Unveil Hidden Secrets to Compare Debt Consolidation Loans

Unlock the potential to simplify your financial life by discovering how to effectively compare debt consolidation loans and find the best options for your needs—browse options today to transform your debt management strategy.

Understanding Debt Consolidation Loans

Debt consolidation loans are financial tools that allow you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your monthly payments and potentially save you money on interest over time. By consolidating your debts, you transform multiple payment schedules into one, making it easier to manage and track your financial obligations.

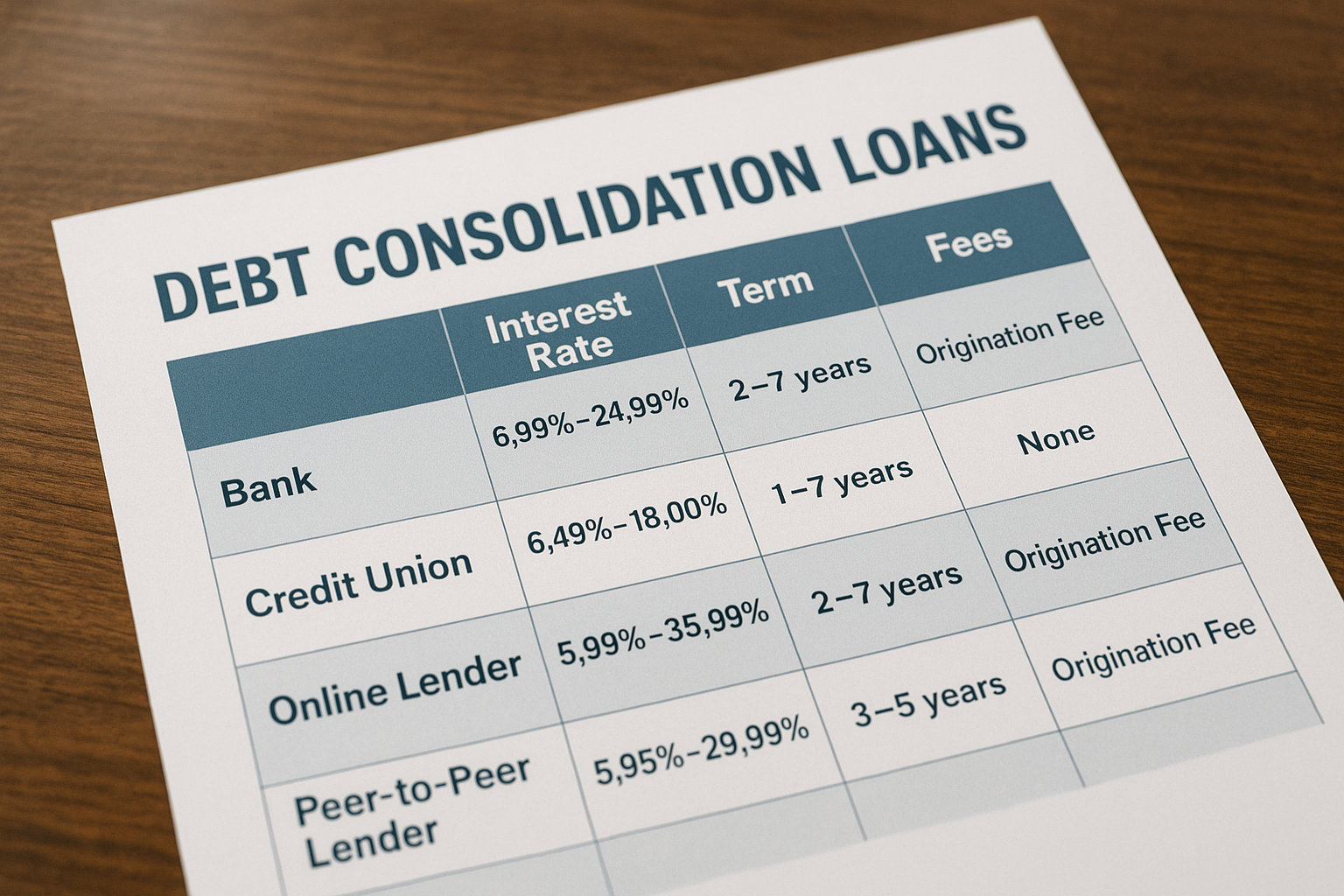

When considering debt consolidation, it's essential to understand the types of loans available. Personal loans, home equity loans, and balance transfer credit cards are popular options for debt consolidation. Each comes with its own set of benefits and drawbacks. For instance, personal loans often provide fixed interest rates and terms, making them predictable and easy to budget for. In contrast, home equity loans might offer lower interest rates but require your home as collateral, which can be risky if you're unable to keep up with payments.