Get Medical Clinic Credit Prequalified In Hours Today

Imagine getting prequalified for medical clinic credit in just hours, unlocking immediate access to essential healthcare services while you browse options and explore the best financial solutions tailored to your needs.

Understanding Medical Clinic Credit Prequalification

Medical clinic credit prequalification is a financial service that allows patients to quickly determine their eligibility for credit lines specifically designed to cover healthcare expenses. This process can be a game-changer for those facing unexpected medical bills or planning elective procedures not covered by insurance. By getting prequalified, you can better manage your healthcare costs without the immediate stress of financial constraints.

The process of prequalification involves a soft credit check, which means it won't affect your credit score. This is an attractive option for many, as it provides a clear picture of the credit amount you might access without any negative impact on your financial standing. Once prequalified, patients can confidently plan their healthcare journey, knowing they have the financial backing needed.

Benefits of Quick Prequalification

One of the most significant advantages of getting prequalified for medical clinic credit is the speed of the process. In many cases, you can receive a prequalification decision within hours. This rapid turnaround enables you to make informed decisions about your healthcare options promptly. Whether you're dealing with an emergency or planning for future medical needs, this quick access to credit can be invaluable.

Additionally, prequalification often comes with competitive interest rates and flexible repayment terms. This flexibility allows you to choose a repayment plan that aligns with your financial situation, easing the burden of medical expenses over time. Many financial institutions offer special promotions or deals, such as zero-interest periods for a set duration, making it even more appealing to consider these options1.

How to Get Prequalified

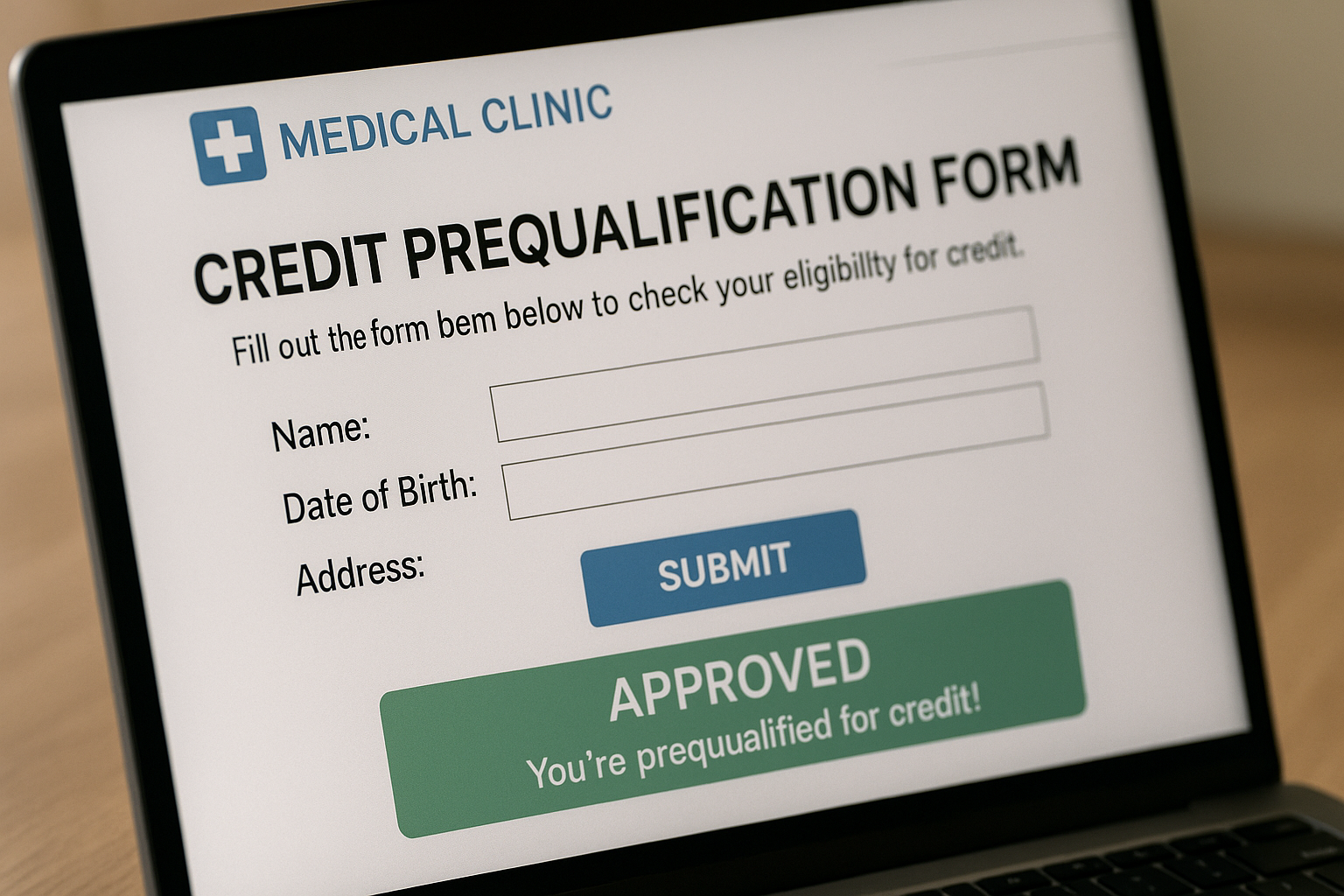

Getting prequalified for medical clinic credit is a straightforward process. Start by researching and comparing different financial institutions that offer medical credit lines. Many banks and credit unions provide online tools where you can enter your information and receive a prequalification decision almost instantly. It's essential to visit websites of reputable lenders to ensure you're getting the best possible terms and conditions.

Once you've selected a lender, you'll typically need to provide basic personal information, including your income, employment status, and desired credit amount. The lender will use this information to assess your creditworthiness and determine the potential credit line available to you. Remember, this is a soft inquiry, so it won't affect your credit score2.

Real-World Examples and Statistics

According to recent data, the average American household spends approximately $5,000 annually on out-of-pocket healthcare costs3. With rising medical expenses, the need for accessible credit options has never been more critical. A study by the Kaiser Family Foundation found that 26% of adults aged 18-64 struggle with medical debt4. These statistics underscore the importance of having financial tools like medical clinic credit to manage healthcare expenses effectively.

Many healthcare providers are now partnering with financial institutions to offer in-house credit solutions, making it easier for patients to access these services directly through their clinic. This integration simplifies the process, allowing patients to focus on their health rather than financial logistics.

Getting prequalified for medical clinic credit in hours provides a practical solution to managing healthcare expenses efficiently. By exploring the available options and utilizing quick prequalification processes, you can ensure that your healthcare needs are met without unnecessary financial stress. Take the time to search options, visit websites, and find the best credit solution for your unique situation.