Transform Profits Instantly Secure Duplex Insurance Wisdom

If you're looking to instantly transform your profits with duplex insurance, exploring the right options can provide you with the financial security and peace of mind you need, so why not browse options and see these opportunities today?

Understanding Duplex Insurance: A Profitable Venture

Duplex insurance is a specialized form of property insurance that covers both sides of a duplex, providing comprehensive protection for landlords and tenants alike. This type of insurance not only safeguards against potential damages and liability claims but also enhances the property's value, making it a lucrative investment for property owners. By understanding the intricacies of duplex insurance, you can strategically secure your assets while maximizing your rental income.

Key Benefits of Duplex Insurance

One of the primary benefits of duplex insurance is its ability to cover a wide range of risks, including fire, theft, vandalism, and natural disasters. This comprehensive coverage ensures that both the structure and personal belongings within the duplex are protected, minimizing financial losses in the event of unforeseen circumstances. Additionally, duplex insurance typically includes liability coverage, which protects landlords from legal claims arising from injuries or damages occurring on the property1.

Another significant advantage is the potential for cost savings. Many insurance providers offer discounts for bundling policies or installing safety features such as smoke detectors and security systems. By taking advantage of these discounts, property owners can reduce their insurance premiums while enhancing the safety of their investment2.

Financial Implications and Opportunities

Investing in duplex insurance can lead to substantial financial benefits. For instance, landlords can command higher rental rates by advertising their property as fully insured, appealing to potential tenants who value safety and security. Moreover, the peace of mind that comes with knowing your property is protected can lead to increased focus on other income-generating activities, further boosting your overall profitability3.

Furthermore, some insurance companies offer specialized policies that cater to multi-unit properties like duplexes, often at competitive rates. By comparing different policies and providers, property owners can find the best coverage that suits their specific needs and budget. This proactive approach not only ensures optimal protection but also enhances the property's marketability and long-term value.

Exploring the Right Insurance Solutions

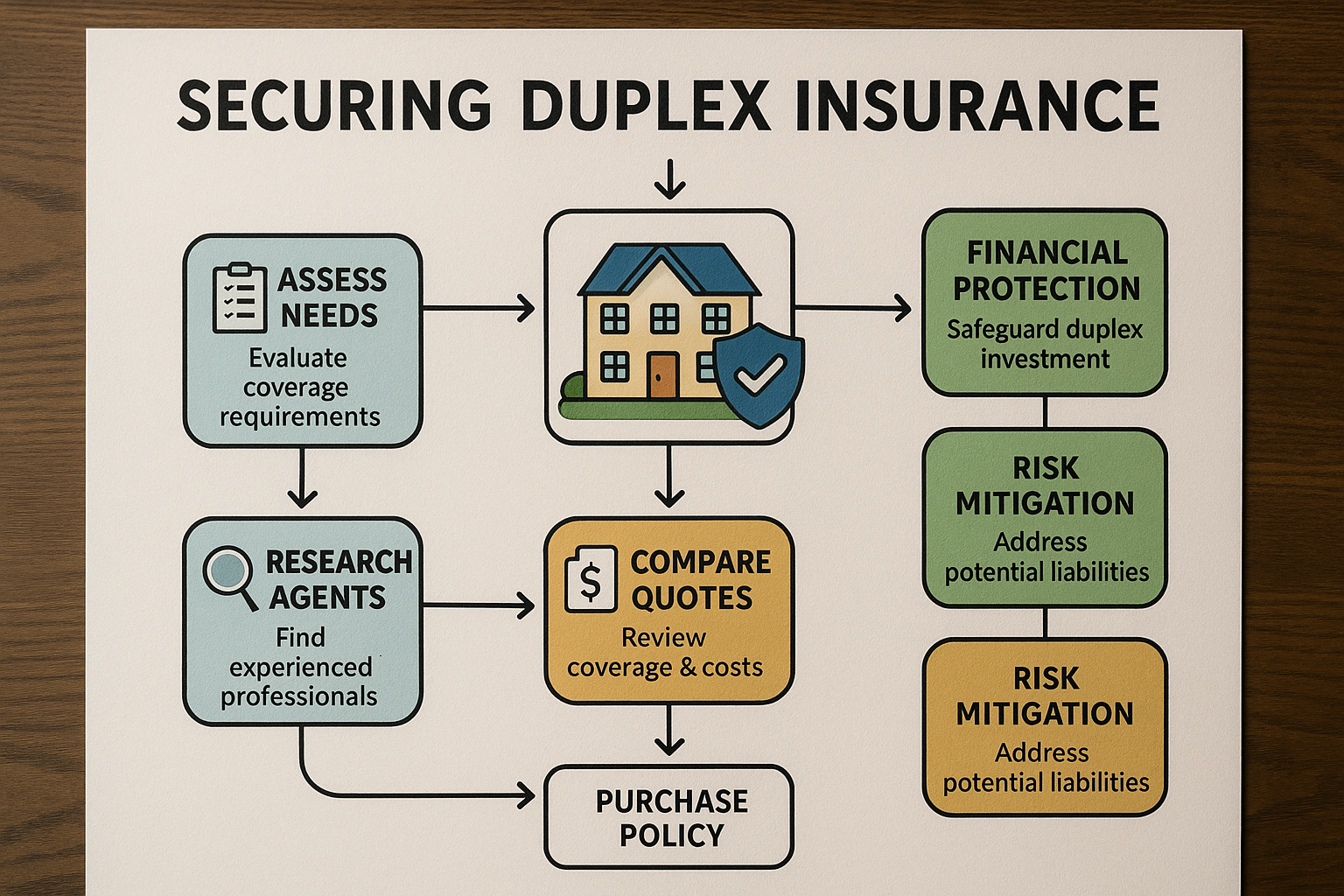

To fully capitalize on the benefits of duplex insurance, it's crucial to explore various options and tailor the coverage to your unique requirements. Begin by assessing the specific risks associated with your property, such as its location, age, and construction type. Then, consult with insurance experts or use online platforms to compare different policies and providers. This research will enable you to make informed decisions and select the most cost-effective and comprehensive insurance solution.

Additionally, staying informed about current market trends and insurance regulations can help you adapt your strategy and maximize your investment's profitability. For those seeking specialized services, numerous resources and platforms offer in-depth insights and guidance on securing the best duplex insurance deals.

By securing duplex insurance, you not only protect your property and tenants but also open doors to increased profitability and peace of mind. As you explore these opportunities, remember to browse options and visit websites that offer tailored solutions for your specific needs. Whether you're a seasoned landlord or new to property investment, understanding and leveraging the benefits of duplex insurance is a strategic move toward financial success.