Uncover Hidden Savings Family Health Insurance Plan Secrets

Discover how you can unlock significant savings on your family health insurance plan by browsing options that reveal hidden discounts and benefits you might be missing out on.

Understanding the Basics of Family Health Insurance Plans

Family health insurance plans are designed to provide comprehensive coverage for all family members under a single policy, often resulting in cost savings compared to individual plans. These plans typically cover a range of medical services, including doctor visits, hospital stays, and preventive care. However, the cost of these plans can vary significantly based on factors such as the number of family members, their ages, and the specific coverage options chosen.

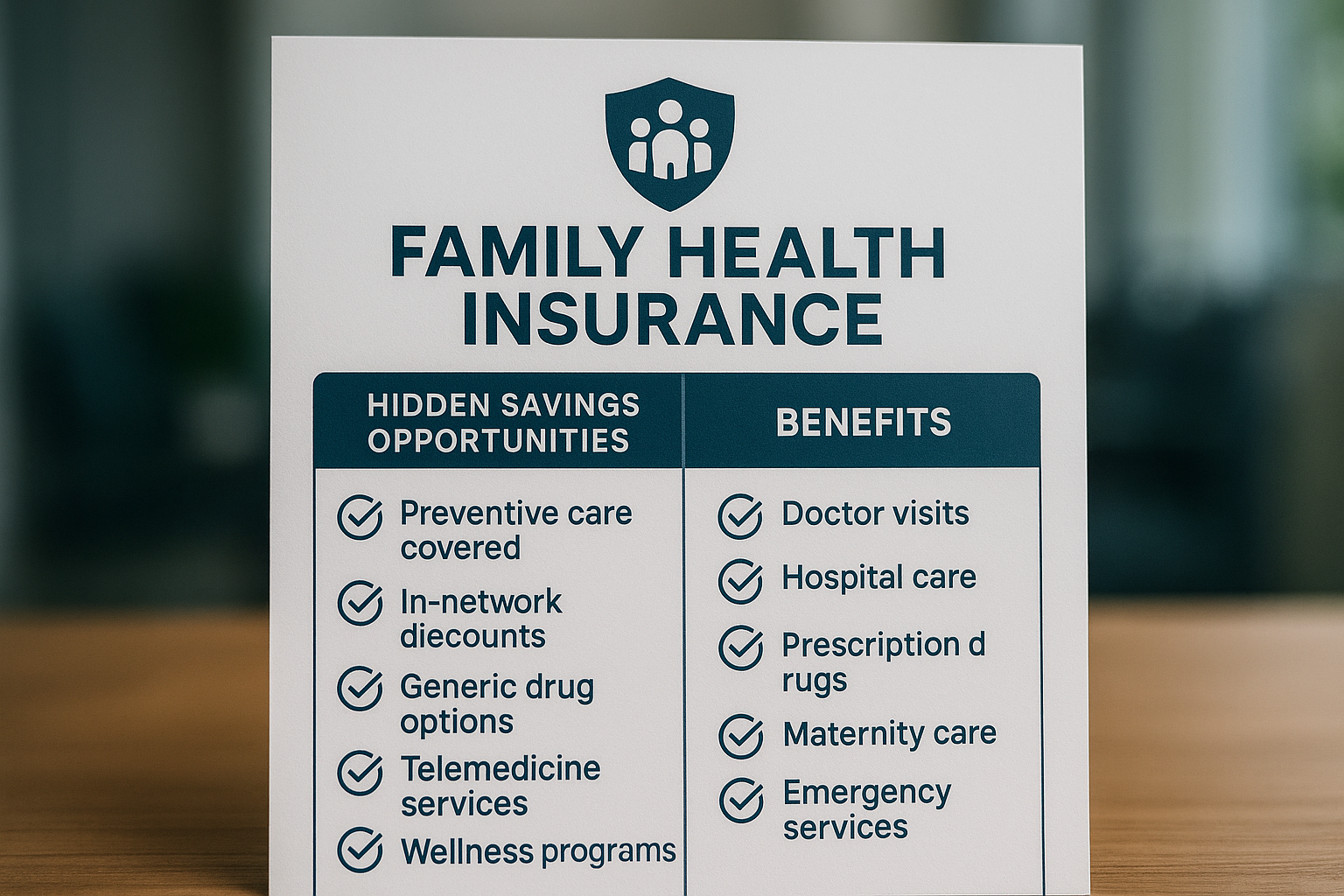

Hidden Savings Opportunities

Many families are unaware of the potential savings that can be achieved through careful selection and management of their health insurance plans. By searching options and comparing different plans, you can identify those that offer the most value for your specific needs. For instance, some insurers provide discounts for families who participate in wellness programs or who maintain a healthy lifestyle. Additionally, bundling health insurance with other types of insurance, such as dental or vision, can often result in reduced premiums.

Maximizing Employer Benefits

If you or your spouse have access to employer-sponsored health insurance, it's essential to explore all available options within these plans. Employers often negotiate lower rates with insurance providers, passing the savings onto employees. Additionally, some employers offer Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which allow you to set aside pre-tax dollars for medical expenses, effectively reducing your taxable income and providing further savings.

Comparing Costs and Coverage

When evaluating family health insurance plans, it's crucial to consider both the premium costs and the out-of-pocket expenses associated with each option. Some plans may have lower premiums but higher deductibles and co-pays, which can increase your total healthcare costs. Conversely, higher premium plans might offer more comprehensive coverage with lower out-of-pocket expenses. Carefully analyzing these factors will help you determine which plan offers the best balance of cost and coverage for your family.

Leveraging Government Programs

Depending on your income level and family size, you may qualify for government programs that provide financial assistance for health insurance. The Affordable Care Act (ACA) offers subsidies to help lower-income families afford health insurance through the Health Insurance Marketplace1. Additionally, programs like Medicaid and the Children's Health Insurance Program (CHIP) offer free or low-cost coverage for qualifying families2.

Exploring Additional Resources

To ensure you're getting the best deal on your family health insurance plan, consider consulting with an independent insurance broker who can provide personalized advice and help you navigate the complexities of different plans. Additionally, many online resources and websites offer tools for comparing insurance plans and calculating potential savings3. By visiting these websites, you can gain a deeper understanding of the options available to you and make informed decisions about your family's health coverage.

By taking the time to browse options and explore the hidden savings opportunities in family health insurance plans, you can significantly reduce your healthcare costs while ensuring your family receives the coverage they need. Whether by leveraging employer benefits, government programs, or expert advice, the potential for savings is substantial and well worth the effort.