Apartment Owners Save Big with Strategic Insurance Secrets

Imagine slashing your apartment insurance costs while enhancing coverage by simply following strategic options that savvy owners are using to save big—browse these options and transform your approach today.

Understanding the Basics of Apartment Insurance

Apartment insurance, often referred to as landlord insurance, is a critical component of property management that protects against potential losses from various risks. Unlike standard homeowner insurance, apartment insurance is tailored to cover the unique challenges faced by property owners, such as tenant-related damages, loss of rental income, and liability claims. By understanding the nuances of these policies, you can make informed decisions that not only protect your investment but also optimize your expenses.

The Financial Benefits of Strategic Insurance

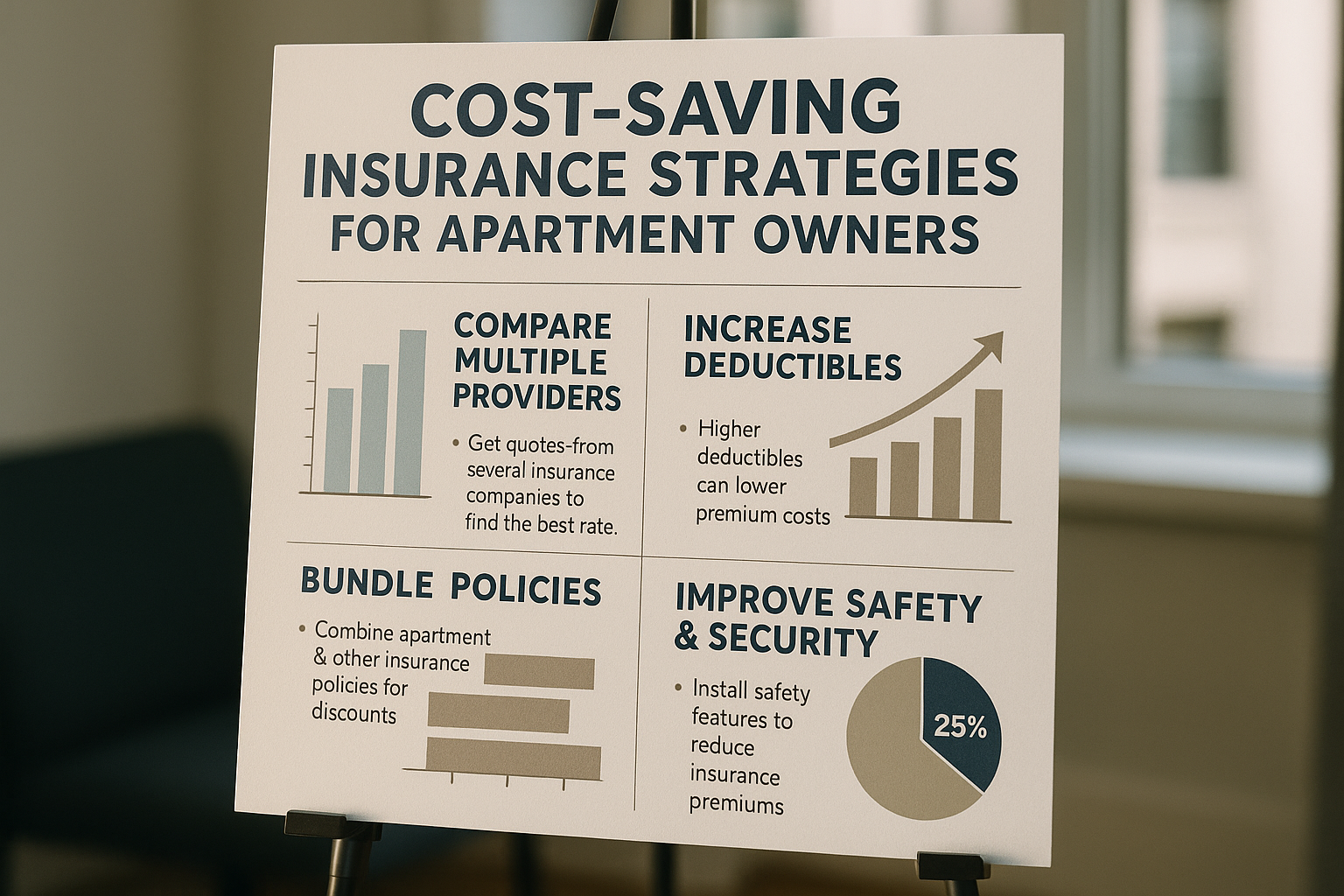

One of the most compelling reasons to explore strategic insurance options is the potential for significant cost savings. Many apartment owners are unaware of the discounts available through bundling policies or implementing risk management strategies. For instance, installing security systems or upgrading to fire-resistant materials can lead to lower premiums. Additionally, many insurance providers offer discounts for loyalty or for maintaining a claims-free history1. By browsing options and negotiating with insurers, you can uncover these savings opportunities.

Types of Coverage to Consider

When selecting an insurance policy, it's crucial to consider the types of coverage that align with your property's specific needs. Common coverage options include:

- Property Damage: Covers repairs or replacements due to events like fire, vandalism, or natural disasters.

- Liability Protection: Protects against legal claims if someone is injured on your property.

- Loss of Income: Compensates for lost rental income if your property becomes uninhabitable due to covered damages.

- Building Code Upgrades: Covers the cost of bringing a damaged building up to current building codes2.

By understanding these options, you can tailor your policy to provide comprehensive protection without overpaying for unnecessary coverage.

Real-World Examples and Savings

Consider the case of a property owner who opted for a higher deductible to lower their premium costs. By increasing their deductible from $500 to $1,000, they reduced their annual premium by nearly 10%3. Similarly, another owner saved approximately 15% by installing a monitored security system and sprinkler system, which also enhanced the property's safety4.

Exploring Specialized Solutions

For those managing multiple properties, a blanket insurance policy can offer a streamlined solution that covers all buildings under a single policy. This not only simplifies management but often results in bulk discounts. Additionally, some insurers provide specialized policies for properties in high-risk areas, such as those prone to flooding or earthquakes, ensuring you have the necessary coverage without excessive costs.

As you navigate the complex world of apartment insurance, remember that the key to maximizing savings lies in your willingness to explore and compare options. By visiting websites, consulting with insurance experts, and leveraging available discounts, you can secure a policy that offers both financial and operational advantages.