Transform Your Finances with Secret Debt Consolidation Insights

Unlock the door to financial freedom by exploring secret debt consolidation insights that can simplify your debt management and potentially save you thousands, prompting you to browse options and visit websites for more personalized solutions.

Understanding Debt Consolidation

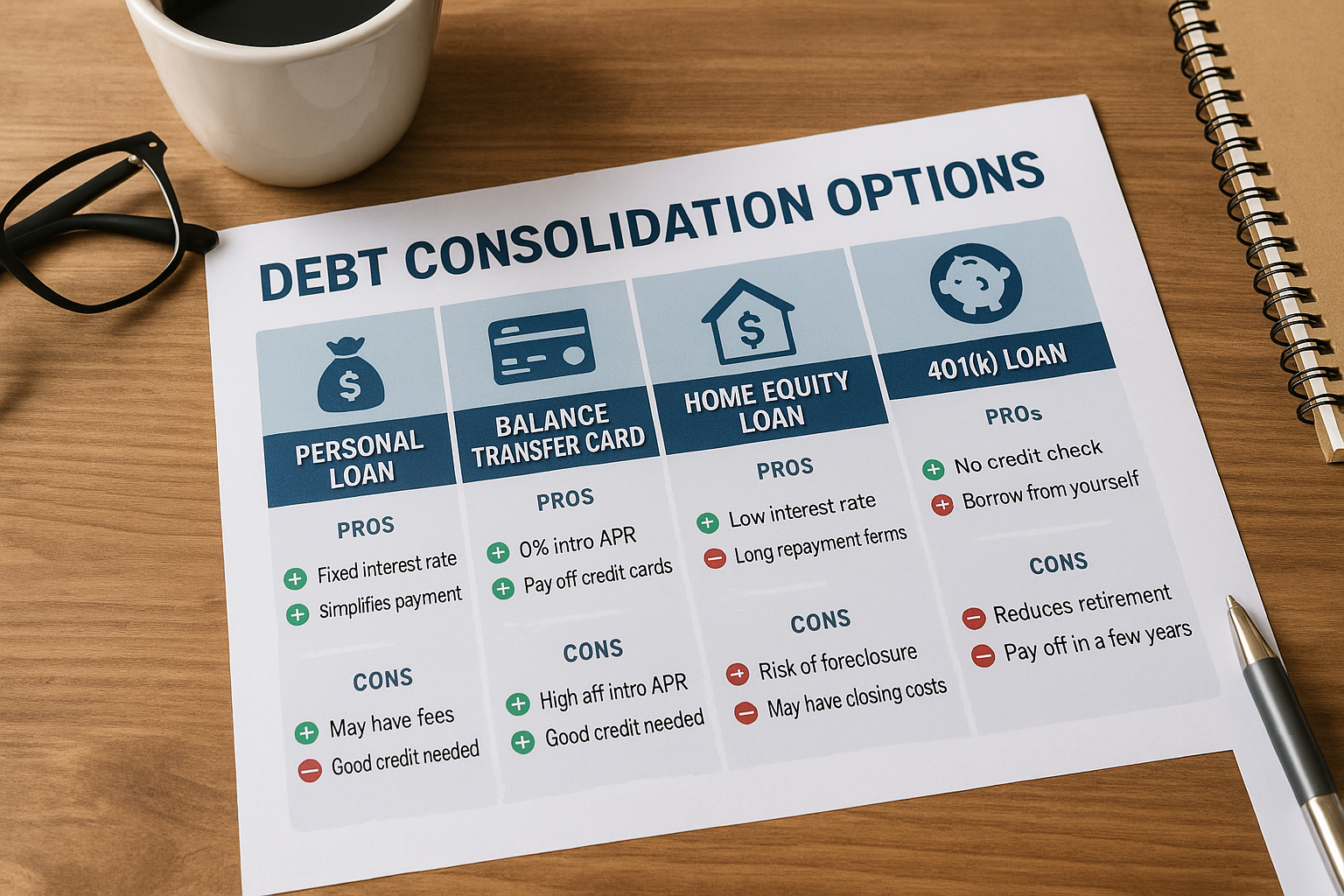

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan, often with a lower interest rate. This approach can significantly simplify your financial life by reducing the number of payments you need to manage each month. By consolidating your debts, you can also potentially lower your monthly payments, making it easier to stay on top of your financial obligations.

The primary goal of debt consolidation is to streamline your finances and reduce the overall cost of your debt. This can be achieved by securing a loan with a lower interest rate than what you are currently paying on your existing debts. For instance, if you have high-interest credit card debt, consolidating it into a personal loan with a lower interest rate can save you a considerable amount of money over time.