Save Money Instantly With Unseen Homeowners Insurance Hack

Imagine unlocking instant savings on your homeowners insurance by discovering a little-known strategy that many overlook—browse options, search options, and see these options to reduce your premiums today.

Understanding Homeowners Insurance and Its Costs

Homeowners insurance is a necessary expense for anyone who owns a home, providing financial protection against damages to the home and personal liability. However, the costs associated with this insurance can sometimes feel burdensome. On average, homeowners in the United States spend approximately $1,312 annually on their premiums1. This figure can vary significantly based on location, coverage amount, and the insurer's risk assessment of your property.

The Unseen Hack: Bundling Policies

One of the most effective yet often overlooked strategies to save money on homeowners insurance is bundling your policies. By combining your homeowners insurance with other policies, such as auto or life insurance, you can unlock substantial discounts. Many insurance companies offer discounts ranging from 5% to 25% for customers who choose to bundle2. This not only simplifies your billing process but can also lead to significant savings.

Improving Home Security for Lower Premiums

Another actionable tip is enhancing your home's security features. Installing security systems, smoke detectors, and deadbolt locks can reduce your insurance premiums. Insurers often provide discounts because these features decrease the likelihood of theft or damage, which in turn reduces their risk. For instance, installing a monitored security system can save you up to 20% on your premium3.

Raising Your Deductible

Adjusting your deductible is another strategic way to lower your insurance costs. By opting for a higher deductible, you agree to pay more out-of-pocket in the event of a claim, which can lower your monthly premiums. For example, increasing your deductible from $500 to $1,000 could save you as much as 25% on your premium4. However, it's important to ensure that you're comfortable with the higher deductible amount in the event of a claim.

Regularly Reviewing and Comparing Policies

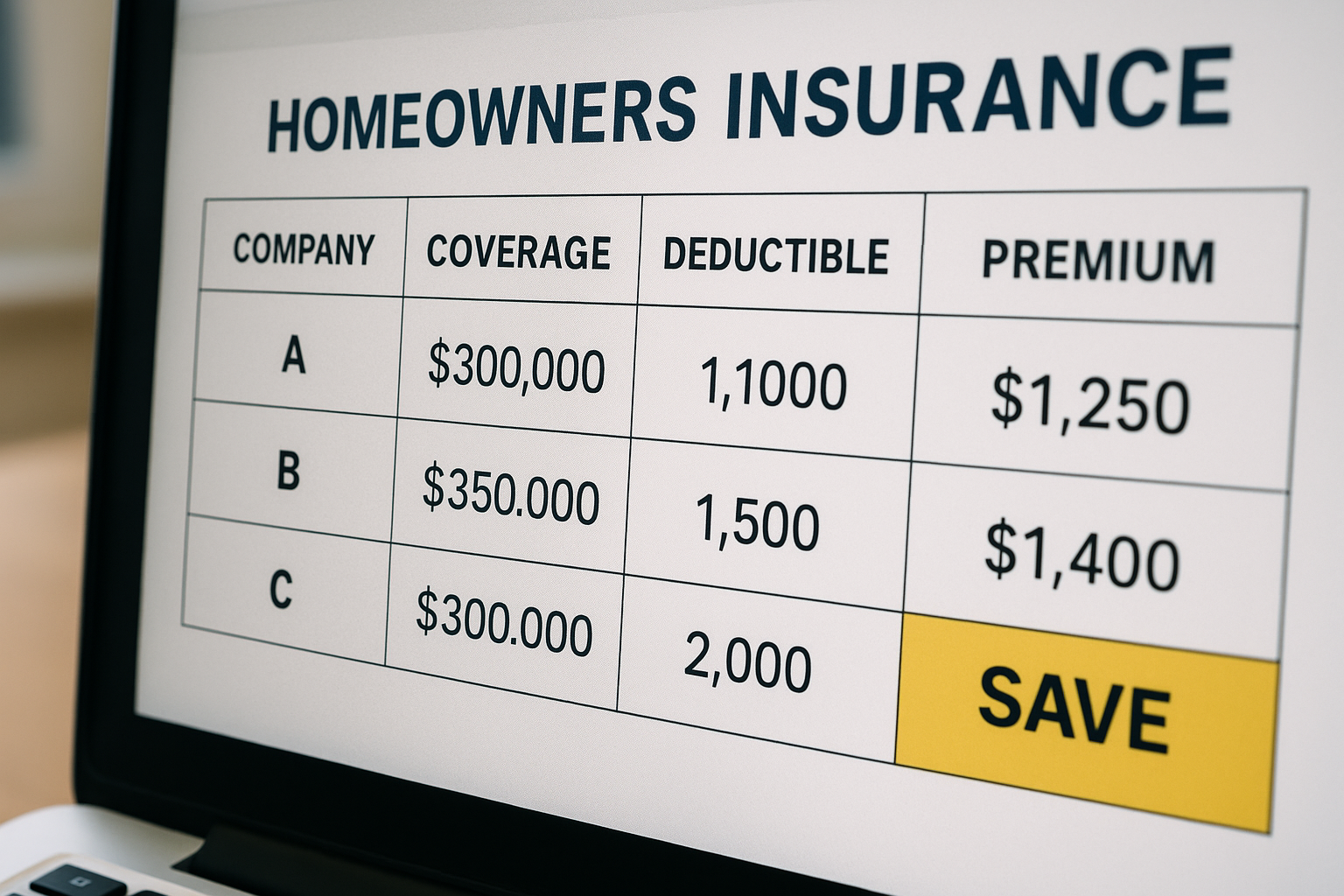

Finally, it's crucial to regularly review your homeowners insurance policy and compare it with other available options. Insurance companies frequently adjust their rates, and new discounts or coverage options may become available. By browsing and searching for options annually, you can ensure you're getting the best deal possible. Many online platforms allow you to compare quotes from various insurers, making it easier than ever to find a policy that fits your needs and budget.

By leveraging these strategies, you can effectively lower your homeowners insurance costs without sacrificing coverage. Take the time to explore these options, and you might be surprised at how much you can save.