Slash Closing Costs Maximize Your Home Equity Today

Unlock the potential of your home equity by slashing closing costs, and explore a range of financial options to maximize your investment today, as you browse options and visit websites that offer valuable insights and solutions.

Understanding Home Equity and Closing Costs

Home equity represents the portion of your property that you truly own, calculated as the difference between your home's market value and any outstanding mortgage balance. It's a powerful financial tool that can be leveraged for various purposes, such as funding renovations, paying off debts, or investing in other opportunities. However, accessing this equity often involves closing costs, which can eat into your potential gains. These costs typically include appraisal fees, title insurance, and attorney fees, among others, and can range from 2% to 5% of the loan amount1.

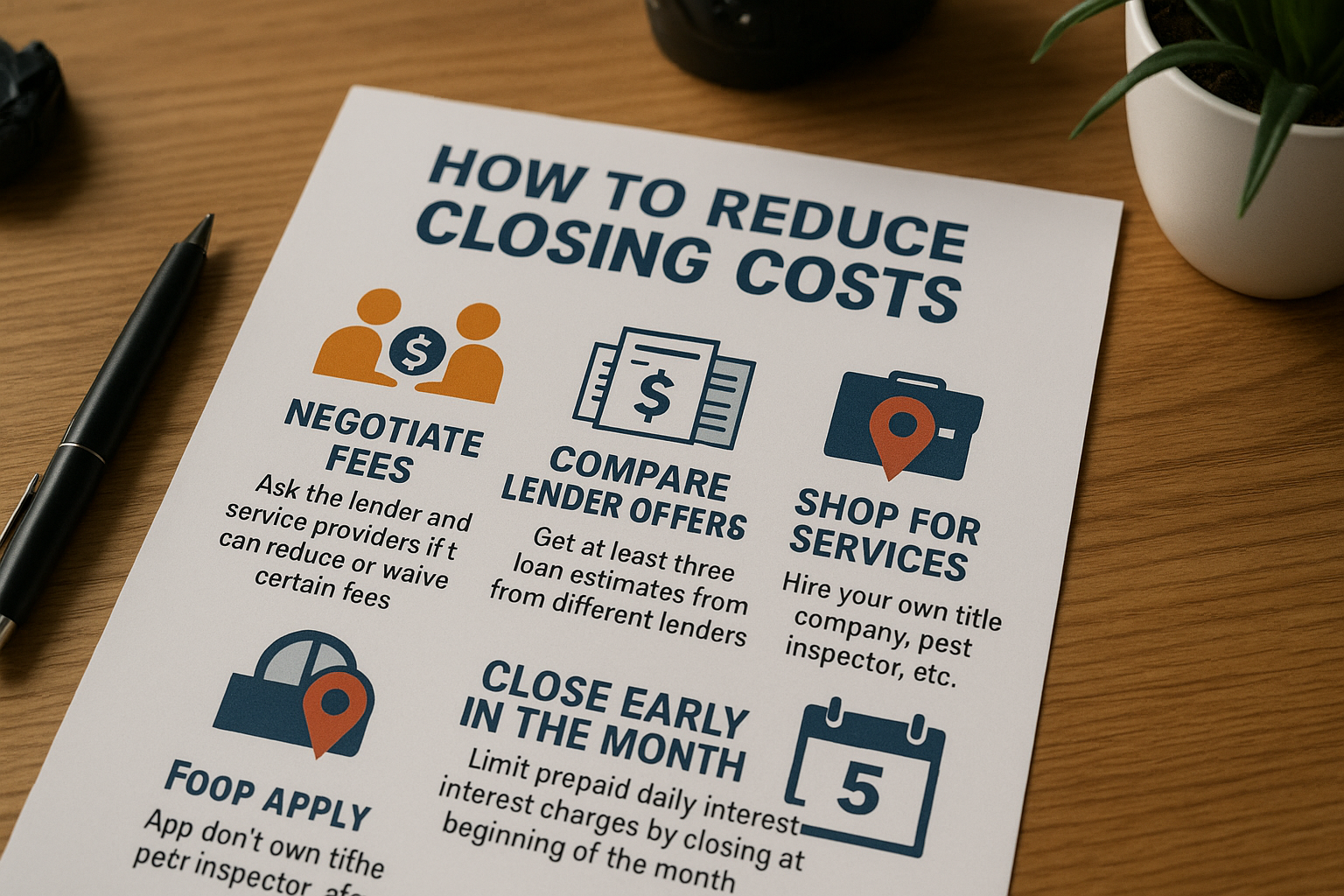

Strategies to Slash Closing Costs

Reducing closing costs is crucial to maximizing your home equity. One effective strategy is to shop around for lenders who offer competitive rates and lower fees. Many lenders provide detailed breakdowns of their costs, allowing you to compare and negotiate better deals. Another option is to explore no-closing-cost mortgages, where the lender covers the upfront fees in exchange for a slightly higher interest rate. This can be beneficial if you plan to stay in your home for a shorter period, as it reduces immediate expenses2.

Maximizing Your Home Equity

Once you've minimized closing costs, you can focus on maximizing your home equity. Consider refinancing your mortgage to take advantage of lower interest rates, which can reduce your monthly payments and increase the equity you build over time. Additionally, making extra payments towards your mortgage principal can significantly boost your equity. For those looking to invest, a home equity line of credit (HELOC) or a home equity loan can provide the necessary funds at competitive interest rates3.

Real-World Examples and Considerations

To illustrate, let's consider a homeowner with a $300,000 home and a $200,000 mortgage balance. By refinancing at a lower rate, they could save thousands in interest payments and increase their equity faster. Alternatively, accessing a HELOC could provide funds for a kitchen remodel, potentially increasing the home's value and, consequently, the owner's equity. It's essential to evaluate your financial goals and consult with a financial advisor to determine the best approach for your situation4.

By effectively slashing closing costs and strategically maximizing your home equity, you can unlock significant financial benefits and explore a range of options to enhance your investment. Whether you're considering refinancing, taking out a HELOC, or simply looking to save on closing expenses, numerous resources and services are available to guide you through the process. Visit websites and search options to find the best solutions tailored to your needs.