Uncover Insider Secrets to London Property Prices Success

Unlock the secrets to navigating London's competitive property market, and you'll find yourself empowered to browse options, search options, and ultimately make informed decisions that could transform your investment portfolio.

Understanding the Dynamics of London Property Prices

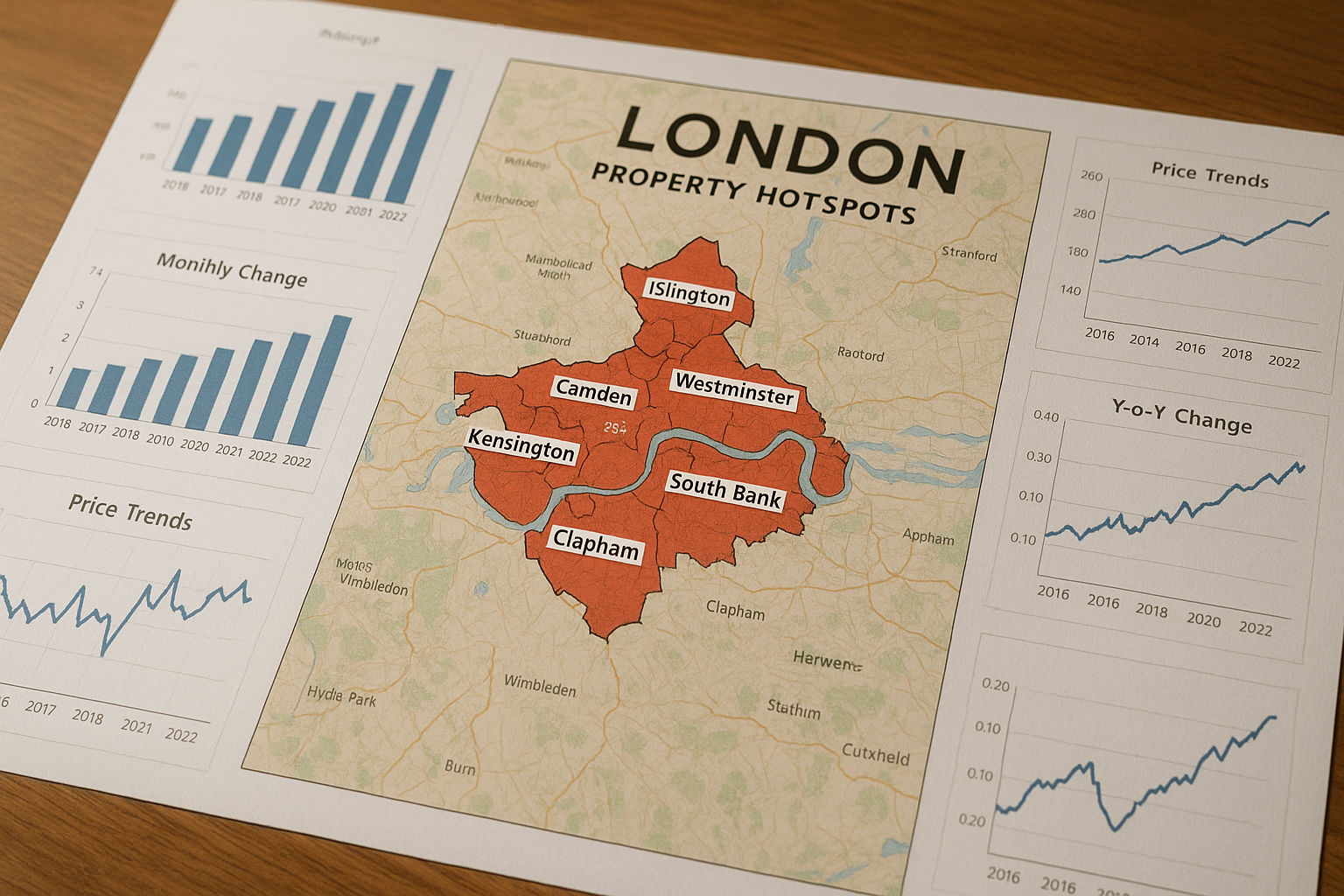

London's property market is a labyrinth of opportunities and challenges, characterized by its diverse neighborhoods and fluctuating prices. To succeed, it's crucial to grasp the underlying factors that drive these price changes. The city's global appeal, robust economy, and cultural richness make it a magnet for international investors, creating a high demand for property1. This demand, coupled with limited supply, often leads to price surges, especially in prime areas like Kensington and Chelsea.

Key Factors Influencing Property Values

Several elements contribute to the valuation of properties in London:

1. **Location:** Proximity to central London, transport links, and amenities significantly impact property prices. Areas like Canary Wharf and Shoreditch have seen substantial growth due to their connectivity and vibrant lifestyle offerings2.

2. **Economic Conditions:** The health of the UK economy, interest rates, and employment levels play a pivotal role in shaping property prices. A strong economy tends to boost buyer confidence and property investments3.

3. **Government Policies:** Initiatives like the Help to Buy scheme and changes in stamp duty can influence market dynamics, making properties more accessible to first-time buyers or affecting investor behavior4.

Insider Secrets to Capitalizing on the Market

To truly capitalize on London's property market, consider these insider strategies:

- **Research Emerging Areas:** Neighborhoods undergoing regeneration often offer better value and growth potential. Areas like Woolwich and Stratford are prime examples where significant investments in infrastructure have spurred property appreciation5.

- **Leverage Local Expertise:** Collaborate with local real estate agents and property consultants who have in-depth knowledge of market trends and can provide valuable insights into upcoming opportunities.

- **Diversify Investments:** Consider diversifying your property portfolio by exploring different types of properties, such as residential, commercial, or mixed-use developments, to mitigate risks and maximize returns.

Exploring Financial Opportunities

Investing in London property can be financially rewarding, but it's essential to understand the financial landscape:

- **Mortgage Options:** With various mortgage products available, including fixed-rate and variable-rate options, it's crucial to find a mortgage that aligns with your financial goals. Consulting with a mortgage advisor can help you navigate these options effectively.

- **Tax Implications:** Be aware of the tax obligations associated with property investment, such as capital gains tax and inheritance tax. Proper planning can help optimize your tax efficiency.

- **Rental Yields:** If you're considering buy-to-let investments, focus on areas with strong rental demand and competitive yields. Understanding tenant demographics and preferences can enhance your investment strategy.

The London property market offers a wealth of opportunities for savvy investors willing to dig deeper and uncover its intricacies. By understanding the factors influencing property prices and leveraging insider knowledge, you can make informed decisions that align with your investment goals. As you explore these options, remember that the right resources and expert guidance can pave the way to success in this dynamic market.