Get Exclusive EPLI Solutions for High-Stakes Investments Today

Unlock unparalleled protection for your high-stakes investments by exploring exclusive EPLI solutions that help you mitigate risks and safeguard your assets—browse options now to ensure you're covered.

Understanding EPLI and Its Importance

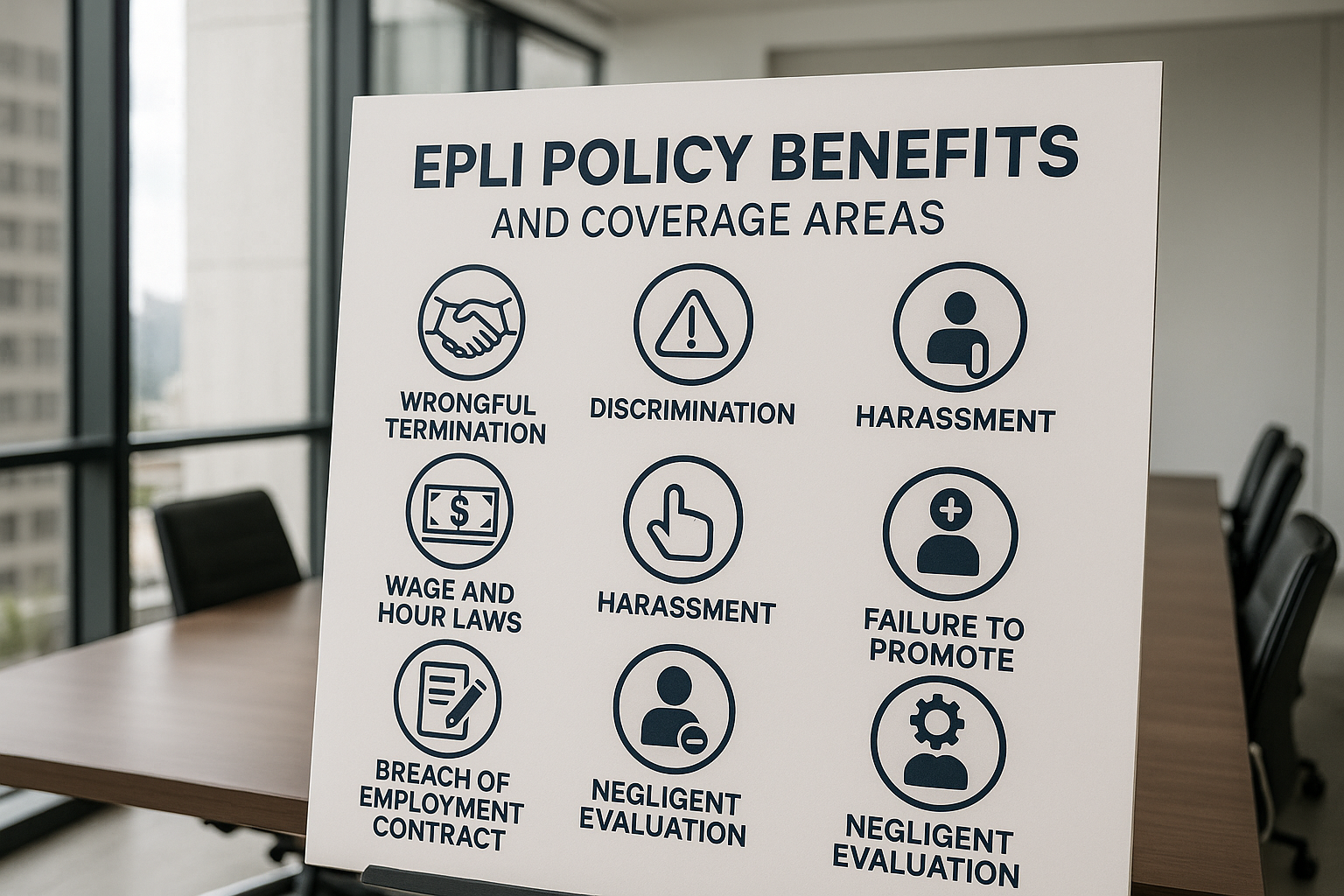

Employment Practices Liability Insurance (EPLI) is a critical component for businesses, especially those involved in high-stakes investments. This specialized insurance offers protection against claims made by employees alleging discrimination, wrongful termination, harassment, and other employment-related issues. As businesses grow and diversify their portfolios, the risk of facing such claims increases, making EPLI an essential safeguard.

The Growing Need for EPLI in High-Stakes Investments

In the current economic climate, high-stakes investments are becoming increasingly complex and competitive. Investors and business owners must navigate a myriad of legal and regulatory challenges, making the protection offered by EPLI more vital than ever. With the rise in employment-related lawsuits, having comprehensive EPLI coverage can save businesses significant financial and reputational damage. According to a study by Hiscox, the average cost of an EPLI claim is approximately $160,000, with 24% of claims resulting in a defense and settlement payment1.

Key Benefits of EPLI for Investors

EPLI provides several advantages for those involved in high-stakes investments:

1. **Financial Protection**: EPLI covers legal fees, settlements, and judgments, which can be substantial in employment-related lawsuits.

2. **Risk Management**: By having EPLI, businesses demonstrate a proactive approach to managing potential risks, which can be attractive to investors and partners.

3. **Peace of Mind**: Knowing that your investments are protected allows you to focus on growth and strategic planning without the constant worry of potential legal issues.

Factors to Consider When Choosing EPLI

When selecting an EPLI policy, there are several factors to consider to ensure it meets your specific needs:

- **Coverage Limits**: Determine the appropriate coverage limit based on the size and nature of your business.

- **Exclusions**: Be aware of what is not covered under the policy to avoid surprises in the event of a claim.

- **Policy Terms**: Review the terms and conditions carefully to understand the scope of coverage and any potential limitations.

Exploring Specialized EPLI Solutions

For high-stakes investments, tailored EPLI solutions can provide comprehensive coverage that addresses the unique risks associated with these ventures. Many insurers offer customizable policies that can be adjusted to fit the specific needs of your investment portfolio. By visiting websites and consulting with insurance experts, you can find specialized options that offer the best protection for your business.

Real-World Examples and Case Studies

Consider the case of a large investment firm that faced a class-action lawsuit from former employees alleging discriminatory practices. With a robust EPLI policy in place, the firm was able to cover the legal expenses and settle the case without significant financial strain. This example highlights the importance of having adequate EPLI coverage to protect against unforeseen legal challenges.

Final Thoughts

In the world of high-stakes investments, the right EPLI solution can be a game-changer, providing the security and confidence needed to pursue ambitious business goals. As you search options and explore the various policies available, remember that the right coverage can not only protect your assets but also enhance your investment strategy. Take the time to assess your needs and consult with experts to find the EPLI solution that best aligns with your business objectives.