Compare Student Loan Refinance Rates Save Thousands Instantly

Imagine instantly saving thousands on your student loans by simply taking a moment to browse options and compare refinance rates that could transform your financial future.

Understanding Student Loan Refinancing

Refinancing student loans is a strategic financial move that involves replacing your existing loans with a new one, typically at a lower interest rate. This process can significantly reduce your monthly payments and the total interest paid over the life of the loan. By refinancing, you can consolidate multiple loans into a single payment, making it easier to manage your finances. The key is to shop around and compare rates from various lenders to find the best deal that suits your financial situation.

Why Compare Refinance Rates?

Interest rates on student loans can vary widely depending on the lender, your credit score, and other factors. By comparing refinance rates, you can potentially lower your interest rate by a few percentage points, which can lead to substantial savings. For instance, reducing your interest rate from 6% to 3% on a $50,000 loan can save you over $8,000 in interest payments over a 10-year term1. Additionally, refinancing can offer you the flexibility to adjust your repayment term, either shortening it to save on interest or lengthening it to lower your monthly payments.

Real-World Benefits of Refinancing

Many borrowers have successfully saved money through refinancing. For example, a borrower with a $100,000 student loan at a 7% interest rate could refinance to a 3.5% rate, saving over $20,000 in interest over 15 years2. Moreover, some lenders offer additional benefits such as autopay discounts, no origination fees, and customer service perks, which can enhance your refinancing experience.

Factors to Consider Before Refinancing

While refinancing can offer significant savings, it's crucial to consider several factors before making a decision. These include:

- Credit Score: A higher credit score can qualify you for better rates. It's advisable to check your credit report and improve your score if necessary before applying.

- Loan Terms: Be mindful of the new loan's terms, including the interest rate type (fixed or variable), repayment period, and any fees involved.

- Federal Loan Benefits: Refinancing federal loans with a private lender means losing federal benefits such as income-driven repayment plans and loan forgiveness programs.

Exploring Your Options

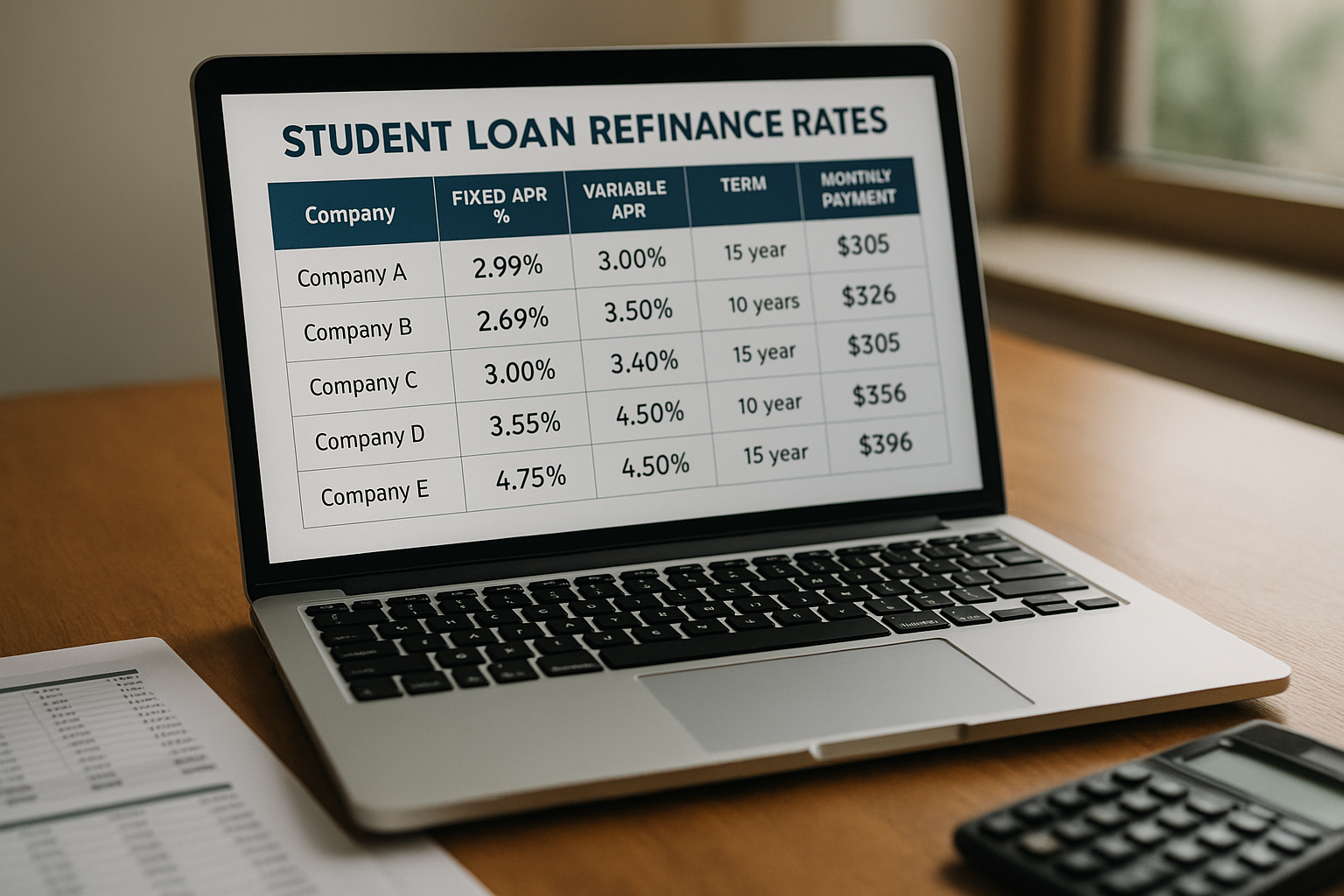

To find the best refinancing deal, it's essential to visit websites of various lenders and use online comparison tools. These resources allow you to see these options side-by-side, making it easier to identify the most competitive rates and terms. Many lenders also offer prequalification processes that don't affect your credit score, enabling you to explore your potential rates without any commitment.

Refinancing your student loans can be a game-changer for your financial health, offering you the chance to save thousands and simplify your repayment process. By taking the time to search options and compare rates, you can unlock opportunities for significant financial relief. Whether you're looking to lower your monthly payments or pay off your debt faster, refinancing could be the solution you need. Start your journey today by exploring the specialized options and resources available to you.