Home equity loan eligibility secrets homeowners must know now

Unlocking the secrets to home equity loan eligibility can empower you to maximize your home's value, and by browsing options, you’ll discover how these insights can transform your financial future.

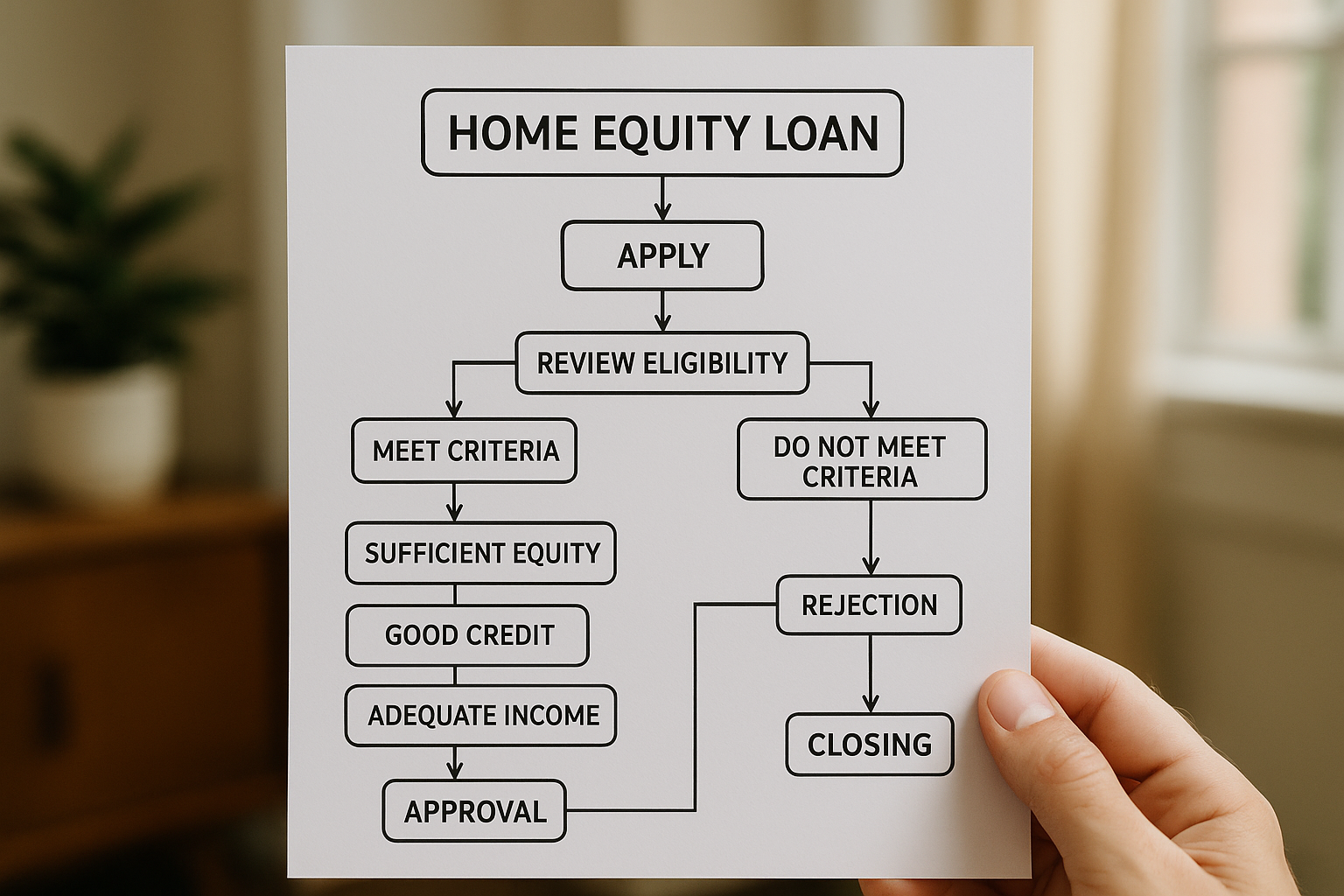

Understanding Home Equity Loans

A home equity loan allows homeowners to borrow against the equity they have built up in their property. This type of loan is often referred to as a second mortgage because it is secured against the value of your home. Homeowners can use this financial tool for various purposes, such as home improvements, debt consolidation, or significant purchases. The appeal of home equity loans lies in their typically lower interest rates compared to unsecured loans, making them a cost-effective borrowing option.

Key Eligibility Criteria

To qualify for a home equity loan, lenders typically require that you have a certain level of equity in your home, often at least 15-20%. This means that the combined loan-to-value (CLTV) ratio of your first mortgage and the home equity loan should not exceed 80-85% of your home's appraised value1. In addition to equity, lenders will assess your credit score, income, and debt-to-income (DTI) ratio. A credit score of 620 or higher is generally preferred, although some lenders may have more flexible criteria.

Income and Debt Considerations

Your income level and DTI ratio are critical factors in determining your eligibility for a home equity loan. Lenders look for a stable income that can comfortably cover both your existing debts and the new loan payments. The DTI ratio, which compares your total monthly debt payments to your gross monthly income, should ideally be below 43%2. Meeting these criteria demonstrates to lenders that you have the financial capacity to manage additional debt responsibly.

Appraisal and Property Requirements

An appraisal is often required as part of the home equity loan application process. The appraisal helps the lender determine the current market value of your home, which in turn affects the amount you can borrow. Properties must be well-maintained, as significant issues could reduce the appraised value and affect your eligibility. Ensuring your home is in good condition before applying can help maximize your loan amount.

Exploring Lender Options

Each lender may have different terms, interest rates, and fees associated with home equity loans. It's crucial to shop around and compare offers from multiple lenders to find the best deal. Some lenders may offer promotional rates or reduced fees for new customers, so it's worth investigating these options to save money. Online platforms and financial websites often provide tools to compare loan offers, helping you make an informed decision3.

Benefits of Home Equity Loans

Home equity loans offer several advantages, including fixed interest rates and predictable monthly payments, which can help with budgeting. Additionally, the interest paid on a home equity loan may be tax-deductible if the funds are used for home improvements4. This tax benefit can further enhance the appeal of using a home equity loan for financing home renovations or expansions.

By understanding these crucial eligibility factors and leveraging the available resources, you can confidently explore home equity loan options to meet your financial goals. Visit websites offering loan comparisons to see these options and secure the best terms for your needs.