Private Equity Real Estate Funds Maximizing Returns Safely

When you explore the world of private equity real estate funds, you unlock the potential for maximizing returns safely, offering you a chance to browse options that align with your financial goals and risk tolerance.

Understanding Private Equity Real Estate Funds

Private equity real estate funds are investment vehicles that pool capital from various investors to acquire, develop, and manage real estate properties. These funds are managed by experienced professionals who aim to generate high returns by strategically investing in properties that have significant growth potential. Unlike publicly traded real estate investment trusts (REITs), private equity funds offer a more tailored approach, allowing investors to benefit from the expertise of fund managers while diversifying their portfolio across different real estate sectors.

The Appeal of Private Equity Real Estate

Investing in private equity real estate funds provides several advantages. Firstly, these funds offer access to a broader range of properties, including commercial, residential, and industrial real estate, which might be difficult for individual investors to acquire on their own. Additionally, private equity funds are known for their ability to leverage capital, thereby enhancing potential returns1. This leverage, combined with professional management, often results in higher returns compared to traditional real estate investments.

Maximizing Returns Safely

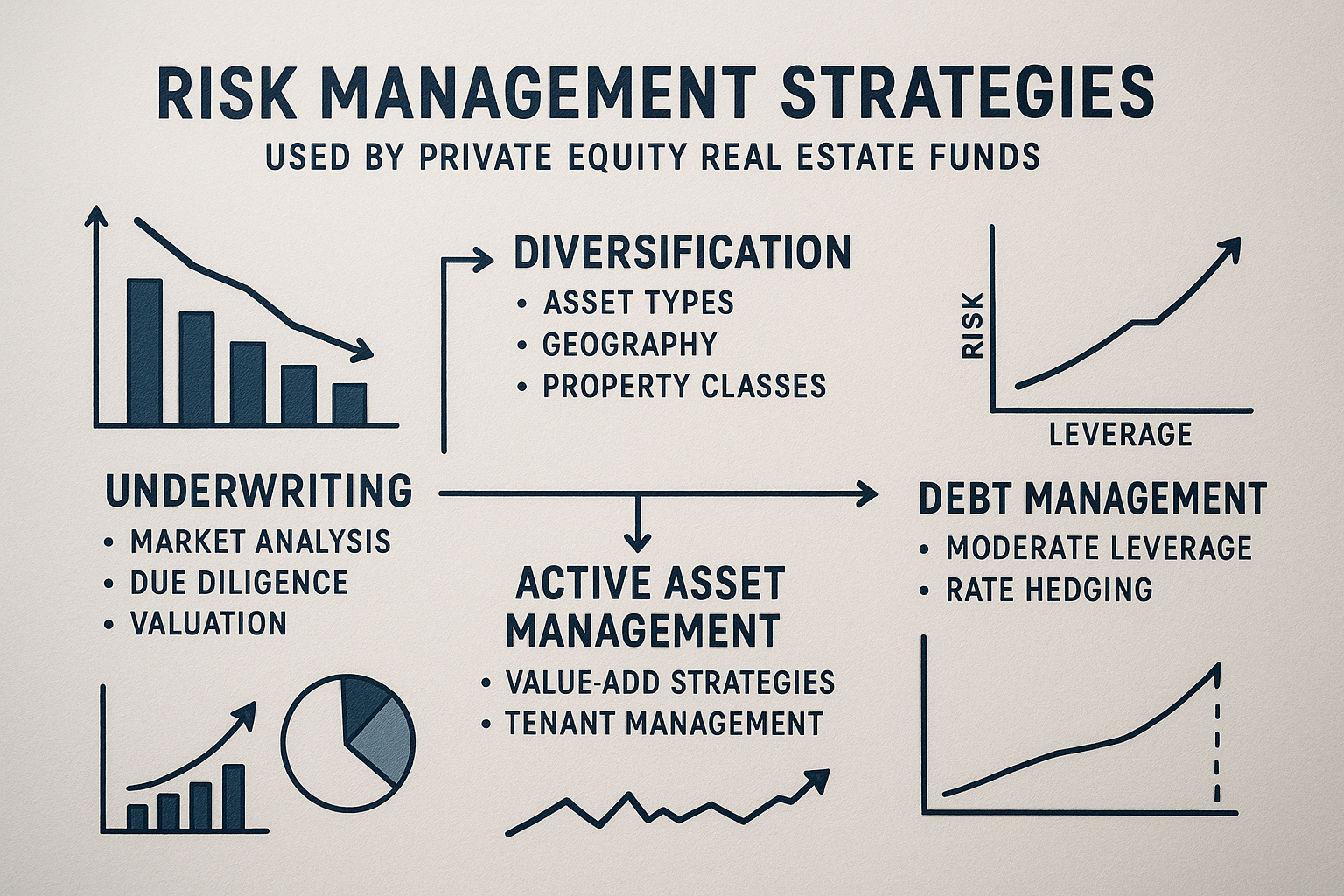

Safety in private equity real estate investments is achieved through diversification and risk management strategies. By investing in a fund, you are spreading your risk across multiple properties and locations, reducing the impact of any single property's underperformance. Moreover, fund managers employ rigorous due diligence processes to assess the potential risks and rewards of each investment, ensuring that only the most promising projects are included in the portfolio2.

Current Market Trends and Opportunities

The real estate market is constantly evolving, and private equity funds are uniquely positioned to capitalize on emerging trends. For instance, the rise of e-commerce has increased demand for industrial and logistics properties, while urbanization trends continue to drive growth in residential and commercial developments. By aligning your investment with these trends, you can potentially achieve higher returns3. It's essential to stay informed and consider browsing options that align with your investment strategy and risk appetite.

Exploring Investment Options

When considering private equity real estate funds, it’s crucial to evaluate the track record of the fund managers, the fund's investment strategy, and the types of properties included in the portfolio. Many funds offer detailed prospectuses that outline their investment approach, past performance, and future projections. By reviewing these documents, you can make informed decisions about which funds align with your financial objectives. Additionally, visiting websites of reputable fund managers can provide further insights into available opportunities and specialized services tailored to your investment needs.

Private equity real estate funds present a compelling opportunity for investors seeking to maximize returns while managing risk effectively. By understanding the dynamics of these funds and staying informed about market trends, you can strategically position yourself to benefit from the unique advantages they offer. Take the time to explore the options available, and consider how these investments can enhance your portfolio and help you achieve your financial goals.