Apartment owners save big on umbrella insurance quotes now

Unlock substantial savings on your umbrella insurance by exploring a variety of options that can safeguard your assets while keeping costs down.

Understanding Umbrella Insurance for Apartment Owners

As an apartment owner, your primary insurance policy might not cover all potential liabilities, which is where umbrella insurance comes into play. This type of insurance provides additional liability protection beyond the limits of your existing policies, such as homeowners or auto insurance. It acts as a financial safety net, covering legal fees, medical bills, and other damages that exceed your base policy limits.

Why Now is the Perfect Time to Explore Options

The current insurance market is highly competitive, leading to better deals and more comprehensive coverage options for apartment owners. Many insurers are offering discounts and tailored packages to attract new customers. By browsing available options, you can find policies that not only meet your coverage needs but also fit within your budget. For instance, some insurers offer discounts if you bundle umbrella insurance with other policies, such as auto or property insurance1.

Benefits of Umbrella Insurance

Umbrella insurance is particularly beneficial for apartment owners due to the unique risks they face. Whether it's a tenant's injury on your property or damage caused by a natural disaster, umbrella insurance ensures that you are not financially exposed beyond your primary policy limits. This type of insurance typically covers:

- Legal defense costs in case of lawsuits

- Liability claims that are not covered by other policies

- Incidents involving your rental properties

Moreover, umbrella insurance can protect against slander, libel, and other personal liability situations that may arise in today's digital age2.

Cost Considerations and Potential Savings

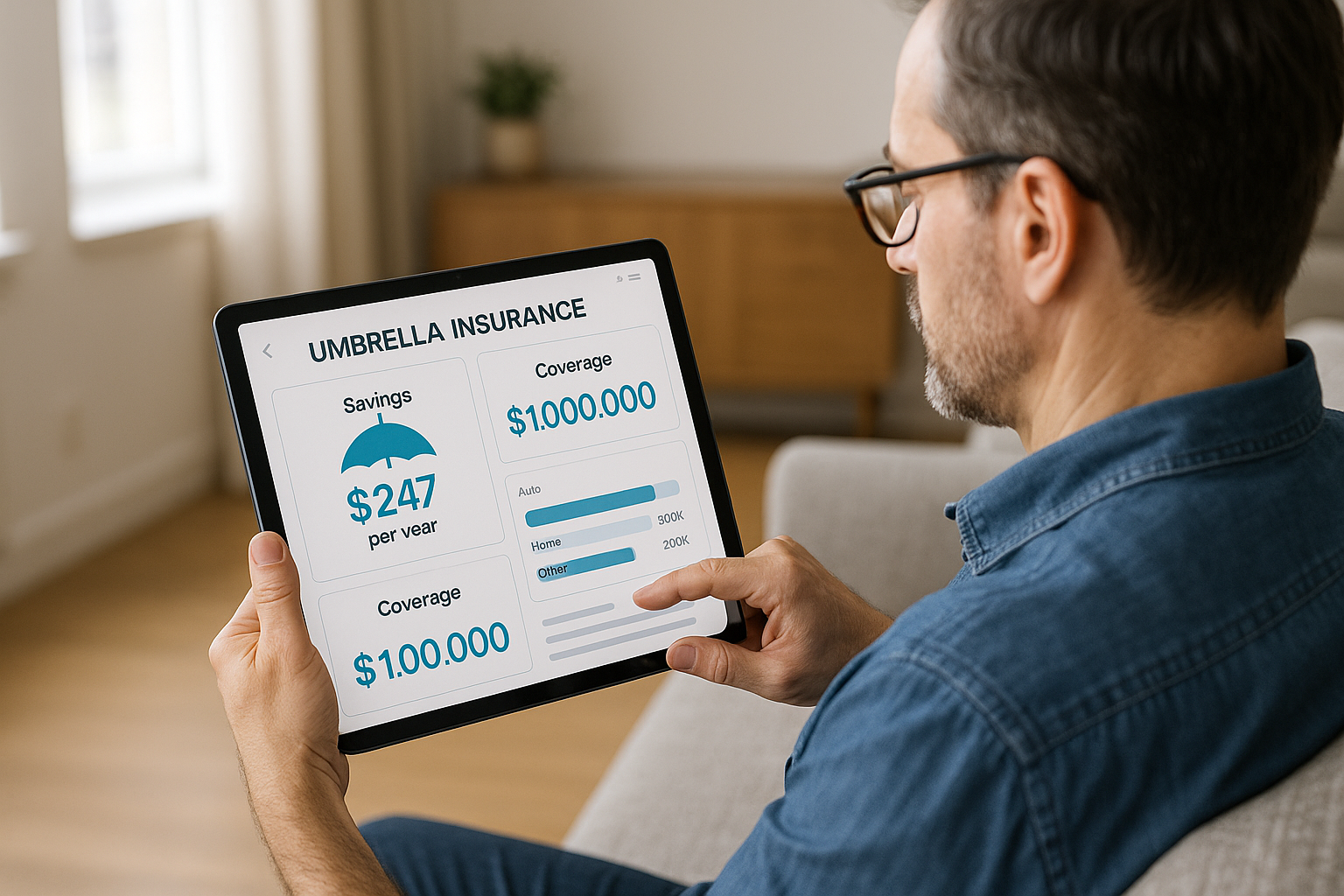

The cost of umbrella insurance can vary based on several factors, including the amount of coverage, your location, and the insurer. Typically, a $1 million policy can cost between $150 and $300 per year3. However, by searching options and comparing quotes from different insurers, you can potentially save a significant amount on premiums.

How to Choose the Right Policy

When selecting an umbrella insurance policy, consider the following steps:

- Assess your current liability coverage and identify any gaps.

- Determine the amount of additional coverage you need based on your assets and potential risks.

- Compare quotes from multiple insurers to find the best rates and coverage options.

- Read the policy details carefully to understand what is and isn't covered.

It's also beneficial to consult with an insurance advisor who can provide personalized recommendations based on your specific situation4.

Ultimately, umbrella insurance offers peace of mind by ensuring that you're protected against unforeseen liabilities that could otherwise lead to significant financial loss. By taking the time to explore your options and choose a policy that aligns with your needs, you can secure comprehensive coverage at a price that suits your budget.