Choose Wisely in Guaranteed vs Indexed Universal Life

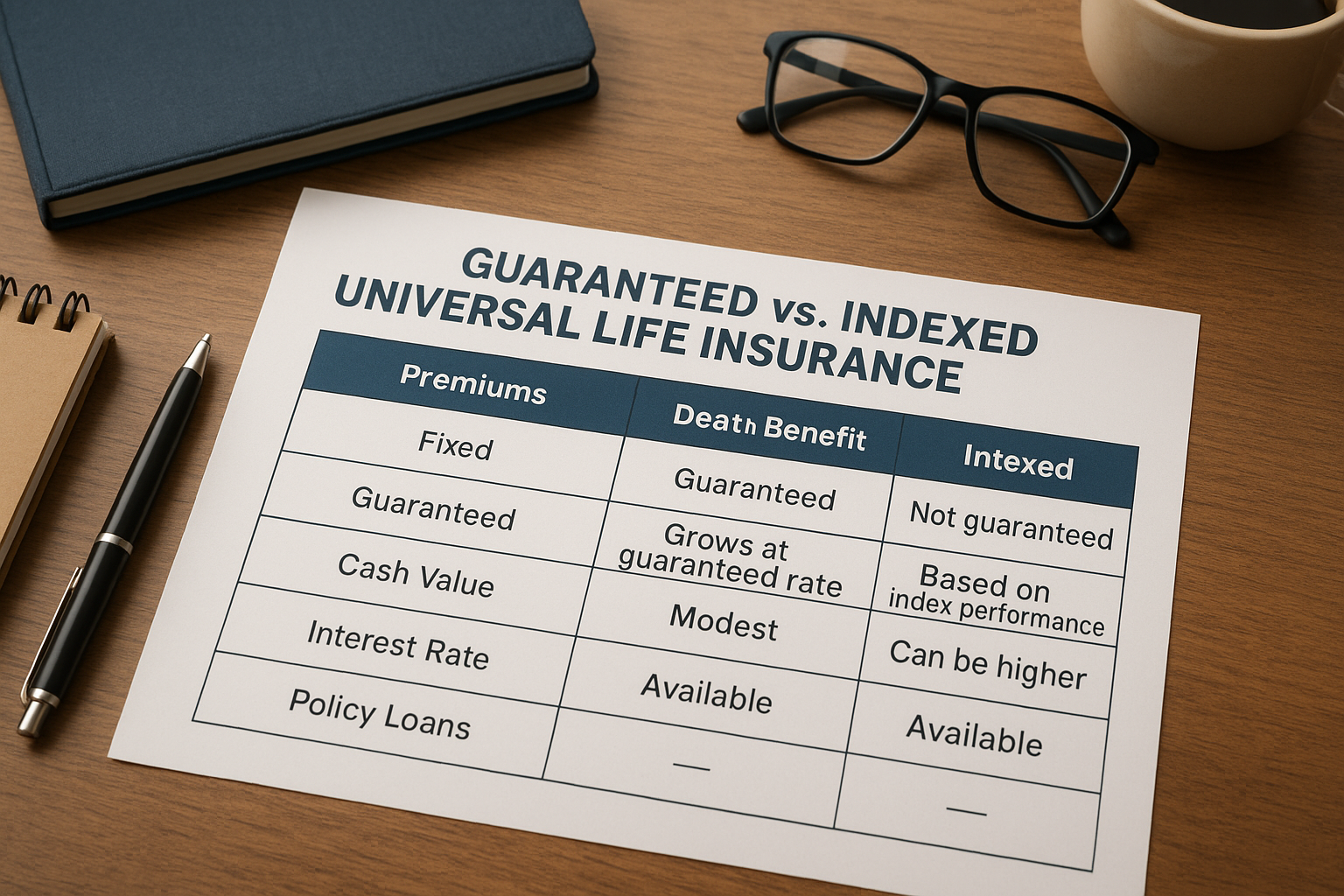

If you're navigating the complex world of life insurance and want to make a confident decision, it's crucial to understand the differences between guaranteed and indexed universal life insurance, and you can easily browse options to find the best fit for your needs.

Understanding Guaranteed Universal Life Insurance

Guaranteed Universal Life (GUL) insurance is designed for individuals who want the assurance of a fixed premium and a guaranteed death benefit, without the complexities of investment components. Unlike whole life insurance, GUL offers flexibility in terms of premium payments and coverage amounts, but it does not accumulate cash value. The primary advantage of GUL is its affordability compared to whole life policies, making it an attractive option for those seeking long-term coverage at a lower cost.

One of the core benefits of GUL is the stability it offers. You can lock in a premium rate for the duration of the policy, ensuring that your costs remain predictable over time. This is particularly advantageous for budget-conscious individuals who desire financial certainty. Moreover, by choosing a GUL policy, you can avoid the risk of market fluctuations impacting your coverage, a key concern for many insurance seekers1.