Get Rapid Tech Insurance Quotes Instantly Save Today

Are you tired of navigating the complex world of tech insurance and ready to unlock immediate savings by exploring a variety of rapid quote options today?

Understanding Tech Insurance: What You Need to Know

In today's fast-paced digital landscape, tech insurance is more crucial than ever. Whether you're a startup, small business, or a large corporation, having the right tech insurance can safeguard your operations against unforeseen risks. Tech insurance typically covers areas such as cybersecurity breaches, data loss, and technology errors or omissions, providing peace of mind and financial protection.

As businesses increasingly rely on technology, the potential for cyber threats and data breaches has skyrocketed. According to a recent study, the average cost of a data breach in 2023 was approximately $4.45 million, highlighting the importance of comprehensive coverage1. This makes obtaining tech insurance not just a precaution, but a necessity.

How to Get Rapid Tech Insurance Quotes

Getting rapid tech insurance quotes has never been easier, thanks to advancements in online platforms. Many insurance providers now offer instant quote services, allowing you to quickly compare policies and premiums from the comfort of your office. By visiting websites that specialize in tech insurance, you can browse options tailored to your specific needs and budget.

These platforms often provide a straightforward process: input your business details, select the coverage types you're interested in, and receive multiple quotes in minutes. This efficiency not only saves time but also empowers you to make informed decisions without the pressure of traditional insurance sales tactics.

Benefits of Quick Insurance Quotes

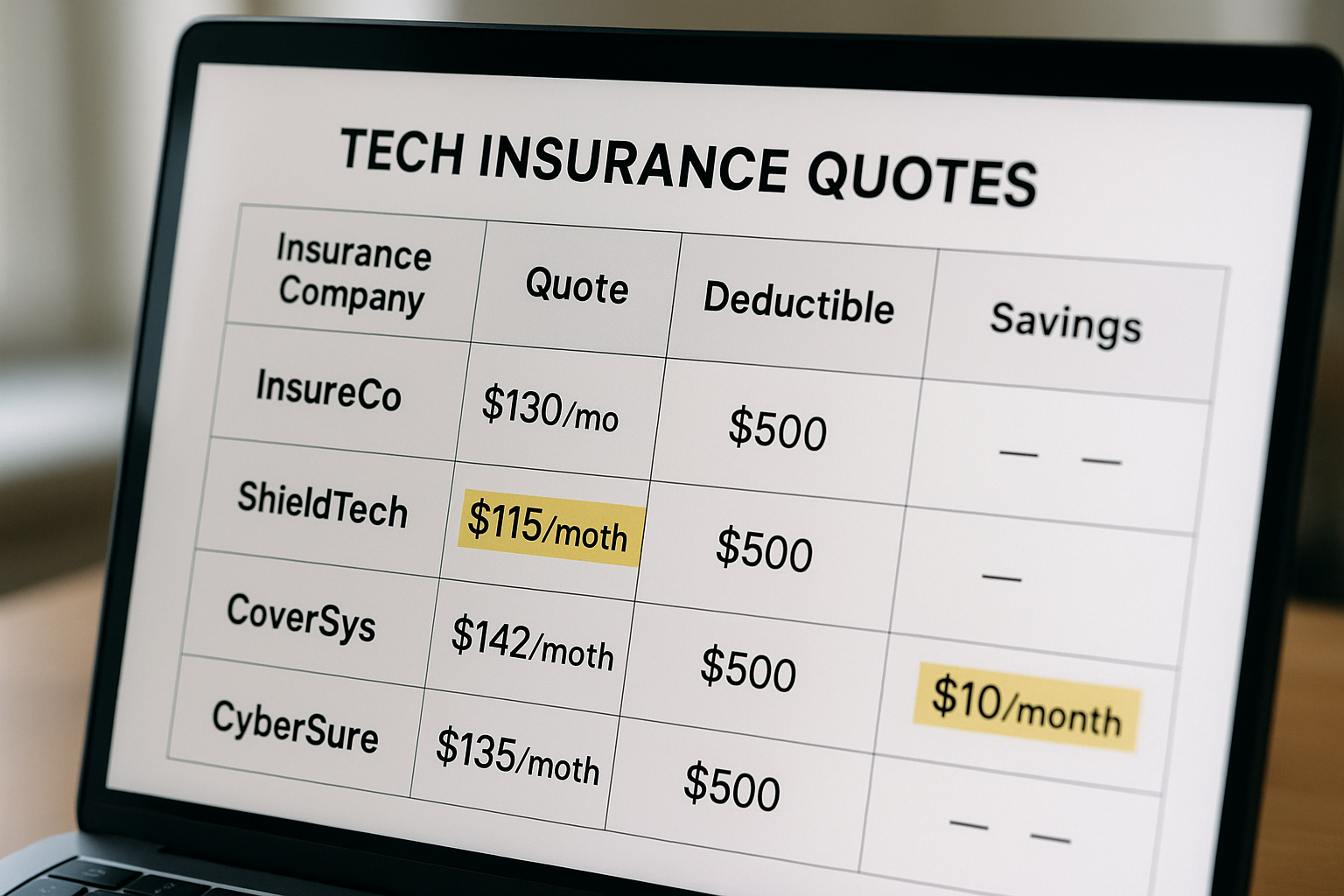

One of the primary benefits of obtaining rapid insurance quotes is the ability to compare multiple options side-by-side. This transparency ensures that you are getting the best possible deal for your coverage requirements. Additionally, some providers offer discounts for bundling policies or for businesses that demonstrate robust cybersecurity measures.

Furthermore, quick quotes can reveal opportunities for cost savings that you might not have considered. For example, some insurers offer lower premiums to companies that implement comprehensive data protection strategies, thereby reducing the risk of claims2.

Exploring Specialized Coverage Options

While standard tech insurance policies cover general risks, many businesses benefit from exploring specialized options. Cyber liability insurance, for instance, is specifically designed to cover expenses related to data breaches and cyberattacks. Similarly, errors and omissions insurance can protect tech companies from claims of negligence or inadequate work.

By following the options available through specialized insurers, you can tailor your coverage to meet the unique challenges of your industry. This customization not only provides better protection but also aligns your insurance strategy with your business goals.

Obtaining rapid tech insurance quotes is a strategic move for any business looking to protect its digital assets and ensure operational continuity. By leveraging online platforms to search options and explore the diverse range of coverage available, you can secure the best possible protection at a competitive price.