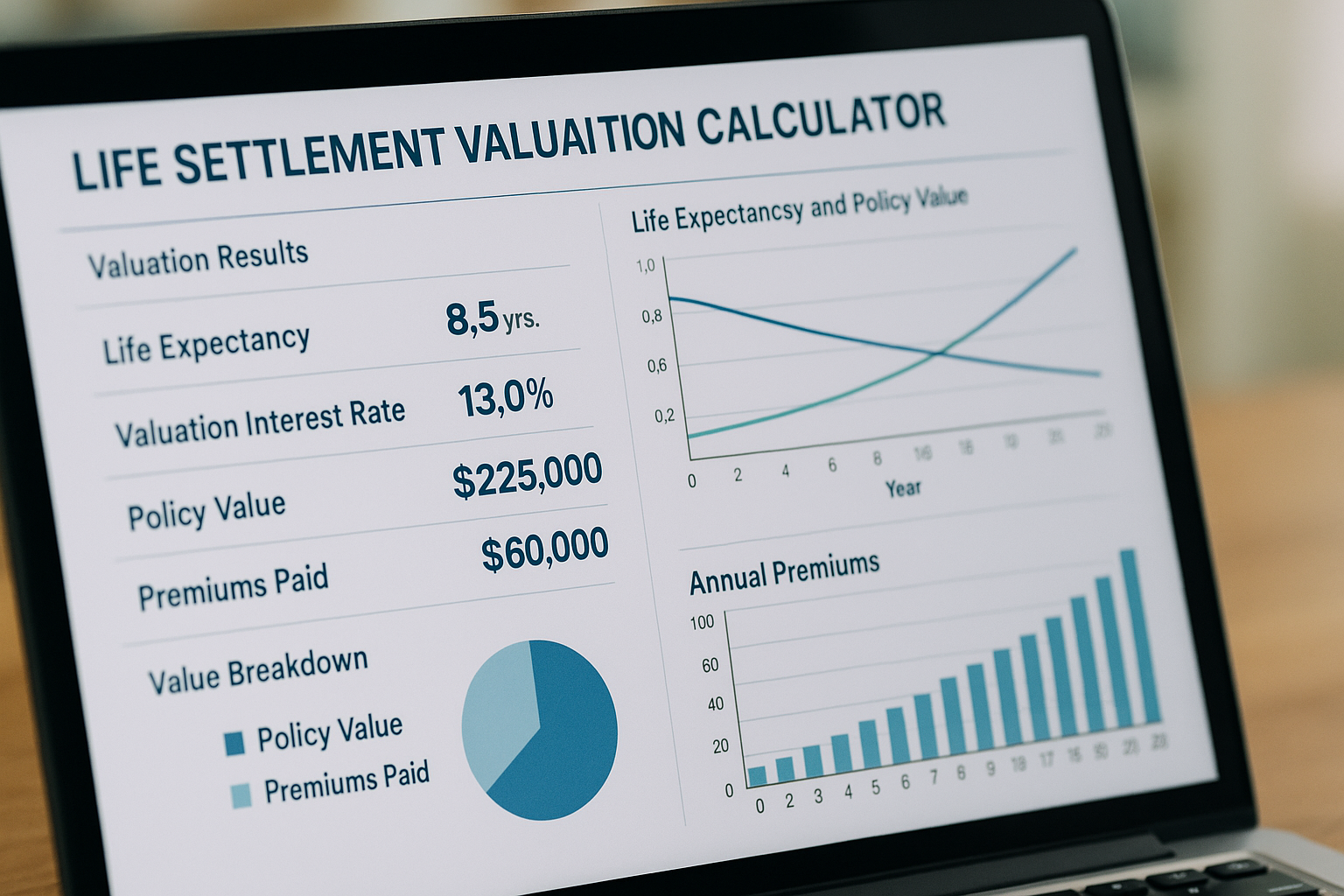

Obtaining a life settlement valuation quote involves assessing the worth of your policy. Factors such as the death benefit, premiums, the policyholder's age, and health status all play a role in determining the policy's value3. Typically, older policyholders or those with significant health issues may receive higher offers due to the reduced life expectancy, which decreases the waiting period for the investor to collect the death benefit.

Real-World Examples and Financial Insights

According to the Life Insurance Settlement Association, life settlements have become an increasingly popular option, with the market growing significantly over recent years4. For example, a 75-year-old policyholder with a $1 million policy might receive an offer ranging from $150,000 to $300,000, depending on health and other factors5. This substantial sum can provide much-needed liquidity for those in retirement or facing unexpected financial challenges.

Exploring Your Options

If you're considering a life settlement, it's crucial to explore your options by visiting websites and consulting with financial advisors who specialize in this area. They can provide personalized advice and help you navigate the complexities of the transaction, ensuring you receive the best possible offer for your policy. Additionally, reputable brokers can connect you with potential buyers and guide you through the negotiation process.

In summary, life settlements present a unique opportunity to unlock the hidden value of your life insurance policy. By understanding the valuation process and exploring the available options, you can make informed decisions that align with your financial goals. Take the first step today by searching options that fit your needs and discover the financial freedom a life settlement can offer.