Never knew you could have multiple HELOCs legally

Did you know you can legally have multiple Home Equity Lines of Credit (HELOCs) to unlock more financial flexibility and expand your investment potential, all while you browse options to maximize your home equity?

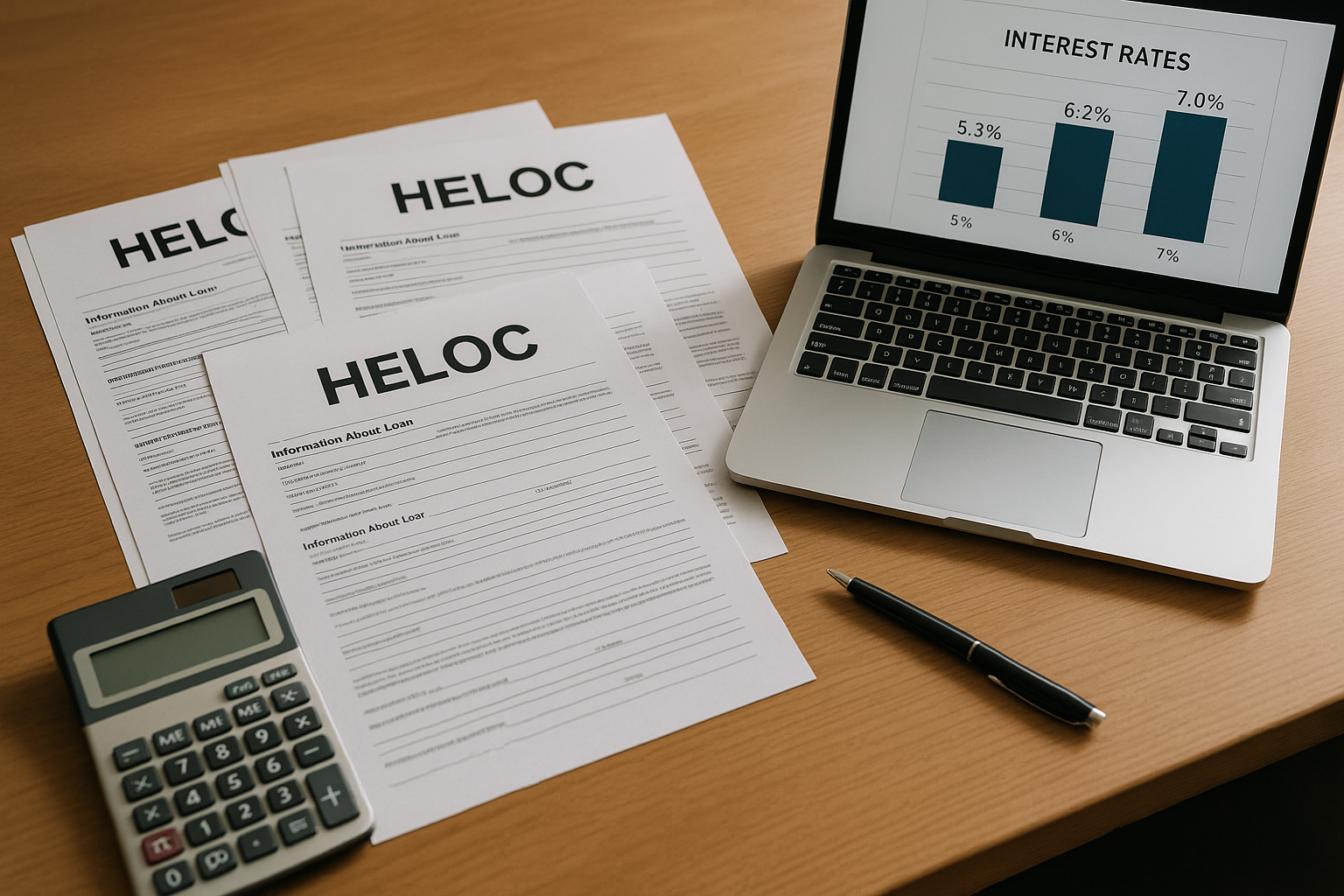

Understanding the Basics of HELOCs

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by the equity in your home. Unlike a traditional loan, a HELOC allows you to borrow against your home equity as needed, similar to a credit card. This flexibility makes it an attractive option for homeowners looking to fund renovations, consolidate debt, or cover unexpected expenses.

HELOCs typically come with variable interest rates, which can lead to lower initial payments compared to fixed-rate loans. However, it's crucial to understand the terms and conditions, including any fees or rate adjustments, before committing to a HELOC.