Maximize Lifetime Savings Through Clever Medicare Insights Now

Unlock the secrets to maximizing your lifetime savings through clever Medicare insights by browsing options that could save you thousands in healthcare costs.

Understanding Medicare: A Foundation for Savings

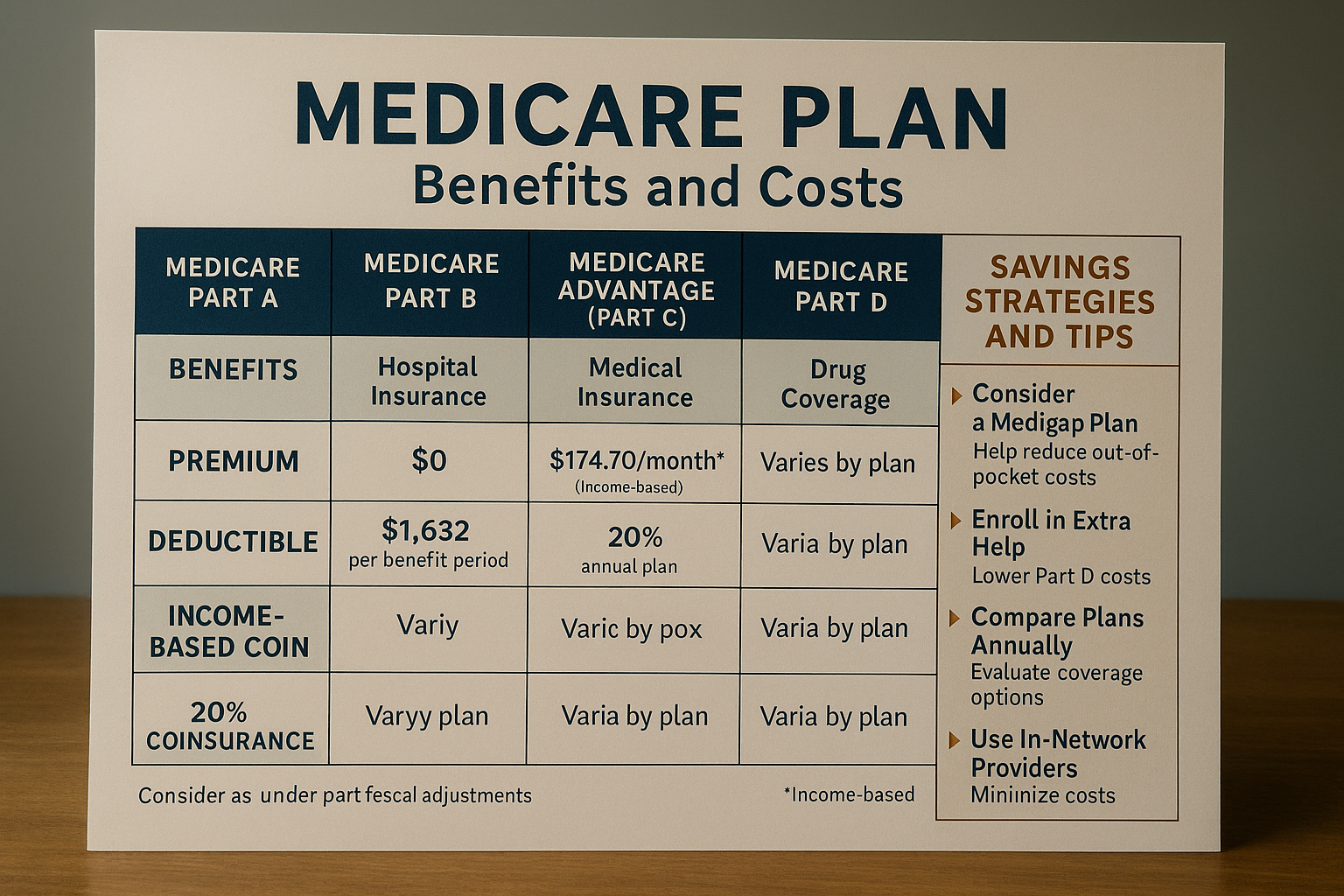

Medicare, the federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities, is a critical component of healthcare planning. By understanding its various parts—Part A (Hospital Insurance), Part B (Medical Insurance), Part C (Medicare Advantage), and Part D (Prescription Drug Coverage)—you can strategically manage your healthcare expenses and maximize savings. For instance, many beneficiaries are unaware that by carefully selecting a Medicare Advantage plan (Part C), they can often receive additional benefits such as dental, vision, and hearing care, which are not covered under Original Medicare1.

Medicare Enrollment: Timing is Everything

One of the most effective ways to maximize savings is by enrolling in Medicare at the right time. Missing your Initial Enrollment Period (IEP), which starts three months before you turn 65 and ends three months after, can result in late enrollment penalties that increase your Part B premiums by 10% for each 12-month period you were eligible but not enrolled2. Additionally, reviewing your Medicare plan annually during the Open Enrollment Period (October 15 to December 7) allows you to adjust your coverage as your healthcare needs change, potentially reducing out-of-pocket costs.

Medigap Policies: Filling the Gaps

Original Medicare does not cover all expenses, which is where Medigap (or Medicare Supplement Insurance) comes into play. These policies help pay some of the healthcare costs that Original Medicare doesn't cover, such as copayments, coinsurance, and deductibles. By comparing different Medigap policies, you can find one that offers the best coverage for your needs and budget. It's important to note that Medigap policies are standardized in most states, meaning the benefits are the same regardless of the insurer, but the premiums can vary significantly3.

Prescription Drug Coverage: Navigating Part D

Prescription drug costs can quickly add up, making Part D an essential component of Medicare for many beneficiaries. Each Part D plan has its own list of covered drugs, known as a formulary, and these can vary widely between plans. By carefully reviewing and comparing Part D plans each year, you can ensure that your medications are covered at the lowest possible cost. Additionally, some plans offer mail-order pharmacy options, which can provide further savings4.

Extra Help and State Assistance Programs

For those with limited income and resources, the Extra Help program can significantly reduce prescription drug costs. This program, administered by Social Security, helps pay for Part D premiums, deductibles, and coinsurance, potentially saving beneficiaries thousands of dollars annually5. Additionally, many states offer Medicare Savings Programs that assist with paying Medicare premiums and other costs. By exploring these options, you can further reduce your healthcare expenses and maximize your savings.

By strategically navigating the complexities of Medicare, you can make informed decisions that lead to substantial savings over your lifetime. Remember to browse options, visit websites, and explore specialized services to find the best solutions tailored to your healthcare and financial needs.