Ultimate Chapter 3 Hacks for Boosting Property Profits Instantly

If you're eager to boost your property profits instantly, seize the opportunity to explore dynamic strategies and browse options that can transform your real estate ventures today.

Understanding the Property Market Dynamics

The real estate market is a complex ecosystem that offers numerous opportunities for profit, but understanding its dynamics is crucial for success. The property market is influenced by various factors such as economic conditions, interest rates, and demographic trends. By staying informed about these factors, you can make strategic decisions that enhance your investment returns. For instance, during periods of low interest rates, borrowing costs decrease, making it an opportune time to invest in property1.

Maximizing Rental Income

One of the most effective ways to boost property profits is by maximizing rental income. This involves setting competitive rental prices, maintaining the property to a high standard, and ensuring tenant satisfaction. According to a study by Zillow, landlords who keep their properties well-maintained can charge up to 10% more in rent2. Additionally, offering amenities such as in-unit laundry or pet-friendly policies can attract a wider pool of potential tenants, further increasing rental income.

Leveraging Tax Benefits

Real estate investors can significantly enhance their profits by leveraging tax benefits. Depreciation, for example, allows property owners to deduct the costs of purchasing and improving a property over its useful life, thus reducing taxable income3. Additionally, investors can benefit from tax deductions on mortgage interest, property taxes, and even certain operational expenses. By understanding and utilizing these tax advantages, you can effectively lower your tax liability and increase your net profits.

Implementing Value-Add Strategies

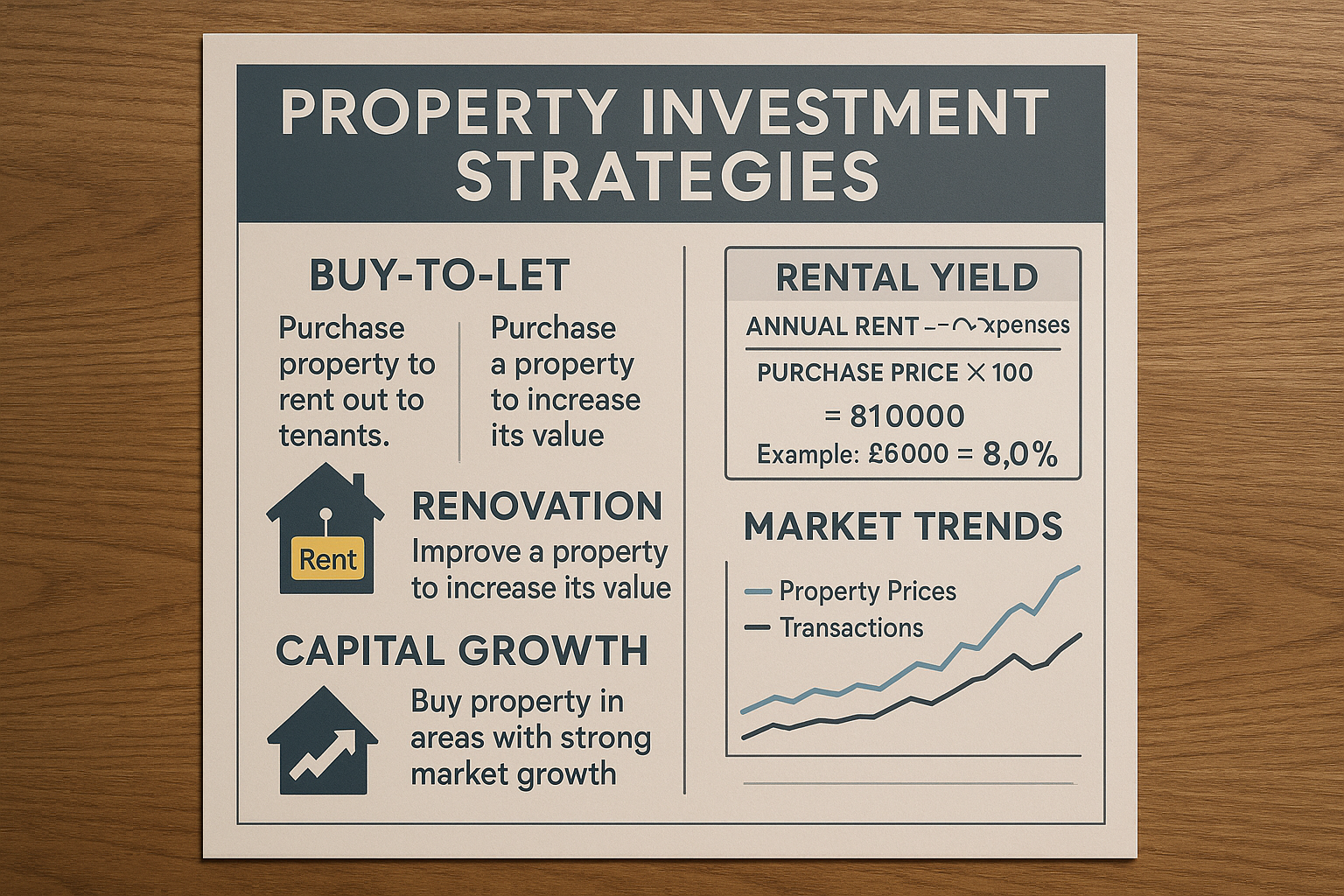

Implementing value-add strategies is another powerful way to boost property profits. This involves making improvements or renovations that increase the property's value and appeal. Common value-add projects include upgrading kitchens and bathrooms, enhancing curb appeal with landscaping, or adding energy-efficient features. According to the National Association of Realtors, kitchen renovations can recoup up to 80% of their cost in added property value4. By strategically investing in such upgrades, you can command higher rental rates or sell the property at a premium.

Exploring Financing Options

Exploring diverse financing options can provide the leverage needed to expand your property portfolio and increase profits. Options such as refinancing can lower your monthly mortgage payments, freeing up cash flow for additional investments. Moreover, using home equity loans or lines of credit can provide the capital necessary for property improvements or the acquisition of new properties. It's essential to compare rates and terms from different lenders to ensure you're getting the best deal5.

Boosting property profits involves a multifaceted approach that includes maximizing rental income, leveraging tax benefits, implementing value-add strategies, and exploring financing options. By understanding the dynamics of the property market and taking strategic actions, you can significantly enhance your real estate returns. For those eager to delve deeper, numerous resources and specialized services are available to help you navigate these opportunities effectively.