Get Staffing Firms D&O Insurance Quotes Instantly

If you're looking to protect your staffing firm from potential liabilities and ensure peace of mind, it's time to browse options for Directors and Officers (D&O) insurance to safeguard your business interests effectively.

Why D&O Insurance is Crucial for Staffing Firms

Directors and Officers insurance is an essential safeguard for staffing firms, providing protection against claims made by employees, clients, or other third parties. This type of insurance covers legal fees, settlements, and other costs associated with lawsuits that could arise from managerial decisions. Given the dynamic nature of the staffing industry, where decisions can have significant repercussions, having a robust D&O policy is a wise investment.

Understanding the Benefits of D&O Insurance

D&O insurance offers several key benefits for staffing firms. Firstly, it protects personal assets of directors and officers, ensuring that their personal wealth isn't jeopardized by business-related lawsuits. Secondly, it enhances the firm's ability to attract and retain top talent, as potential leaders are more likely to join a company that provides such protections. Lastly, it supports corporate governance by encouraging responsible decision-making, knowing that the firm is protected against costly legal battles.

Factors Influencing D&O Insurance Costs

The cost of D&O insurance for staffing firms can vary based on several factors. These include the size of the firm, the industry sector, the firm's claims history, and the level of coverage required. Typically, smaller firms might see annual premiums ranging from $5,000 to $10,000, while larger firms might pay significantly more1. It's crucial for firms to assess their specific needs and risks to determine the most appropriate level of coverage.

How to Obtain D&O Insurance Quotes Instantly

In today's digital age, obtaining D&O insurance quotes has become more streamlined and efficient. Many insurance providers offer online platforms where you can easily enter your firm's details and receive instant quotes tailored to your needs. These platforms often allow you to compare different policies, ensuring you find the best coverage at the most competitive price. It's advisable to visit websites of reputable insurance companies and use these tools to explore your options.

Additional Considerations for Staffing Firms

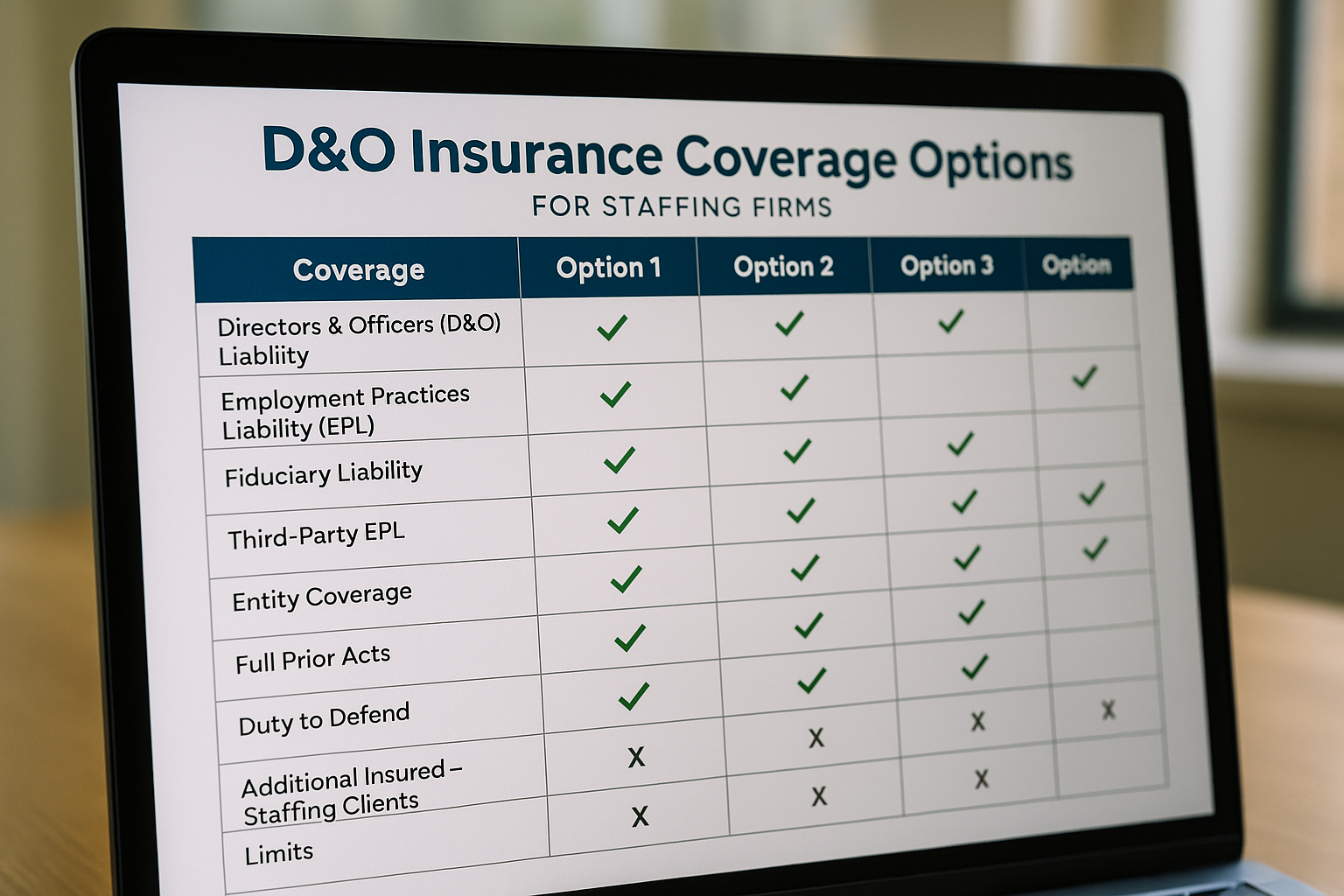

Beyond the basic coverage, staffing firms might also consider additional endorsements or specialized policies that cater to their unique operational risks. For instance, Employment Practices Liability Insurance (EPLI) can be bundled with D&O insurance to cover claims related to employment practices, such as wrongful termination or discrimination2. Exploring these options can provide a more comprehensive risk management strategy.

Real-World Examples and Case Studies

Real-world scenarios highlight the importance of D&O insurance. For instance, a staffing firm faced a lawsuit from a former executive claiming wrongful dismissal. Thanks to their D&O policy, the firm was able to cover legal expenses and settle the case without significant financial strain. Such examples underscore the practical value of having robust insurance coverage3.

Protecting your staffing firm with D&O insurance is not just a prudent business decision; it's a strategic move that can secure your company's future. As you explore the various options available, consider the specific needs of your firm and the potential risks you face. By doing so, you can ensure that your firm is well-protected and poised for continued success.