Maximize Profits With This Rental Property Analysis Secret

Unlock the secret to maximizing your rental property profits by exploring effective analysis techniques that allow you to browse options and see these opportunities in action, enhancing your investment strategy and boosting your income potential.

Understanding Rental Property Analysis

Rental property analysis is a critical process for investors aiming to maximize their returns. It involves evaluating potential properties to determine their profitability and long-term viability. By conducting a thorough analysis, you can make informed decisions that align with your financial goals. This process includes assessing factors such as location, market trends, property condition, and potential rental income.

The Secret to Maximizing Profits

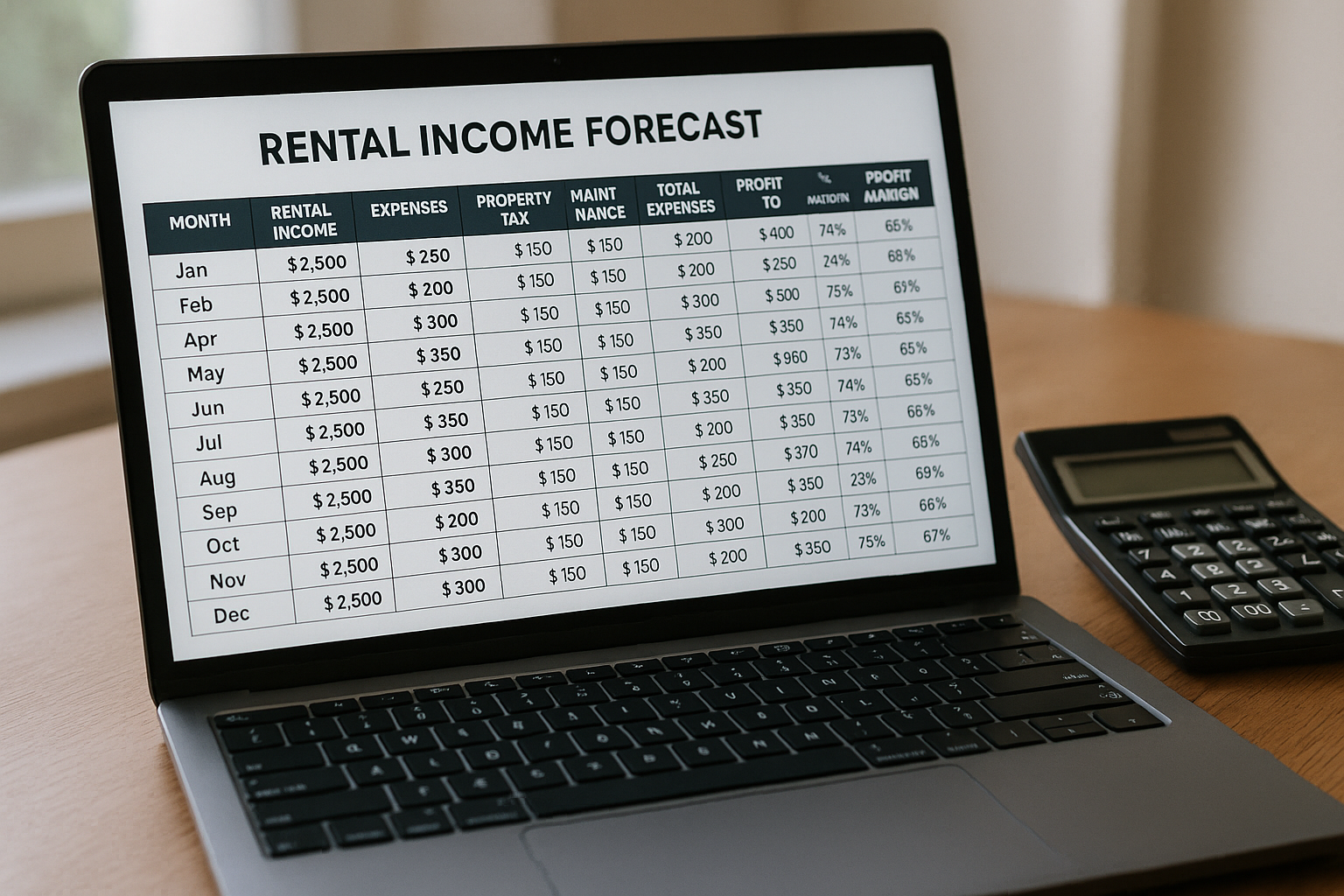

The key to maximizing profits from rental properties lies in a comprehensive understanding of cash flow and return on investment (ROI). Cash flow refers to the net income generated from a rental property after all expenses are deducted. A positive cash flow indicates that the property is earning more than it costs to maintain. ROI, on the other hand, measures the efficiency of an investment, providing insights into how well your money is working for you.

To effectively analyze these aspects, consider using specialized software tools that offer detailed financial insights and projections. These tools can help you simulate different scenarios, allowing you to make data-driven decisions. Many platforms offer free trials, so you can browse options and find the best fit for your needs.

Critical Factors in Rental Property Analysis

1. **Location and Market Trends**: The property's location significantly impacts its rental value and appreciation potential. Research local market trends to understand demand, rental rates, and economic conditions. Websites like Zillow and Realtor.com offer valuable data on property values and market dynamics1.

2. **Property Condition and Maintenance Costs**: Assess the property's condition to estimate repair and maintenance expenses. Properties requiring significant renovations may offer lower upfront costs but could lead to higher long-term expenses. Conduct a thorough inspection or hire a professional to evaluate the property.

3. **Rental Income and Expenses**: Calculate potential rental income by analyzing comparable properties in the area. Factor in all expenses, including mortgage payments, property taxes, insurance, and maintenance costs. This will help you determine the property's cash flow and profitability.

4. **Financing Options and Interest Rates**: Explore different financing options to secure the best interest rates. Lower interest rates can significantly enhance your ROI. Consider visiting websites like Bankrate to compare mortgage offers and find competitive rates2.

Maximizing Your Investment

Once you've analyzed a property and decided to invest, there are strategies you can employ to further maximize your profits. Consider implementing value-add improvements, such as modernizing the kitchen or adding energy-efficient features, to increase rental value and attract quality tenants. Additionally, maintaining a good relationship with tenants can reduce turnover and vacancy rates, ensuring a steady income stream.

Exploring Additional Resources

For investors seeking specialized insights or assistance, numerous resources are available. Real estate investment groups, online forums, and professional consultants offer valuable guidance and support. Websites like BiggerPockets provide a wealth of knowledge and community support for real estate investors3.

By leveraging these insights and resources, you can make informed decisions that enhance your rental property's profitability. As you continue your investment journey, remember to stay informed and adaptive to market changes, ensuring long-term success and financial growth.