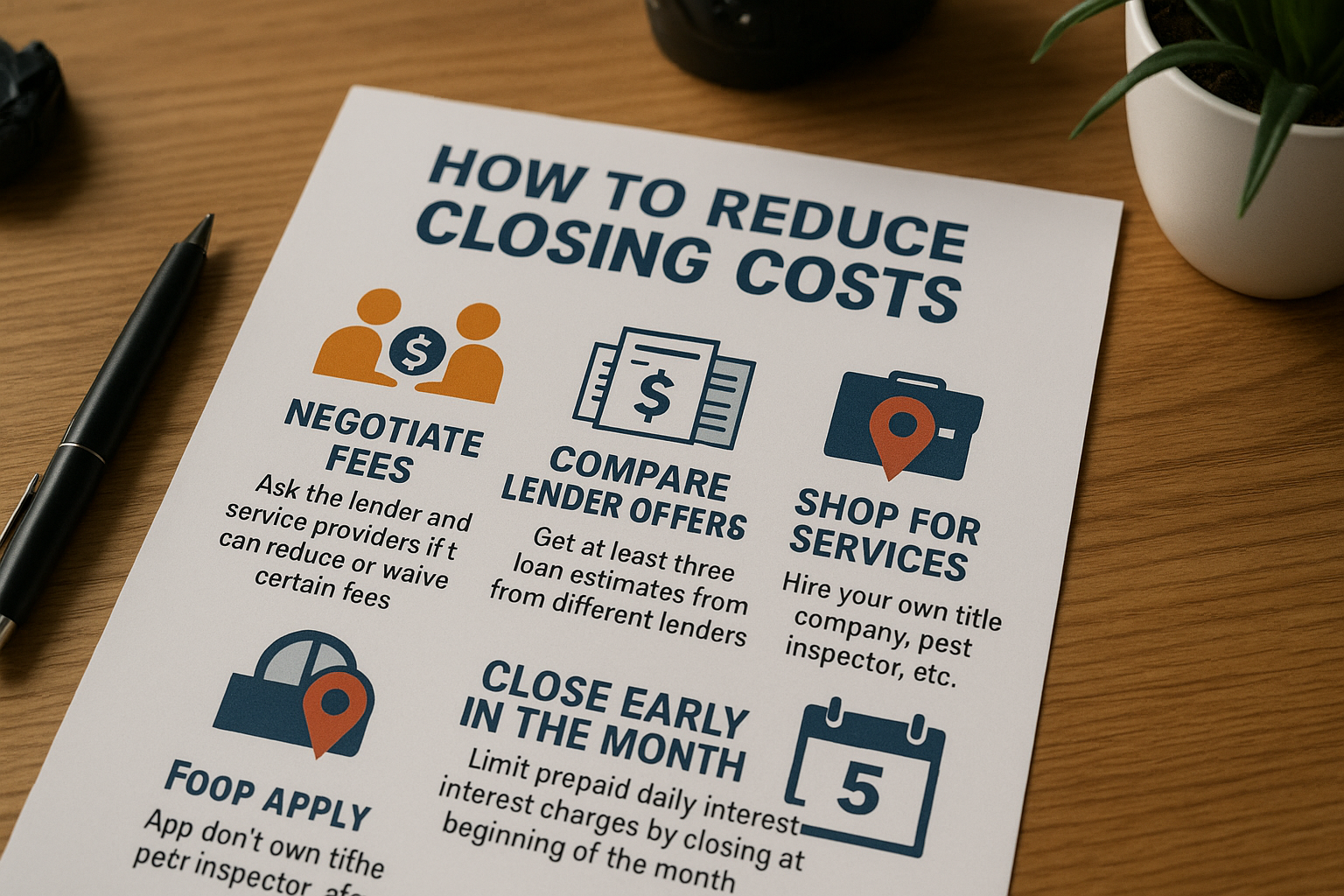

Slash Closing Costs Maximize Your Home Equity Today

Unlock the potential of your home equity by slashing closing costs, and explore a range of financial options to maximize your investment today, as you browse options and visit websites that offer valuable insights and solutions.

Understanding Home Equity and Closing Costs

Home equity represents the portion of your property that you truly own, calculated as the difference between your home's market value and any outstanding mortgage balance. It's a powerful financial tool that can be leveraged for various purposes, such as funding renovations, paying off debts, or investing in other opportunities. However, accessing this equity often involves closing costs, which can eat into your potential gains. These costs typically include appraisal fees, title insurance, and attorney fees, among others, and can range from 2% to 5% of the loan amount1.