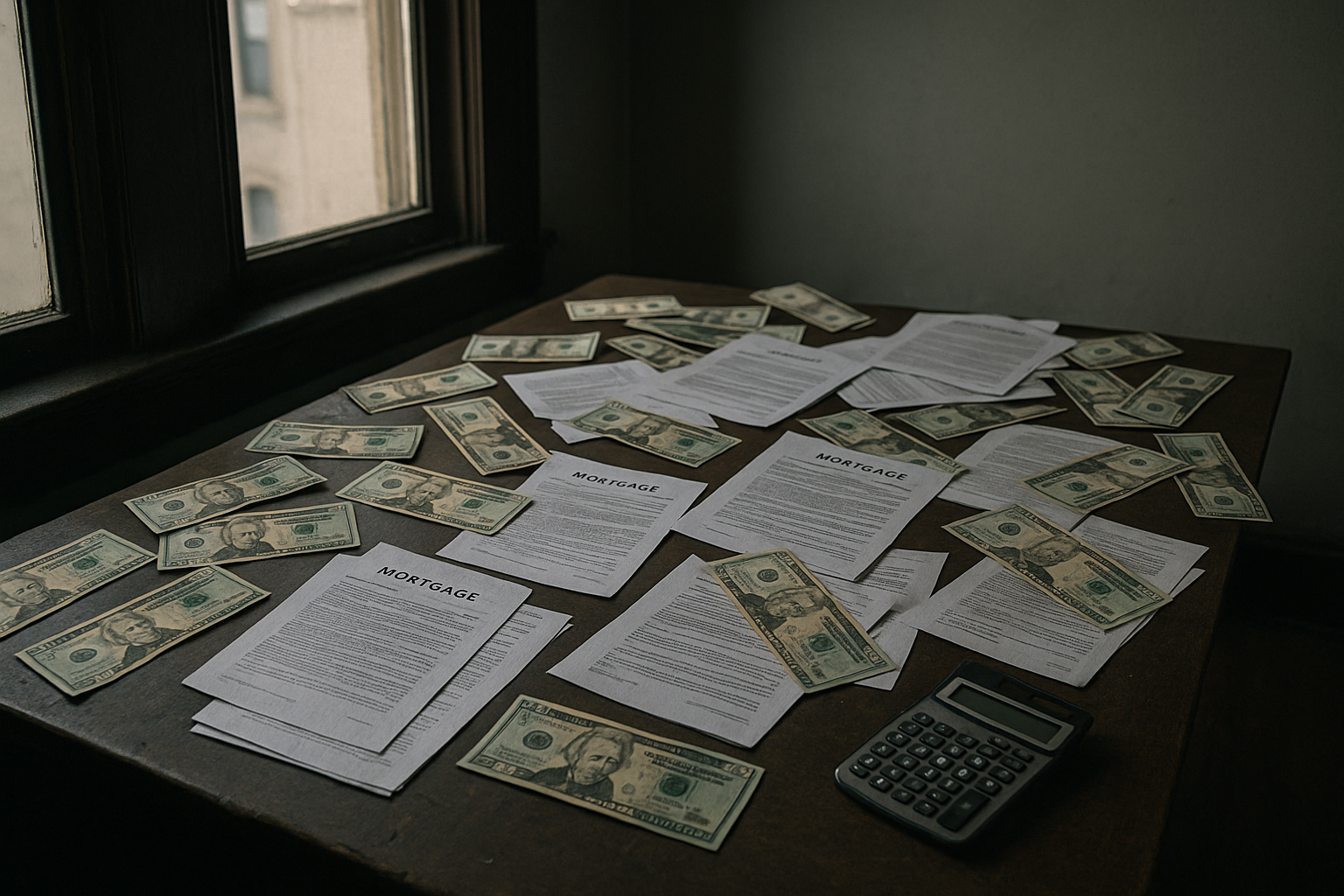

The shocking truth when you buy a house you lose

When you buy a house, you might be shocked to find that you could be losing more than you gain, but by taking the time to browse options and explore the hidden costs, you can make informed decisions that could save you thousands in the long run.

The True Cost of Homeownership

Buying a house is often seen as a cornerstone of the "American Dream," but the reality is that homeownership comes with a plethora of hidden costs that can quickly add up. While the initial purchase price is the most obvious expense, it's just the tip of the iceberg. Homeowners need to consider property taxes, insurance, maintenance, and potential repairs, which can significantly increase the overall cost of owning a home.

For instance, property taxes vary widely depending on location. In New Jersey, homeowners face some of the highest property taxes in the nation, with an average effective property tax rate of 2.49%1. This means that on a $300,000 home, you could be paying nearly $7,500 annually just in taxes. Similarly, homeowners insurance is a recurring expense that can range from $300 to over $1,000 per year, depending on factors like the home's location and value2.