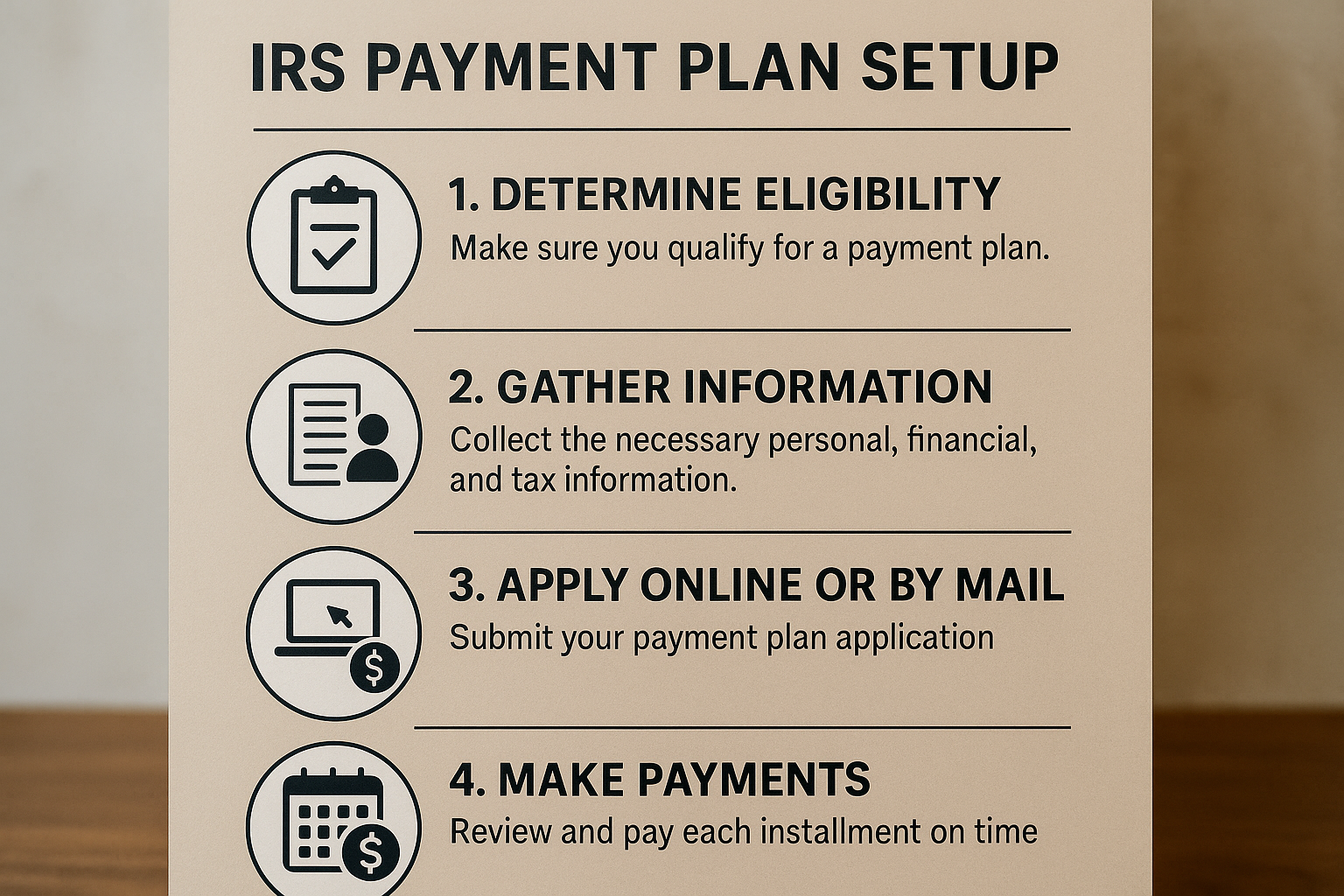

Slash Your Debt Hassle-Free IRS Payment Plan Setup

If you're struggling with tax debts and looking for a hassle-free way to manage them, exploring IRS payment plan options can provide you with the relief you need—browse options, search options, and see these options to find the best fit for your financial situation.

Understanding IRS Payment Plans

Navigating the complexities of IRS tax debt can be daunting, but setting up a payment plan offers a structured way to tackle what you owe without the stress of immediate full payment. An IRS payment plan, or installment agreement, allows you to pay off your tax debt over time, usually in monthly installments. This option is particularly beneficial for those who cannot afford to pay their taxes in full by the due date.

The IRS offers several types of payment plans, including short-term and long-term agreements, each designed to accommodate different financial situations. A short-term payment plan is typically for debts that can be paid off in 180 days or less, while a long-term plan extends beyond 180 days and can last up to 72 months. Understanding which plan suits your needs can help you manage your finances more effectively.