Drive Less Pay Less Auto Insurance Comparison Guide

If you've ever felt overwhelmed by auto insurance costs, it's time to explore how "Drive Less Pay Less" policies can offer you significant savings and tailored options—browse these options to find the perfect fit for your driving habits.

Understanding "Drive Less Pay Less" Auto Insurance

"Drive Less Pay Less" auto insurance, often referred to as usage-based insurance (UBI), is a modern approach that calculates premiums based on your actual driving habits rather than traditional factors like age or location. This innovative model uses telematics technology to monitor how much and how safely you drive, rewarding careful and infrequent drivers with lower rates. For many, this means a fairer premium that reflects their real-world usage, potentially leading to substantial savings.

How Does It Work?

The core of "Drive Less Pay Less" insurance is telematics—a system that tracks driving data through a device installed in your vehicle or a mobile app. This data includes mileage, speed, braking patterns, and time of day when you drive. Insurance companies analyze this information to assess risk more accurately and adjust your premium accordingly. For instance, if you drive fewer miles and exhibit safe driving behaviors, you may see a reduction in your insurance costs.

Benefits of Usage-Based Insurance

The primary benefit of usage-based insurance is cost savings, especially for those who drive less frequently. According to the Insurance Information Institute, drivers can save an average of 10-15% on their premiums by switching to a UBI policy1. Additionally, UBI encourages safer driving habits, as drivers are more aware of their driving patterns and the impact on their insurance rates. This model can also be more environmentally friendly by incentivizing reduced vehicle use, contributing to lower emissions.

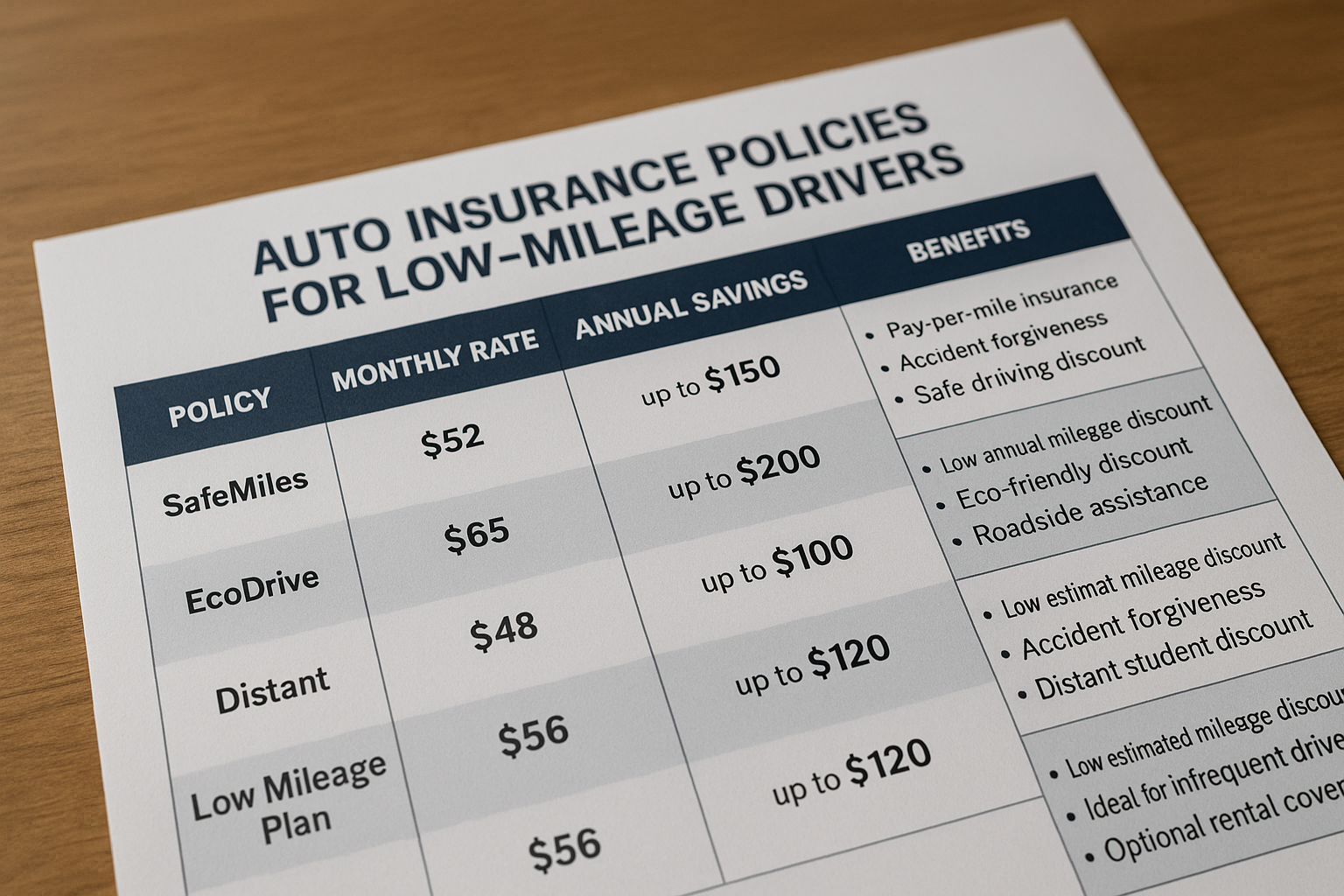

Comparing Your Options

When considering "Drive Less Pay Less" insurance, it's essential to compare various providers to find the best fit for your needs. Major insurers like Progressive, Allstate, and State Farm offer UBI programs such as Snapshot, Drivewise, and Drive Safe & Save, respectively. Each program has unique features and potential discounts, so it's crucial to review the specifics of each offering. For example, Progressive's Snapshot program claims that drivers can save an average of $145 per year2.

Is It Right for You?

Usage-based insurance is ideal for low-mileage drivers, such as those who work from home, retirees, or individuals who primarily use public transportation. If you drive less than 12,000 miles per year, you might benefit significantly from a "Drive Less Pay Less" policy3. However, if you frequently drive long distances or have irregular driving patterns, traditional insurance might still be more cost-effective.

Next Steps

To get started, visit websites of various insurers and use their online tools to estimate your potential savings with a usage-based policy. Be sure to read customer reviews and consider any additional features or discounts offered. Engaging with these options will help you make an informed decision that aligns with your driving habits and financial goals.

By exploring the possibilities of "Drive Less Pay Less" insurance, you can take control of your auto insurance costs, potentially leading to significant savings and a more personalized coverage experience.