Find Your Ideal Credit Monitoring Service Today

Unlock the peace of mind you deserve by exploring a range of credit monitoring services that suit your financial needs, and see these options to safeguard your credit health today.

Why Credit Monitoring Matters

Credit monitoring services play an essential role in protecting your financial well-being by keeping you informed about changes to your credit report. These services alert you to potential fraud, identity theft, and unauthorized transactions, enabling you to address issues promptly. With the increasing prevalence of cybercrime, having a robust credit monitoring system is more crucial than ever. According to Experian, identity theft affected over 14 million consumers in 2021 alone1.

Types of Credit Monitoring Services

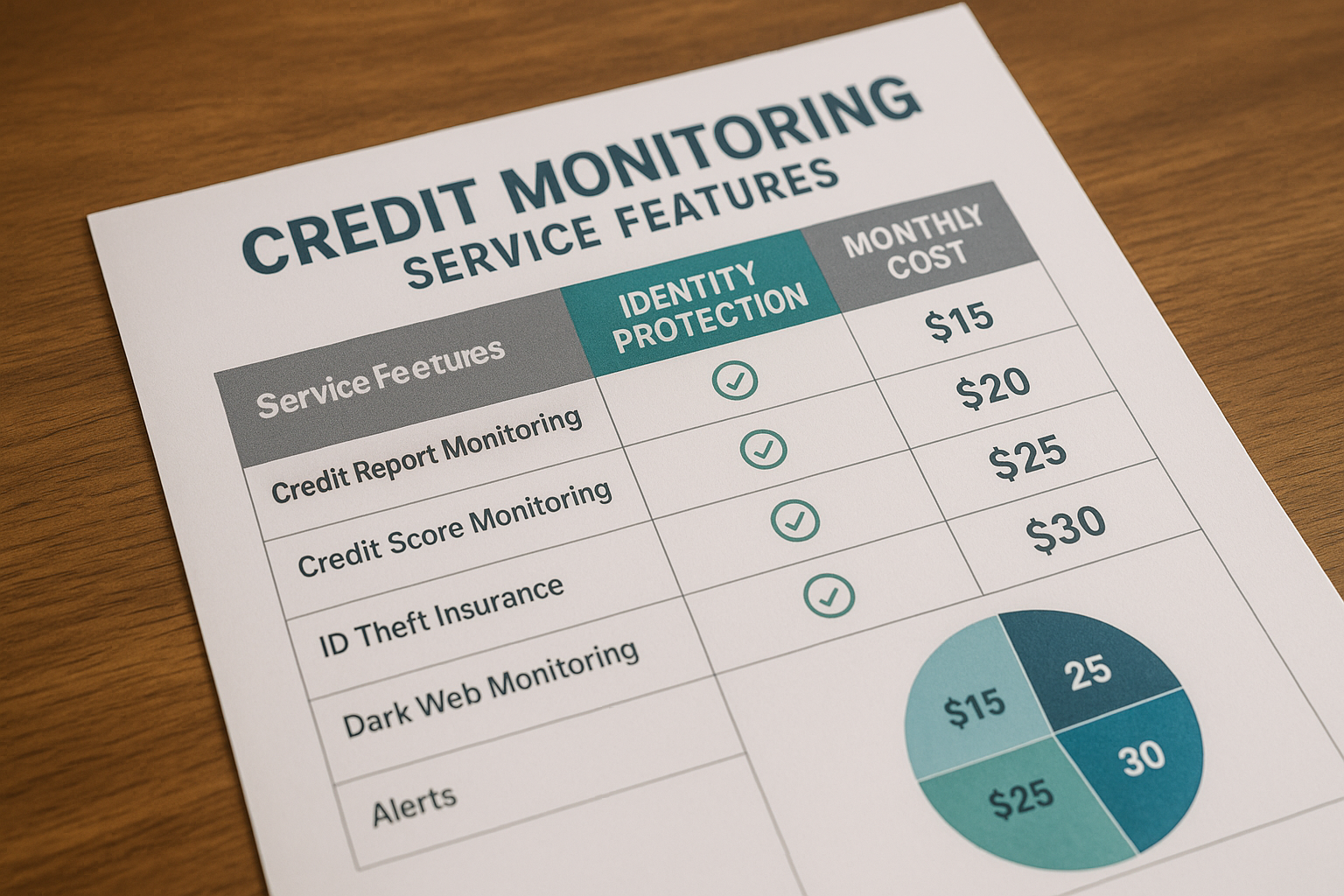

There are various types of credit monitoring services, each offering distinct features. Basic services typically provide alerts for changes in your credit report, such as new accounts or hard inquiries. More comprehensive plans may include identity theft protection, credit score tracking, and even insurance against identity theft losses.

1. **Basic Credit Monitoring**: These services alert you to changes in your credit report, helping you spot potential fraud early. They often cover one or two of the major credit bureaus.

2. **Comprehensive Credit Monitoring**: These plans monitor all three major credit bureaus—Experian, Equifax, and TransUnion—and include additional features like identity theft protection and credit score updates.

3. **Identity Theft Protection Services**: Beyond monitoring your credit, these services offer tools to safeguard your personal information, such as dark web surveillance and identity recovery assistance.

Costs and Benefits

The cost of credit monitoring services can vary widely, from free basic monitoring to premium plans costing $20-$30 per month. Free services, like those offered by Credit Karma, provide basic alerts and credit score access but may lack comprehensive protection2. On the other hand, premium services like Identity Guard offer extensive features, including identity theft insurance and personalized risk assessments3.

Investing in a credit monitoring service can save you time and money by preventing identity theft and credit fraud. According to Javelin Strategy & Research, victims of identity theft spent an average of 15 hours resolving issues and lost approximately $1,343 in 20204.

Choosing the Right Service for You

When selecting a credit monitoring service, consider your specific needs and budget. Evaluate the features offered, such as the number of credit bureaus monitored, identity theft protection, and additional perks like credit score simulators. It's also wise to read reviews and compare services to ensure you're getting the best value.

Getting Started

To find your ideal credit monitoring service, start by assessing your financial goals and risk tolerance. Do you need basic monitoring, or would a comprehensive package better suit your needs? Once you've determined your requirements, browse options and visit websites of reputable providers to compare plans and features.

Credit monitoring is an investment in your financial security. By choosing the right service, you can protect your credit, prevent fraud, and gain peace of mind. Explore these options today to take control of your credit health.