Get Real Tax Relief Enjoy IRS Payment Plans

Are you feeling overwhelmed by tax debt and eager to find a manageable solution? Discover how IRS payment plans can offer you real tax relief, and browse options that could ease your financial burden today.

Understanding IRS Payment Plans

Dealing with tax debt can be daunting, but the IRS offers several payment plans designed to help taxpayers manage their obligations without undue stress. These plans provide a structured approach to settling your tax debt over time, making it easier to stay on top of your finances. By opting for a payment plan, you can avoid the severe penalties and interest that come with unpaid taxes, ultimately saving you money and providing peace of mind.

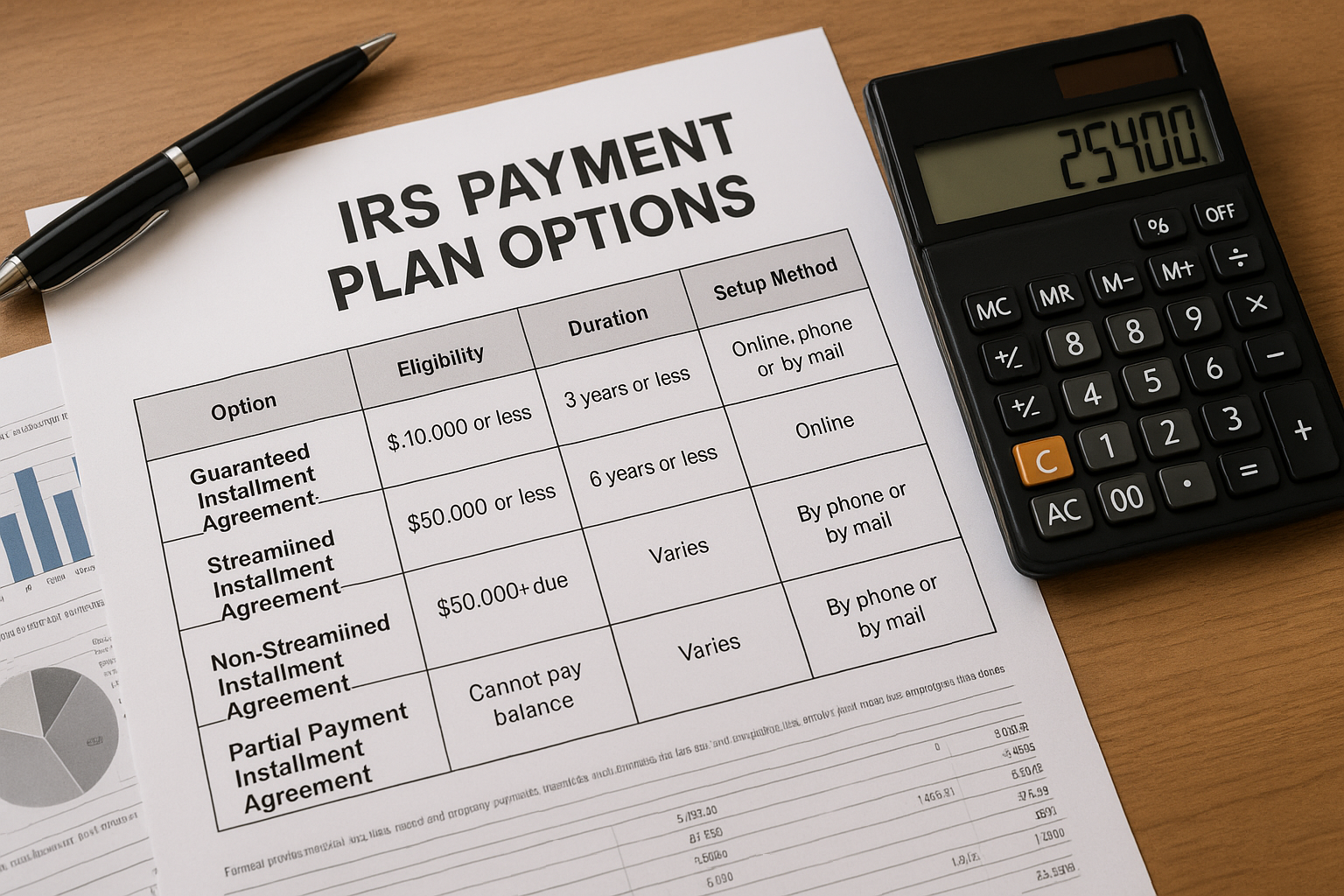

Types of IRS Payment Plans

The IRS offers different types of payment plans, each catering to varying financial situations. The most common options include:

- Short-Term Payment Plan: This plan allows you to pay your tax debt in full within 120 days. It's suitable for those who can settle their debt relatively quickly but need a little extra time to gather funds.

- Long-Term Payment Plan (Installment Agreement): This option is ideal for individuals who need more than 120 days to pay off their debt. It allows you to make monthly payments over a longer period, typically up to 72 months.

- Offer in Compromise: This is a more specialized solution where the IRS agrees to settle your tax debt for less than the full amount owed, based on your ability to pay. It's a viable option for those facing significant financial hardship.

Benefits of IRS Payment Plans

Enrolling in an IRS payment plan offers several benefits that can alleviate the stress of managing tax debt:

How to Apply for an IRS Payment Plan

Applying for an IRS payment plan is a straightforward process. You can apply online through the IRS website, where you'll need to provide your financial information, including income, expenses, and the amount you owe. Alternatively, you can call the IRS or work with a tax professional to assist you in the application process. It's crucial to ensure that all your tax returns are filed before applying, as the IRS requires compliance with all filing obligations.

Costs and Considerations

While IRS payment plans offer significant relief, it's important to be aware of the costs involved. For instance, there may be setup fees for installment agreements, which vary based on the type of plan and your payment method. However, low-income taxpayers may qualify for reduced fees or even fee waivers. Interest will continue to accrue on your unpaid balance, so it's in your best interest to pay off the debt as quickly as possible.

If you're considering an Offer in Compromise, be prepared for a thorough evaluation of your financial situation, as the IRS will only accept offers that reflect your true ability to pay. This option requires careful consideration and often the guidance of a tax professional to ensure you meet all the criteria.

Exploring Further Options

For those seeking additional guidance, numerous resources and services are available to help you navigate the complexities of IRS payment plans. Tax professionals can provide personalized advice tailored to your unique financial circumstances, ensuring you make the best decision for your situation. Additionally, visiting websites dedicated to tax relief can offer further insights and options for managing your tax obligations effectively.

By understanding and utilizing IRS payment plans, you can take control of your tax debt and work towards a more secure financial future. Don't hesitate to explore the options available to you, and remember that professional assistance is always at hand to guide you through the process.