Shield Your Rental Profits Gain Peace with Insurance

Shield your rental profits and gain peace of mind by exploring insurance options that protect your investment and ensure steady income, giving you the opportunity to browse options that fit your specific needs.

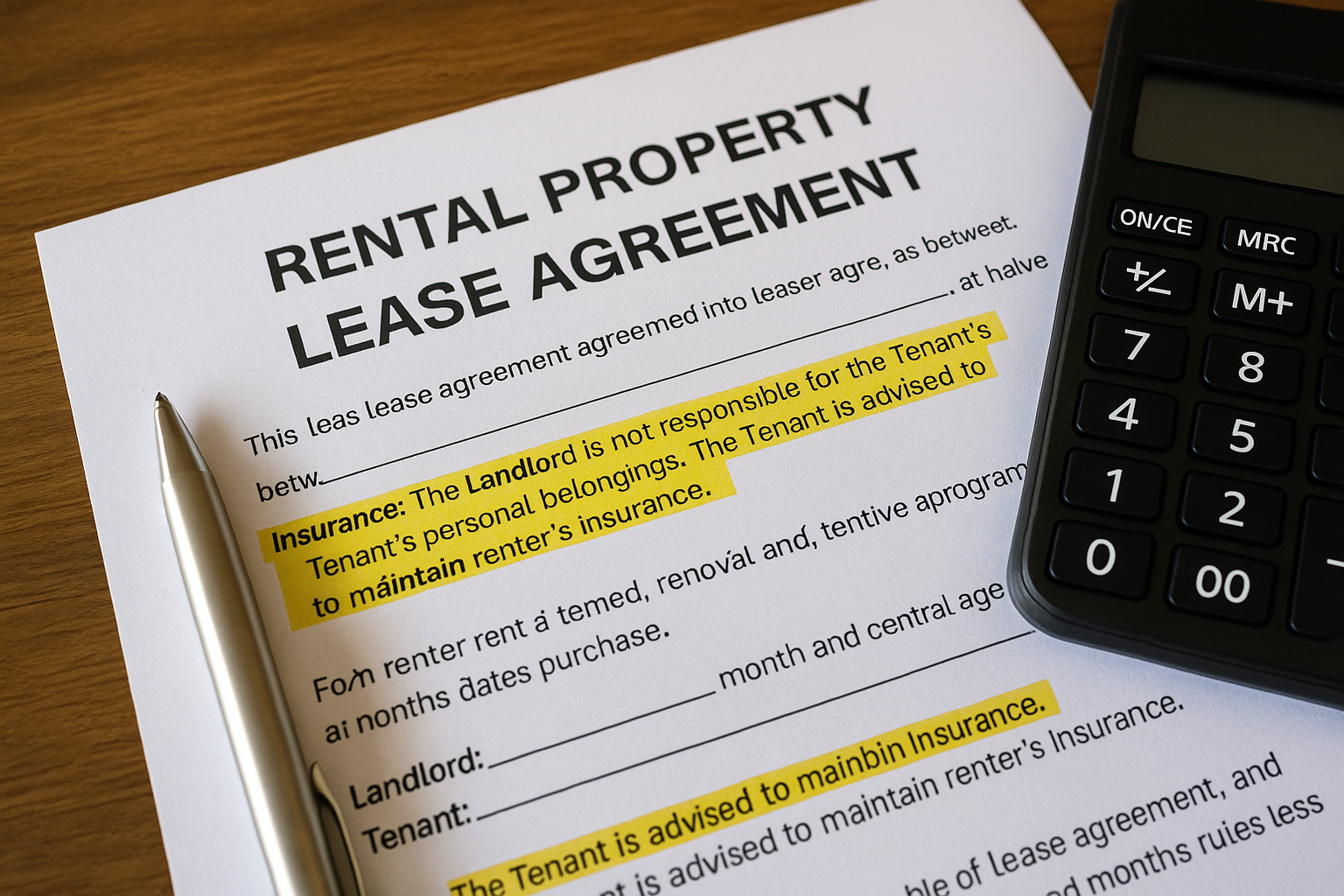

Understanding the Importance of Rental Property Insurance

Rental property insurance is an essential tool for landlords looking to safeguard their investments against unforeseen events. Unlike standard homeowner's insurance, rental property insurance, often called landlord insurance, offers coverage tailored to the unique risks associated with rental properties. This includes protection against property damage, liability claims, and loss of rental income due to covered perils1.

Types of Coverage Available

When considering rental property insurance, it's crucial to understand the different types of coverage available:

1. **Property Damage**: This covers physical damage to the property from events like fire, vandalism, or severe weather. It's essential to have comprehensive coverage to ensure repairs or replacements don't come out of pocket.

2. **Liability Protection**: This shields you from legal and medical costs if a tenant or visitor is injured on your property. Liability claims can be costly, and having this protection ensures you're not financially burdened.

3. **Loss of Rental Income**: If your property becomes uninhabitable due to a covered event, this coverage compensates for lost rental income during repairs2.

Financial Benefits of Rental Property Insurance

Investing in rental property insurance not only protects your assets but also offers financial stability. The cost of premiums varies based on factors like location, property size, and coverage level. On average, landlords can expect to pay 15-25% more than homeowner's insurance for similar coverage3. However, the peace of mind and financial protection it provides far outweigh the costs.

Real-World Examples and Statistics

Consider a scenario where a rental property is damaged by a severe storm. Without insurance, the landlord would need to cover repair costs and face potential income loss during the renovation period. With insurance, these expenses are significantly mitigated, preserving cash flow and protecting the investment. According to recent data, about 37% of landlords have experienced property damage in the last two years, highlighting the necessity of adequate coverage4.

Exploring Your Options

When selecting rental property insurance, it's vital to compare policies from multiple providers to find the best fit for your needs. Many insurers offer customizable plans, allowing you to add specific coverages like flood insurance or increased liability limits. Visiting websites of reputable insurance companies can provide detailed insights into available options and help you make an informed decision.

Securing rental property insurance is a strategic move that protects your investment and ensures long-term financial stability. By understanding the types of coverage available and evaluating your specific needs, you can choose a policy that offers comprehensive protection. As you explore these options, remember that the right insurance plan not only shields your rental profits but also provides peace of mind, allowing you to focus on maximizing returns and growing your portfolio.