Save Big With Insider California Auto Insurance Secrets

Unlock the potential to save significantly on your auto insurance by exploring insider secrets and browsing options that reveal how California drivers can cut costs without sacrificing coverage.

Understanding California Auto Insurance Basics

Auto insurance in California is not just a legal requirement but also a crucial financial safeguard. The state mandates minimum liability coverage, which includes $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for damage to property1. However, understanding these basics is just the beginning of saving money.

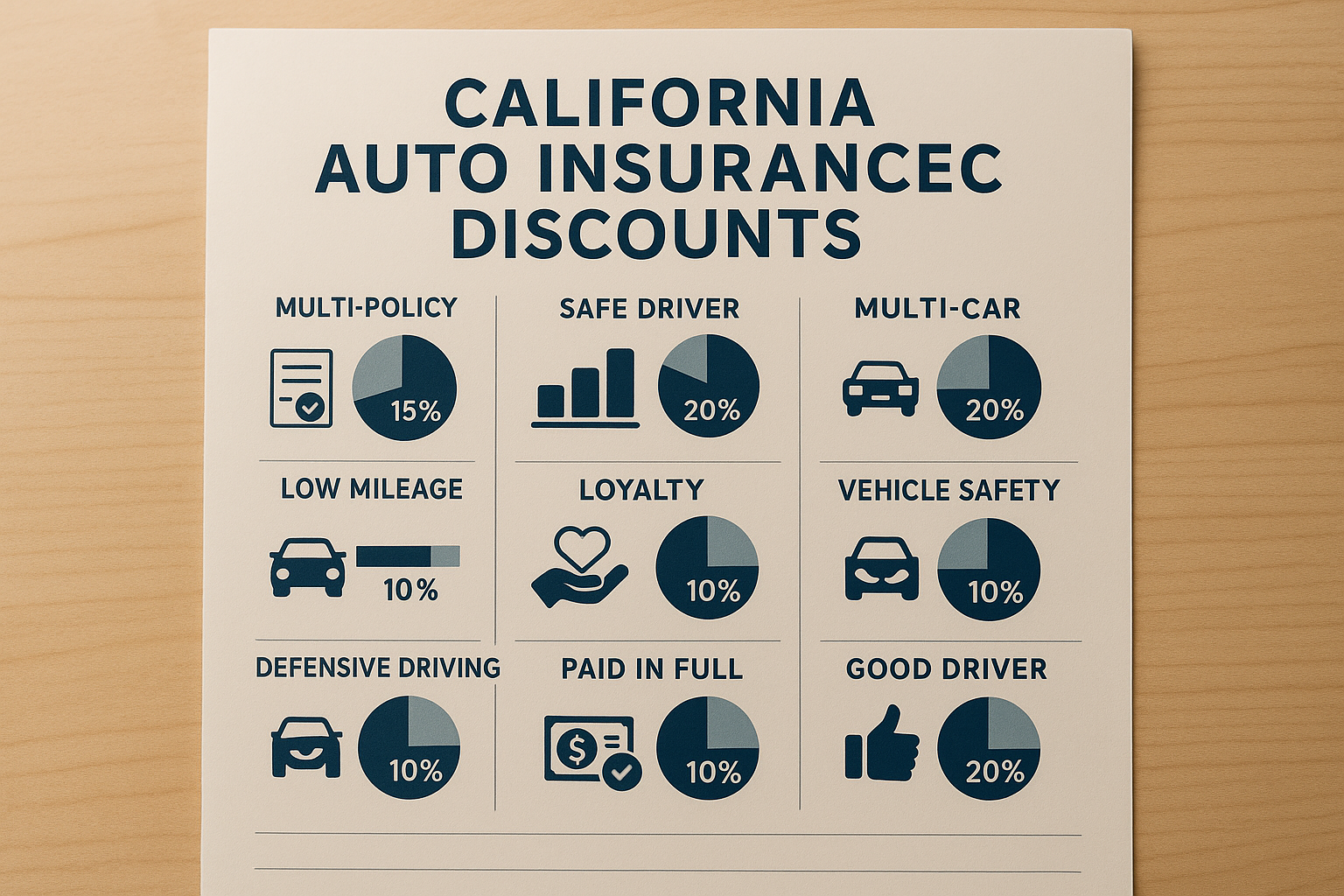

Leverage Discounts and Promotions

Many insurers offer a plethora of discounts that can lead to significant savings. For instance, bundling your auto insurance with home insurance can often result in discounts of up to 25%2. Additionally, maintaining a clean driving record, completing a defensive driving course, or even being a good student can qualify you for further reductions. It's worth taking the time to visit websites of various insurers to compare these options.

Explore Usage-Based Insurance

Usage-based insurance (UBI) programs are gaining popularity in California. These programs track your driving habits via telematics devices and can offer savings of up to 30% for safe drivers3. If you drive less frequently or maintain safe driving habits, UBI could be a cost-effective option. Search options to see if your current insurer offers a UBI program or if switching to one could be beneficial.

Consider Higher Deductibles

Opting for a higher deductible is another strategy to lower your premium. By increasing your deductible from $500 to $1,000, you could save up to 15% on your premium4. However, ensure that you have enough savings to cover the deductible in the event of a claim.

Shop Around Regularly

It's crucial to regularly shop around and compare rates from different insurers. Prices can vary significantly, and what was the cheapest option a year ago might not be the same today. Utilize online tools and resources to get personalized quotes and see these options to ensure you're getting the best deal possible.

Take Advantage of Group Insurance Plans

If you're affiliated with certain professional associations, alumni groups, or employers, you might be eligible for group insurance discounts. These plans often provide lower rates due to the collective bargaining power of the group. Follow the options available through your affiliations to uncover potential savings.

By staying informed and proactive, you can navigate the complex landscape of California auto insurance and uncover opportunities to save. Whether by leveraging discounts, exploring new insurance models, or simply shopping around, the key is to remain engaged and willing to adjust your strategy as needed. As you explore these options, remember that the right combination of coverage and cost savings is within reach.