Unveil Hidden Secrets to Compare Debt Consolidation Loans

Unlock the potential to simplify your financial life by discovering how to effectively compare debt consolidation loans and find the best options for your needs—browse options today to transform your debt management strategy.

Understanding Debt Consolidation Loans

Debt consolidation loans are financial tools that allow you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your monthly payments and potentially save you money on interest over time. By consolidating your debts, you transform multiple payment schedules into one, making it easier to manage and track your financial obligations.

When considering debt consolidation, it's essential to understand the types of loans available. Personal loans, home equity loans, and balance transfer credit cards are popular options for debt consolidation. Each comes with its own set of benefits and drawbacks. For instance, personal loans often provide fixed interest rates and terms, making them predictable and easy to budget for. In contrast, home equity loans might offer lower interest rates but require your home as collateral, which can be risky if you're unable to keep up with payments.

Key Benefits of Debt Consolidation

The primary advantage of debt consolidation is the potential to reduce your overall interest payments. By securing a loan with a lower interest rate than your existing debts, you can decrease the total amount you pay over time. Additionally, having a single monthly payment can reduce the stress associated with managing multiple bills, helping you to focus on other financial goals.

Moreover, debt consolidation can improve your credit score over time. As you make consistent payments on your new loan, your credit utilization ratio may decrease, and your payment history will reflect positively on your credit report. However, it's crucial to ensure that you don't accumulate new debt while repaying your consolidated loan, as this could negate the benefits.

How to Compare Debt Consolidation Loans

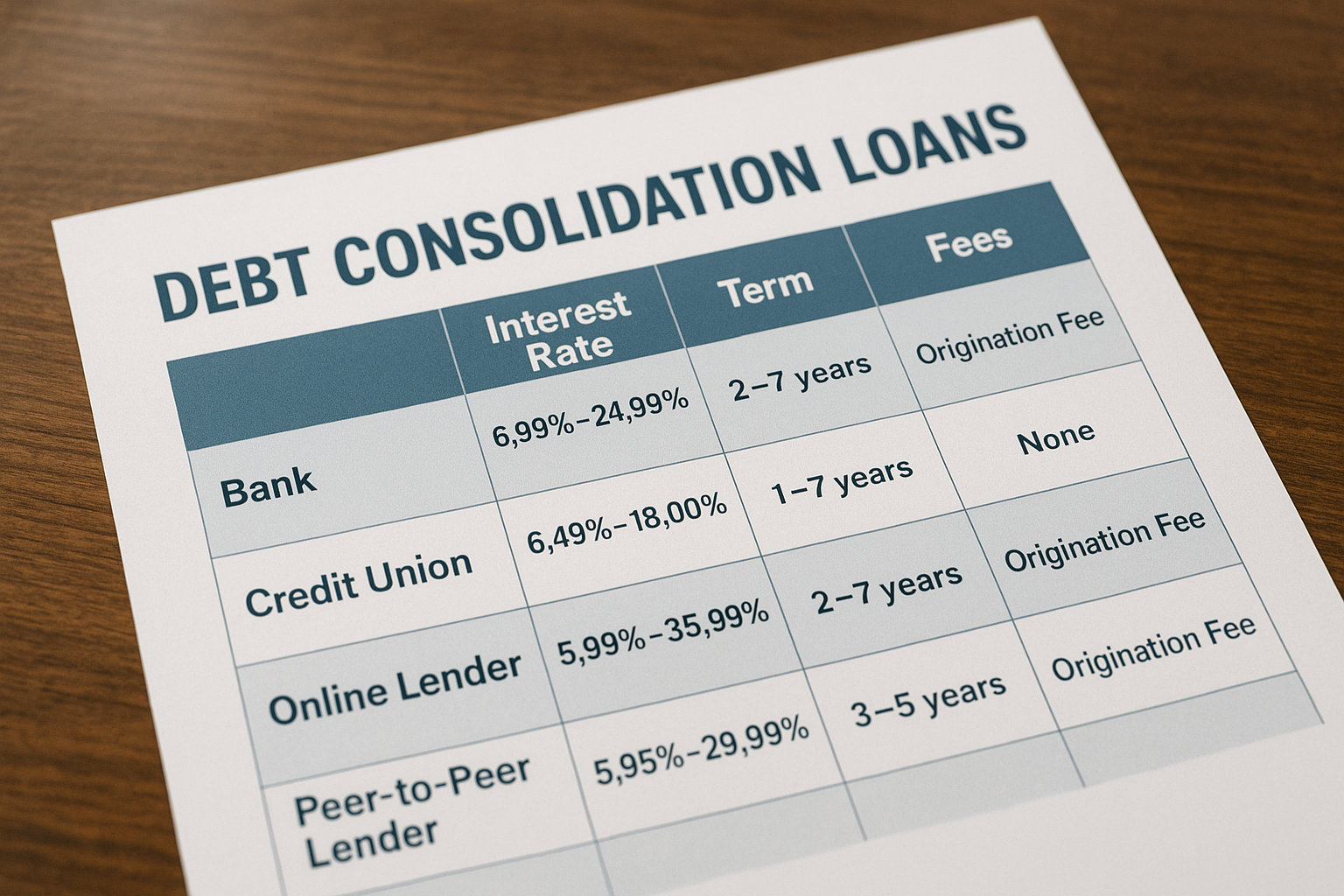

When comparing debt consolidation loans, consider the following factors:

- Interest Rates: Look for loans with lower interest rates than your current debts to maximize savings.

- Loan Terms: Evaluate the length of the loan term. Shorter terms may result in higher monthly payments but can save you money on interest in the long run.

- Fees: Be aware of any origination fees, late fees, or prepayment penalties that could affect the overall cost of the loan.

- Lender Reputation: Research lenders to ensure they have a solid reputation and positive customer reviews.

It's also wise to use online comparison tools and calculators to estimate potential savings and determine the best loan option for your situation. Many websites offer these resources, allowing you to input your current debts and explore various consolidation scenarios.

Real-World Examples and Data

According to a report by the Federal Reserve, the average credit card interest rate is around 16%1. By consolidating with a personal loan at a lower rate, such as 7% to 10%, you could significantly reduce your interest expenses. For instance, if you have $10,000 in credit card debt at 16% interest, switching to a 7% loan could save you over $1,000 in interest over a three-year term.

In addition, a survey by Bankrate found that nearly 60% of Americans have used a personal loan to consolidate debt, highlighting its popularity as a financial strategy2.

Exploring Specialized Services and Resources

For those interested in exploring specialized debt consolidation services, numerous financial institutions and online platforms offer tailored solutions. These services often provide personalized advice and tools to help you assess your financial situation and choose the best consolidation strategy. By visiting websites dedicated to debt management, you can access a wealth of information and resources to guide your decision-making process.

Ultimately, the key to successful debt consolidation lies in thorough research and careful comparison of available options. By understanding the benefits, potential savings, and risks, you can make an informed decision that aligns with your financial goals. As you navigate this journey, remember that numerous resources are available to support you in achieving a more manageable and stress-free financial future.