Reveal Hidden Secrets in Claims vs Occurrence Policies

Unlocking the hidden secrets of claims versus occurrence policies can empower you to make informed insurance choices that protect your assets and peace of mind, while you browse options and explore the best solutions tailored to your needs.

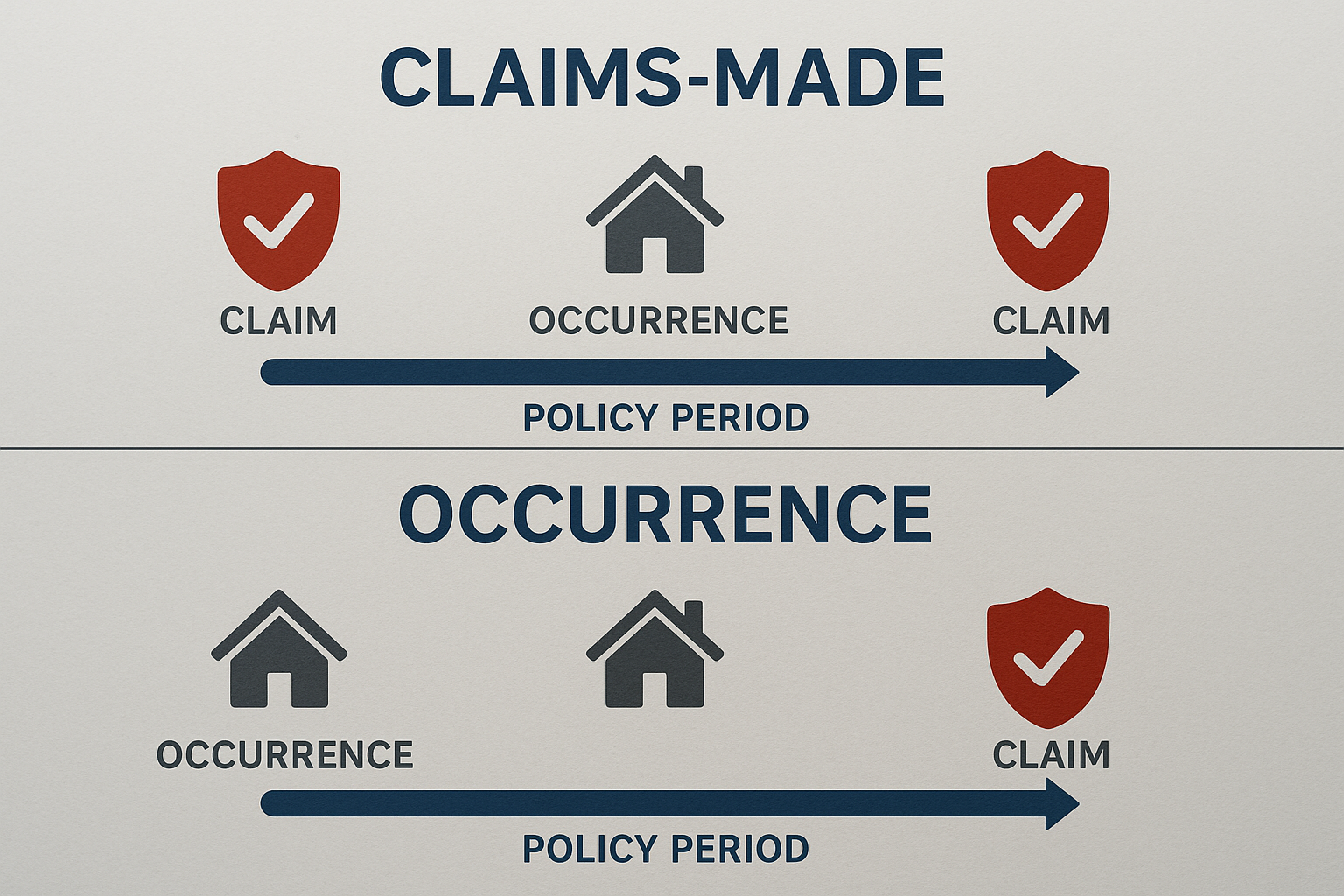

Understanding Claims-Made and Occurrence Policies

Insurance policies are a crucial part of risk management for individuals and businesses alike, and knowing the differences between claims-made and occurrence policies can significantly impact your coverage. A claims-made policy provides coverage for claims made during the policy period, regardless of when the incident occurred, as long as the incident happened after the policy's retroactive date. In contrast, an occurrence policy covers incidents that happen during the policy period, regardless of when the claim is made. This fundamental difference can influence your decision based on your specific risk exposure and financial planning.