Zero Interest Burden Ends With This Credit Card Deal

Eliminate the burden of high-interest credit card debt by exploring zero-interest options that can save you money and provide financial freedom—browse options now to find the perfect deal for you.

Understanding Zero Interest Credit Card Deals

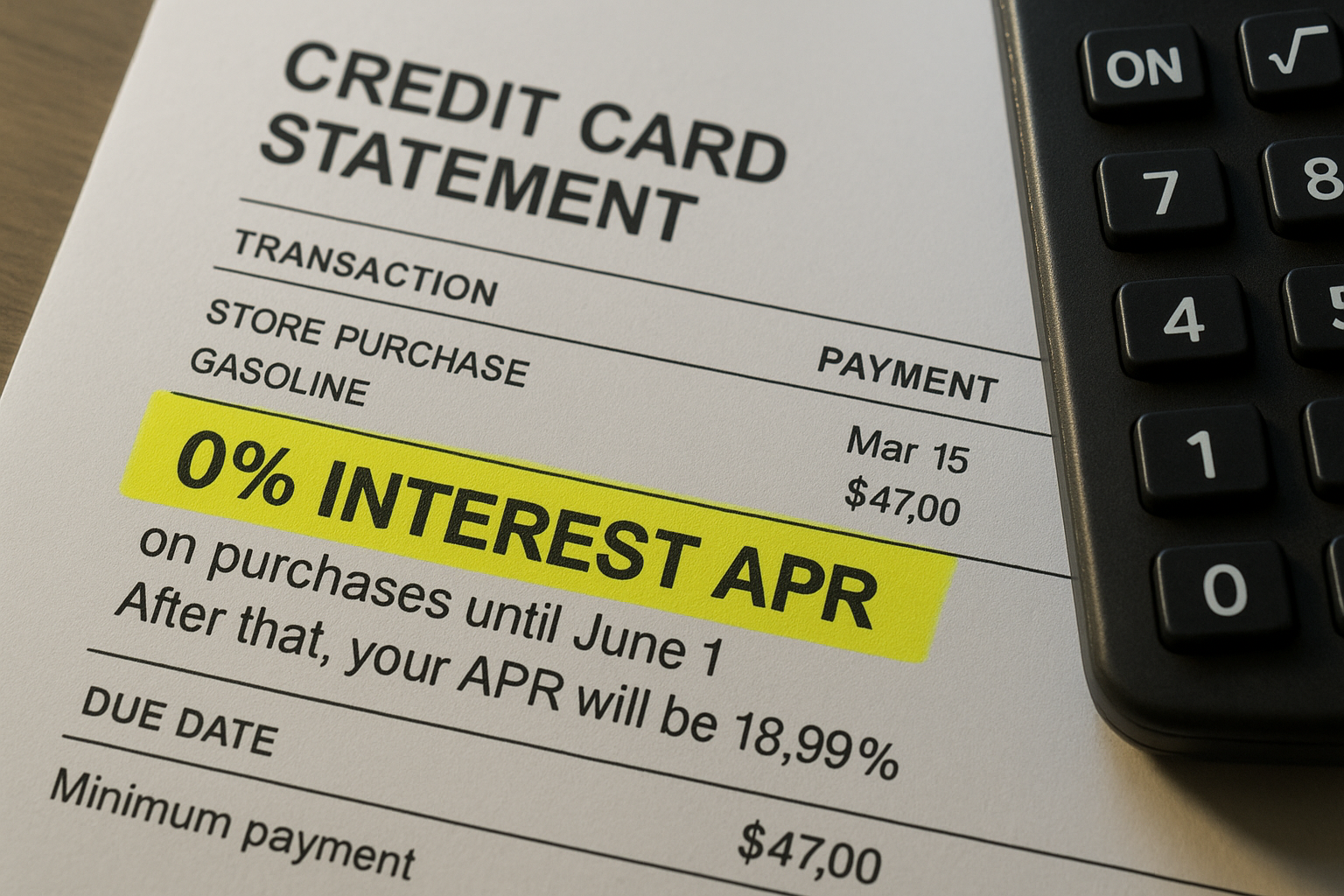

Zero interest credit card deals, often referred to as 0% APR offers, are promotional offers that provide cardholders with a period during which no interest is charged on purchases or balance transfers. These deals can last anywhere from six to 21 months, depending on the card issuer and the specific offer. During this period, you can save significantly on interest payments, allowing you to pay down your principal balance more effectively.

The Benefits of Zero Interest Credit Cards

The primary advantage of zero interest credit cards is the potential for substantial savings. By eliminating interest charges, you can allocate more of your monthly payments toward reducing your principal balance. This can be particularly beneficial if you're carrying high-interest debt, as it allows you to pay off the debt faster and with less financial strain.

Additionally, zero interest offers can provide a financial cushion for large purchases. For instance, if you're planning a big expense like a home renovation or a significant purchase, using a 0% APR card can spread the cost over several months without incurring extra charges.

How to Maximize Zero Interest Offers

To make the most of zero interest credit card deals, it's crucial to have a repayment plan in place. Here are some steps to consider:

- Calculate Your Payments: Determine how much you need to pay each month to clear your balance before the promotional period ends.

- Track the Expiry Date: Be aware of when the 0% APR period ends, as any remaining balance will start accruing interest at the standard rate.

- Avoid New Purchases: Focus on paying down existing debt rather than adding new charges to the card.

- Check for Fees: Some cards may charge a balance transfer fee, typically around 3% of the transferred amount, which should be factored into your savings calculations.

Finding the Right Zero Interest Card

When searching for the ideal zero interest credit card, consider factors such as the length of the promotional period, any applicable fees, and the standard interest rate after the promotion ends. Websites like NerdWallet and Bankrate offer comprehensive comparisons of available credit card deals, making it easier to identify the best options for your financial situation12.

Real-World Examples

Several credit cards currently offer competitive zero interest deals. For example, the Chase Freedom Unlimited card provides 0% APR on purchases and balance transfers for the first 15 months, followed by a variable APR of 20.49% to 29.24%3. Similarly, the Citi Simplicity Card offers 0% APR for 21 months on balance transfers, making it an attractive option for those looking to consolidate debt4.

In summary, zero interest credit card deals present a valuable opportunity to manage debt more effectively and make large purchases without the burden of interest. By carefully selecting the right card and adhering to a disciplined repayment plan, you can take full advantage of these offers. Explore various options today to find the deal that best suits your financial goals and needs.